UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ |

|

|

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ |

|

|

Preliminary Proxy Statement |

☐ |

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

|

Definitive Proxy Statement |

☐ |

|

|

Definitive Additional Materials |

☐ |

|

|

Soliciting Material Pursuant to §240.14a-12 |

Hercules Capital, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

|

|

No fee required |

☐ |

|

|

Fee paid previously with preliminary materials |

☐ |

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11 |

April 29, 2022

Dear Stockholder:

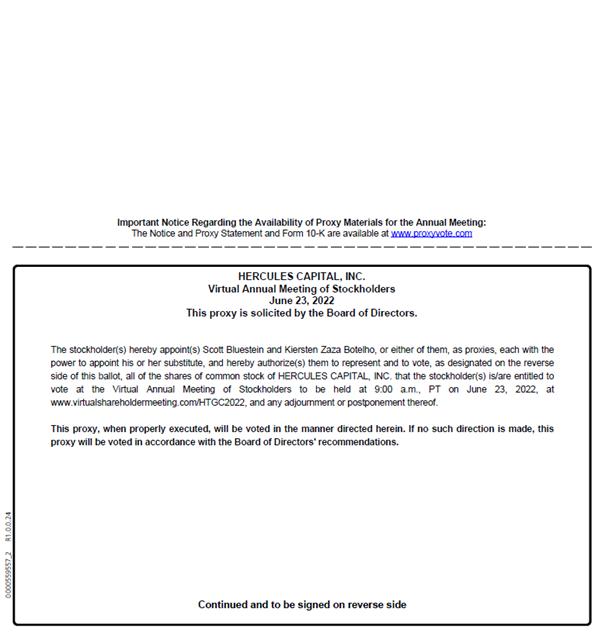

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Hercules Capital, Inc., which will be held virtually on Thursday, June 23, 2022 at 9:00 a.m. (Pacific Time). The annual meeting can be accessed by visiting www.virtualshareholdermeeting.com/HTGC2022, where you will be able to listen to the meeting live, submit questions, and vote online.

Details regarding the business to be conducted at the annual meeting are more fully described in the accompanying notice of annual meeting and proxy statement.

Your vote is very important. Whether or not you plan to attend the virtual meeting, please cast your vote as soon as possible by Internet, by QR Code, by telephone, or by completing and returning the enclosed proxy card in the postage-prepaid envelope to ensure that your shares will be represented. For shares held in “street name,” please follow the relevant instructions for telephone and Internet voting provided by your broker, bank or other nominee. Returning the proxy does not deprive you of your right to attend the virtual meeting and to vote your shares at the virtual meeting.

Your continuing support of Hercules is very much appreciated.

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

|

Scott Bluestein Chief Executive Officer Chief Investment Officer |

400 Hamilton Avenue, Suite 310

Palo Alto, California 94301

(650) 289-3060

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

HERCULES CAPITAL, INC.

|

|

|

|

|

|

|

Time |

|

|

9:00 a.m., Pacific Time |

|||

|

|

|

|

|

|

|

Date |

|

|

June 23, 2022 |

|||

|

|

|

|

|

|

|

Place |

|

|

Virtually at www.virtualshareholdermeeting.com/HTGC2022 |

|||

|

|

|

|

|

|

|

|

|

|

Please have your 16-Digit Control Number to join the annual meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted on www.proxyvote.com. |

|||

|

|

|

|

|

|

|

Purpose |

|

|

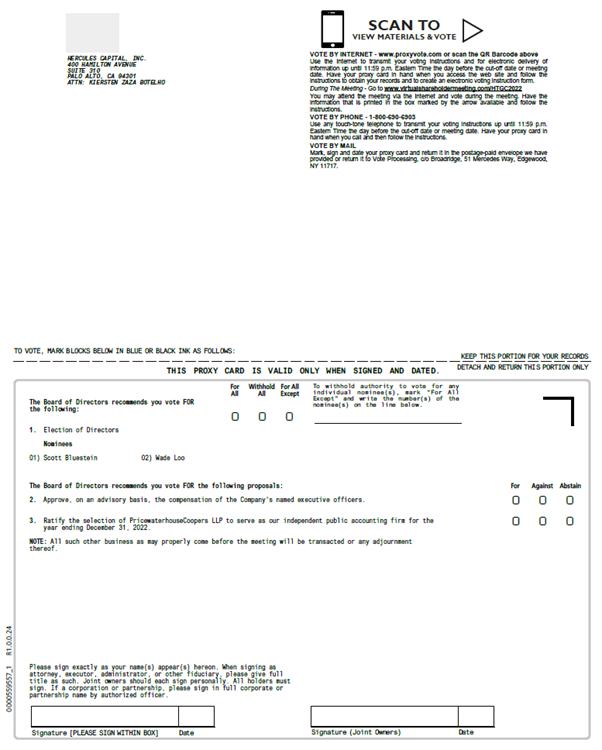

1. |

|

|

Elect two directors who will serve for the term specified in the Proxy Statement. |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

Approve, on an advisory basis, the compensation of the Company’s named executive officers. |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

Ratify the selection of PricewaterhouseCoopers LLP to serve as our independent public accounting firm for the year ending December 31, 2022. |

|

|

|

|

|

|

|

|

|

|

4. |

|

|

Transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

|

|

|

|

|

|

|

Record Date |

|

|

You have the right to receive notice of and to vote at the annual meeting if you were a stockholder of record at the close of business on April 25, 2022. We plan to begin mailing this Proxy Statement on or about May 4, 2022 to all stockholders entitled to vote their shares at the annual meeting. |

|||

|

|

|

|

|

|

|

Voting by Proxy |

|

|

Please submit a proxy card or, for shares held in “street name,” voting instruction form as soon as possible so your shares can be voted at the virtual meeting. You may submit your proxy card or voting instruction form by mail. If you are a registered stockholder, you may also vote electronically by telephone or over the Internet by following the instructions included with your proxy card. If your shares are held in “street name,” you will receive instructions for voting of shares from your broker, bank or other nominee, which may permit telephone or Internet voting. Follow the instructions on the voting instruction form that you receive from your broker, bank or other nominee to ensure that your shares are properly voted at the annual meeting. |

|||

|

|

|

|

|

|

|

|

|

|

The enclosed Proxy Statement is also available at www.proxyvote.com. This website also includes copies of the proxy card and our annual report to stockholders. Stockholders may request a copy of the Proxy Statement and our annual report by contacting our main office at (650) 289-3060. |

|||

|

|

|

By Order of the Board, |

|

|

|

|

|

|

|

Kiersten Zaza Botelho General Counsel, Chief Compliance Officer and Secretary |

PROXY STATEMENT—TABLE OF CONTENTS

|

|

|

Page |

|

|

1 |

|

Security Ownership of Certain Beneficial Owners and Management |

|

|

5 |

Board of Directors and Corporate Governance |

|

|

|

|

|

7 |

|

|

|

7 |

|

|

|

9 |

|

|

|

11 |

|

|

|

21 |

|

|

|

21 |

|

|

|

21 |

|

|

|

22 |

|

|

|

23 |

|

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

Executive Officers and Director Compensation |

|

|

|

|

|

26 |

|

|

|

28 |

|

|

|

28 |

|

|

|

40 |

|

|

|

46 |

|

|

|

47 |

OTHER PROXY PROPOSALS |

|

|

|

Proposal 2—Advisory Vote to Approve the Company’s Named Executive Officer Compensation |

|

|

48 |

Proposal 3—Ratification of Selection of Independent Public Accountant |

|

|

50 |

|

|

50 |

|

MEETING AND OTHER INFORMATION |

|

|

|

|

|

52 |

|

|

|

53 |

SUMMARY INFORMATION

This summary provides highlights about Hercules Capital, Inc., and information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider when deciding how to vote your shares. The “Company,” “Hercules,” “HTGC,” “we,” “us” and “our” refer to Hercules Capital, Inc. and its wholly owned subsidiaries and its affiliated securitization trusts.

ABOUT HERCULES AND 2021 FINANCIAL HIGHLIGHTS

We are a specialty finance company focused on providing senior secured loans to high-growth, innovative venture capital-backed and institutional-backed companies in a variety of technology, life sciences and sustainable and renewable technology industries.

2021 PEER GROUP ANALYSIS

As of December 31, 2021, the Company generally outperformed most of its Peer Group (defined on page 32) over a one-, three- and five-year period in both financial efficiencies measured using Return on Average Assets (“ROAA”), Return on Equity (“ROE”), Return on Investment Capital (“ROIC”), as well as using the market measure Average Annual Shareholder Return (“AASR”):

|

Performance Period |

|

|

Return on Average Assets (excl. cash) |

|

|

Return on Equity |

|

|

Return on Invested Capital |

|

|

Average Annual Shareholder Return (“AASR”) |

||||||||||||

|

HTGC |

|

|

% Rank of Peer Group |

|

|

HTGC |

|

|

% Rank of Peer Group |

|

|

HTGC |

|

|

% Rank of Peer Group |

|

|

HTGC |

|

|

% Rank of Peer Group |

|||

|

1-year |

|

|

5.4% |

|

|

100% |

|

|

10.2% |

|

|

91% |

|

|

5.6% |

|

|

100% |

|

|

26.0% |

|

|

35% |

|

3-year |

|

|

5.7% |

|

|

100% |

|

|

11.4% |

|

|

100% |

|

|

5.8% |

|

|

100% |

|

|

26.6% |

|

|

60% |

|

5-year |

|

|

5.7% |

|

|

100% |

|

|

11.2% |

|

|

100% |

|

|

5.8% |

|

|

100% |

|

|

14.0% |

|

|

65% |

−1-, 3- and 5-year calculations of performance are based on data as of December 31, 2021.

−Companies with less than three and/or less than five full years of historical financial and AASR performance are excluded.

−Financial Services peers are excluded from analysis of capital allocation because services companies are not as capital intensive as REITs and BDCs, which are primarily engaged in direct investment of firm capital.

−The data is from S&P Capital IQ and is not adjusted by FW Cook, which means the data may not reflect internal adjustments regularly made by Hercules or by the peer companies when assessing their performance.

VOTING MATTERS AND RECOMMENDATIONS

Agenda Items |

|

|

Board Vote Recommendation |

|

|

Page Reference (for more detail) |

|||

|

|

|

|

|

|

|

|

|

|

1. |

|

|

To elect two directors who will serve for the term specified in the Proxy Statement. |

|

|

FOR |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

Approve, on an advisory basis, the compensation of the Company’s named executive officers. |

|

|

FOR |

|

|

48 |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

To ratify the selection of PricewaterhouseCoopers LLP (“PwC”) to serve as our independent public accounting firm for the fiscal year ending December 31, 2022. |

|

|

FOR |

|

|

50 |

SUMMARY INFORMATION |

1 |

BOARD NOMINEES

|

|

|

|

|

|

|

|

Board Committee Members |

||||

Name |

|

Age |

|

Director Since |

|

Independent(1) |

|

AC |

|

CC |

|

NCGC |

Scott Bluestein |

|

43 |

|

2019 |

|

|

|

|

|

|

|

|

Wade Loo |

|

61 |

|

2021 |

|

X |

|

M |

|

M |

|

|

AC = Audit Committee CC = Compensation Committee NCGC = Nominating and Corporate Governance Committee

M = Member C = Committee Chairman

(1) Under the rules and regulations of the SEC and the listing standards of New York Stock Exchange (“NYSE”).

CORPORATE GOVERNANCE HIGHLIGHTS

EXECUTIVE COMPENSATION (Say-on-Pay)

Consistent with our Board’s recommendation and our stockholders’ preference, we submit an advisory vote to approve our executive compensation (otherwise known as “say-on-pay”) on an annual basis. Accordingly, we are seeking your approval, on an advisory basis, of the compensation for our NEOs, as further described in the “Compensation Discussion and Analysis” section of this Proxy Statement. In 2021, stockholders voted 89.23% in favor of Say-on-Pay.

2021 EXECUTIVE COMPENSATION HIGHLIGHTS

For a summary of our 2021 executive compensation and key features of our executive compensation programs, please refer to the Executive Summary of the “Compensation Discussion and Analysis” section of this Proxy Statement on page 28.

AUDITOR MATTERS

We are seeking your ratification of PwC as our independent public accounting firm for the 2022 fiscal year. The following table summarizes the fees billed by PwC for the fiscal year ending December 31, 2021 (please refer to the proposal on page 50):

|

|

2021 |

|

|

Audit Fees |

|

$ |

1.2 |

|

Audit-Related Fees |

|

$ |

— |

|

Tax Fees |

|

$ |

0.1 |

|

All Other Fee |

|

$ |

0.1 |

|

Total |

|

$ |

1.4 |

|

For 2021, 86% of the 2021 fees represented audit and audit-related fees.

SUMMARY INFORMATION |

2 |

HERCULES CAPITAL DELIVERED RECORD

ORIGINATIONS PERFORMANCE FOR 2021

Our success is a testament to the strength of our team's capabilities, our

discipline credit selection, robust liquidity, and the scale and strength of our

platform and brand recognition as the largest BDC venture lender.

$2.64B Record Total Gross Debt and Equity Commitments

|

$1.57B Record Total Gross Fundings |

UP 122.1% |

UP 106.0% |

|

|

$2.60B Total Assets

|

$2.39B Total Investments at Cost

|

$281.0M Total Investment Income

|

$150.0M Net Investment Income

|

12.4% Return on Average Equity Q4 2021

|

6.2% Return on Average Assets Q4 2021

|

$1. Record Declared Cash

UP 2 |

66 Distributions per Share

3.0%

|

SUMMARY INFORMATION |

3 |

GENERAL INFORMATION

For general information regarding our Proxy Statement, please review the questions and answers at the end of our Proxy Statement. For questions in which you require additional information, please call us at (617) 314-9973 or send an e-mail to Kiersten Zaza Botelho, Secretary, at kbotelho@htgc.com.

You may authorize a proxy to cast your vote in any of the following ways:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet

Visit www.proxyvote.com. You will need the 16-digit control number included in the proxy card, voter instruction card or notice. |

|

|

QR Code

You can scan the QR Code on your proxy card to vote with your mobile phone. |

|

|

Phone

Call 1-800-690-6903 or the number on your voter instruction form. You will need the control number included in your proxy card. |

|

|

Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. |

|

|

In Person

Attend the virtual meeting in person.

Please have your 16-Digit Control Number to join the annual meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted on www.proxyvote.com |

|

GENERAL INFORMATION |

4 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 25, 2022 (except as noted below), the beneficial ownership of each current director, each nominee for director, our NEOs, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and our executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. Common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of April 25, 2022 are deemed to be outstanding and beneficially owned by the person holding such options or warrants. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Percentage of ownership is based on 123,880,353 shares of common stock outstanding as of April 25, 2022.

Unless otherwise indicated, to our knowledge, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned by the stockholder, except to the extent authority is shared by their spouses under applicable law. Unless otherwise indicated, the address of all executive officers and directors is c/o Hercules Capital, Inc., 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301.

Our directors are divided into two groups—interested directors and independent directors. Interested directors are “interested persons” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), and independent directors are all other directors.

Name and Address of Beneficial Owner |

|

Type of Ownership |

|

Number of |

|

|

Percentage |

|

||

Interested Director |

|

|

|

|

|

|

|

|

||

Scott Bluestein(2) |

|

Record/Beneficial |

|

|

1,087,787 |

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

||

Independent Directors |

|

|

|

|

|

|

|

|

||

Robert P. Badavas(3) |

|

Record/Beneficial |

|

|

122,452 |

|

|

* |

|

|

Gayle Crowell(4) |

|

Record/Beneficial |

|

|

23,586 |

|

|

* |

|

|

Thomas J. Fallon(5) |

|

Record/Beneficial |

|

|

58,835 |

|

|

* |

|

|

Joseph F. Hoffman(6) |

|

Record/Beneficial |

|

|

42,862 |

|

|

* |

|

|

Brad Koenig(7) |

|

Record/Beneficial |

|

|

28,379 |

|

|

* |

|

|

Wade Loo(8) |

|

Record/Beneficial |

|

|

1,176 |

|

|

* |

|

|

Pam Randhawa(9) |

|

Record |

|

|

1,971 |

|

|

* |

|

|

Doreen Woo Ho(10) |

|

Record/Beneficial |

|

|

27,201 |

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

||

Other Named Executive Officers |

|

|

|

|

|

|

|

|

||

Seth H. Meyer(11) |

|

Record/Beneficial |

|

|

214,075 |

|

|

* |

|

|

Melanie Grace(12) |

|

Beneficial |

|

|

52,071 |

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

||

Executive officers and directors as a group (13 persons)(13) |

|

|

|

|

|

|

|

1.4 |

% |

|

SECURITY OWNERSHIP INFORMATION |

5 |

* Less than 1%.

The following table sets forth as of April 25, 2022 (except as noted below), the dollar range of our securities owned by our directors and executive officers.

Name |

|

Dollar Range of |

Interested Director |

|

|

Scott Bluestein |

|

Over $100,000 |

|

|

|

Independent Directors |

|

|

Robert P. Badavas |

|

Over $100,000 |

Gayle Crowell |

|

Over $100,000 |

Thomas J. Fallon |

|

Over $100,000 |

Joseph F. Hoffman |

|

Over $100,000 |

Brad Koenig |

|

Over $100,000 |

Wade Loo |

|

$0-$50,000 |

Pam Randhawa |

|

$0-$50,000 |

Doreen Woo Ho |

|

Over $100,000 |

|

|

|

Other Executive Officers |

|

|

Seth H. Meyer |

|

Over $100,000 |

Kiersten Zaza Botelho |

|

Over $100,000 |

Christian Follmann |

|

Over $100,000 |

Melanie Grace* |

|

Over $100,000 |

* As of September 23, 2021. On September 24, 2021, Ms. Grace resigned from her position as Chief Compliance Officer, General Counsel and Secretary.

SECURITY OWNERSHIP INFORMATION |

6 |

PROPOSAL 1: ELECTION OF DIRECTORS

The Board unanimously recommends that you vote FOR the nominees for director

(Item 1 on your proxy card)

General

As of the date of this proxy statement, the Board consists of nine directors, eight of which are not "interested persons" of Hercules, as such term is defined under the 1940 Act. Two directors, Mr. Hoffman and Ms. Woo Ho, will retire from the Board following the expiration of their current terms at the 2022 annual meeting.

The Board is divided into three classes. Each director serves until the third annual meeting following his or her election and until his or her successor is duly elected and qualifies. Our Class III directors, whose terms expire at the annual meeting, are Scott Bluestein and Wade Loo. The nomination of Messrs. Bluestein and Loo to stand for election at the annual meeting has been recommended by the Governance Committee and has been approved by the Board. Messrs. Bluestein and Loo, if elected, each will serve for a three-year term expiring at the 2025 Annual Meeting of Stockholders, and until their successor is duly elected and qualifies, or until their earlier death, resignation or removal from the Board.

Neither Messrs. Bluestein nor Loo are being nominated as a director for election pursuant to any agreement or understanding between such persons and Hercules. Messrs. Bluestein and Loo have indicated their willingness to continue to serve if elected and have consented to be named as nominees. Mr. Loo is not an “interested person” of Hercules, as such term is defined under the 1940 Act.

Director Qualifications

The Board recognizes that it is important to assemble a body of directors that, taken together, has the skills, qualifications, experience and attributes appropriate for functioning as a Board, and working with management, effectively. The Governance Committee is responsible for maintaining a well-rounded and diverse Board that has the requisite range of skills and qualifications to oversee the Company effectively. Our Board believes in the value of diversity and seeks to ensure that its composition reflects a mix of members representing various backgrounds, industries, skills, professional experiences, genders, races, and ethnicities. The Board complies with all rules and regulations while striving to always do what it believes is right. The Board must also comprise individuals with experience or skills sufficient to meet the requirements of the various rules and regulations of the NYSE and the SEC, such as the requirements to have a majority of independent directors and an Audit Committee Financial Expert. In light of our business, the primary areas of experience and qualifications sought by the Governance Committee in incumbent and director candidates include, but are not limited to, the following:

For each director, we have highlighted certain key areas of experience that qualify him or her to serve on the Board in each of their respective biographies below beginning on page 9.

A stockholder can vote for or withhold his, her or its vote for the nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each of the nominees

PROPOPOSAL 1 |

7 |

named in this Proxy Statement. If any nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of the person nominated by our Board as a replacement. Our Board has no reason to believe that the nominees will be unable or unwilling to serve.

Required Vote

Since this is an uncontested election, directors will be elected by a majority of the votes cast at the annual meeting, in person virtually or by proxy, such that a nominee for director will be elected to the Board if the votes cast FOR the nominee’s election exceed the votes cast AGAINST such nominee's election. Abstentions and broker non-votes are not counted as votes cast for purposes of the election of directors and, therefore, will have no effect on the outcome of such election. Stockholders may not cumulate their votes. Even if a director is not re-elected, he or she will remain in office as a director until the earlier of the acceptance by the Board of his or her resignation or his or her removal. If a director is not re-elected, the director is required to offer to resign from the Board. In that event, the Governance Committee will consider such offer to resign and make a recommendation to the Board who will then vote whether to accept the director’s resignation in accordance with the procedures listed in our Corporate Governance Guidelines.

Broker Non-Votes

A broker non-vote is a vote that is not cast on a non-routine matter by a broker that is present (in person or by proxy) at the meeting because the shares entitled to cast the vote are held in street name, the broker lacks discretionary authority to vote the shares and the broker has not received voting instructions from the beneficial owner. Proposal 1 is a non-routine matter. As a result, if you hold shares in “street name” through a broker, bank or other nominee, your broker, bank or nominee will not be permitted to exercise voting discretion with respect to Proposal 1, the election of directors. If you do not vote and you do not give your broker or other nominee specific instructions on how to vote for you, then your shares will have no effect on Proposal 1.

PROPOPOSAL 1 |

8 |

Information about the Directors and Executive Officers

Mr. Hoffman and Ms. Woo Ho will retire from the Board following the expiration of their current terms at the 2022 annual meeting. For each director who will, or is nominated to, continue to serve on the Board following the 2022 annual meeting, we have highlighted certain key areas of experience that qualify him or her to serve on the Board in each of their respective biographies below.

PROPOPOSAL 1 |

9 |

Name, Address, and Age(1) |

|

|

Position(s) held with Company |

|

|

Term of Office and Length of Time Served |

|

|

Principal Occupation(s) During Past 5 Years |

|

|

Other Directorships Held by Director or Nominee for Director During the past 5 years(2) |

Independent Directors |

|

|

|

|

|

|

|

|

|

|

|

|

Robert P. Badavas (69) |

|

|

Director |

|

|

Class I Director since 2006 |

|

|

Retired. Chairman and Chief Executive Officer of PlumChoice, provider of virtual technical services and support, from 2011-2016. |

|

|

Constant Contact, Inc., an online marketing company, from 2007-2016. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pam Randhawa (53) |

|

|

Director |

|

|

Class I Director since 2021 |

|

|

CEO and Founder of Empiriko Corporation, a biotechnology startup, since 2010 |

|

|

None. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gayle Crowell (71) |

|

|

Director |

|

|

Class II Director since 2019 |

|

|

Former Senior Operating Consultant at Warburg Pincus, a global private equity firm focused on growth investing 2002-2019. |

|

|

Envestnet, a provider of integrated portfolio, practice management, and reporting solutions to financial advisors and institutions since 2016. Pliant Therapeutics, a clinical stage biopharmaceutical company that discovers, develops and commercializes novel therapies for the treatment of fibrosis since 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas J. Fallon (60) |

|

|

Director |

|

|

Class II Director since 2014 |

|

|

Executive Vice President - Business Development, Sanmina Corporation (2022-present). Former Chief Executive Officer of Infinera Corporation, manufacturer of high capacity optical transmission equipment, from 2010-2020. |

|

|

Infinera Corporation since 2009. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Brad Koenig (63) |

|

|

Director |

|

|

Class II Director since 2017 |

|

|

Adviser to the board of directors of AvePoint, Inc. since 2021. Former Co-Chief Executive Officer of Apex Tech Acquisition, a blank check acquisition company or SPAC from 2019-2021. Former Founder and Chief Executive Officer of FoodyDirect.com, an online marketplace that features foods from the top restaurants, bakeries and artisan purveyors around the country from 2011-2018 which was acquired by Goldbelly, Inc. in 2018. |

|

|

SuRo Capital Corp. (f/k/a GSV Capital Corporation), identifies and invests in rapidly growing late stage venture capital-backed private companies from 2015-2017. Apex Tech Acquisition Corp, a blank check acquisition company or SPAC (2019-2021). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wade Loo (61) |

|

|

Director Nominee |

|

|

Class III Director since 2021 |

|

|

Retired. Audit Partner KPMG LLP in Silicon Valley from 1991 to 2010. |

|

|

Guidance Software from 2016 to 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interested Director |

|

|

|

|

|

|

|

|

|

|

|

|

Scott Bluestein (43) |

|

|

Director Nominee, Chief Executive Officer and Chief Investment Officer |

|

|

Class III Director Since 2019 |

|

|

Chief Investment Officer of Hercules since 2014; Interim Chief Executive Officer from March 2019 to July 2019; Director and Chief Executive Officer since July 2019 |

|

|

None. |

PROPOPOSAL 1 |

10 |

Director Nominees Biographies

The biographical information for the director nominees is as follows:

Scott Bluestein |

|

|

Board Committee: |

|

|

Independent |

|

|

|

N/A |

|

|

No |

Mr. Bluestein, 43, joined us in 2010 as Chief Credit Officer. He was promoted to Chief Investment Officer in 2014. In addition to Chief Investment Officer, he was elected Interim Chief Executive Officer in March 2019. In July 2019, he was elected Chief Executive Officer and President. He has served as a director on our Board since July 2019 and his term expires in 2022.

Business Experience |

|

|

• |

|

|

Founder and Partner, Century Tree Capital Management (2009-2010) |

|

• |

|

|

Managing Director, Laurus-Valens Capital Management, an investment firm specializing in financing small and microcap growth-oriented businesses through debt and equity securities (2003-2009) |

||

|

• |

|

|

Member of Financial Institutions Coverage Group focused on Financial Technology, UBS Investment Bank (2000-2003) |

||

|

|

|

|

|

|

|

Education/ Other: |

|

|

• |

|

|

Bachelor’s in Business Administration from Emory University |

|

PROPOPOSAL 1 |

11 |

Wade Loo |

|

|

Board Committee: |

|

Independent: |

|

|

|

• Audit |

|

Yes |

|

|

|

• Compensation |

|

|

Mr. Loo, 61, is retired from KPMG LLP after 30 years of service with the firm. Since retiring from KPMG LLP, he has been serving on both public and non-public boards and investment committees. He has served as a director on our Board since June 2021 and his term expires in 2022.

Business Experience: |

|

|

• |

|

|

Audit partner for multinationals and venture-backed entities, with experience working with companies in the areas of technology, financial and life sciences |

|

• |

|

|

Partner in Charge of KPMG LLP's Northern California Audit Business Unit, whose territory includes the Silicon Valley and San Francisco offices |

||

|

• |

|

|

Certified Public Accountant (California) |

||

|

|

|

|

|

|

|

Prior Public Company Directorships: |

|

|

• |

|

|

Guidance Software - Board Member and Audit Committee Chair (2016-2017) |

|

• |

|

|

Kofax Ltd. - Board Member and Audit Committee Chair (2011-2015) |

||

|

|

|

|

|

|

|

Private and Non-Profit |

|

|

• |

|

|

Investment Committee Member at Mapletree Europe Income Trust and Mapletree US Income Commercial Trust, both Private Real Estate Investment Trusts (2021-present) |

Directorships: |

|

|

• |

|

|

Board Member (2015-present), Audit Committee Chair (2015-2019) and Board Chair (2021-present) at the Silicon Valley Community Foundation |

|

|

|

• |

|

|

Executive Advisory Board Member at the University of Denver - Daniels College of Business (2015-present) and Board Chair (2018-2021) |

|

|

|

• |

|

|

JobTrain - Board Member (2006-2018), Audit Committee Chair (2006-2010) and Board Chair (2011-2017) |

|

|

|

|

|

|

|

Other Experience: |

|

|

• |

|

|

Let KPMG's Audit Committee Institute activities in Silicon Valley, which provides audit committee and governance best practices to audit committee chairs |

|

|

|

|

|

|

|

Education: |

|

|

• |

|

|

Bachelor's in Accounting from the University of Denver |

PROPOPOSAL 1 |

12 |

Skills/ Qualifications: |

|

|

Mr. Loo’s key areas of skill/qualifications include, but are not limited to: |

|||

|

|

|

• |

|

|

Client Industries—Experience with venture capital-backed companies in general, and our specific portfolio company industries: technology, life sciences and middle market |

|

|

|

• |

|

|

Banking/Financial Services—Experience with banking, mutual fund or other financial services industries, including regulatory experience and specific knowledge of the Securities Act |

|

|

|

• |

|

|

Leadership/Strategy—Both as Partner at KPMG and Board Chair, responsible for leading large teams and establishing and executing successful business strategies |

|

|

|

• |

|

|

Finance, IT and Other Business Processes—Significant experience as an audit partner and audit committee chair related to finance, accounting and internal controls, IT and other key business processes |

|

|

|

• |

|

|

Enterprise Risk Management—Experience with enterprise risk management processes and functions, including compliance and operational |

|

|

|

• |

|

|

Governance—Experience with corporate governance issues, particularly in publicly-traded companies |

|

|

|

• |

|

|

Strategic Planning—Experience with senior executive-level strategic planning for publicly-traded companies, private companies and non-profit companies |

|

|

|

• |

|

|

Mergers and Acquisitions—Experience with public and/or private company M&A, both in identifying targets and evaluating potential targets, as well as post-acquisition integration activities |

|

||||||

PROPOPOSAL 1 |

13 |

Independent Director Biographies

As noted above, Mr. Hoffman and Ms. Woo Ho will retire from the Board following the expiration of their current terms at the 2022 annual meeting. The biographical information for each of the independent directors who will continue on the Board following the 2022 annual meeting is as follows:

Robert P. Badavas |

|

|

Board Committee: |

|

|

Independent: |

|

|

|

• Audit |

|

|

Yes (Board Chair) |

Mr. Badavas, 69, retired in August 2016 as Chairman and Chief Executive Officer of PlumChoice, a venture-backed technology, software and services company (since December 2011). He was appointed Interim Chairman of the Board in March 2019 and Chairman in July 2019. He has served as a director on our Board since March 2006. His term expires in 2023.

Business Experience: |

|

|

• |

|

|

President, Petros Ventures, Inc., a management and advisory services firm (2009-2011 and since 2016) |

|

• |

|

|

President and Chief Executive Officer at TAC Worldwide, a multi-national technical workforce management and business services company (2005-2009) |

||

|

• |

|

|

Executive Vice President and Chief Financial Officer, TAC Worldwide (2003-2005) |

||

|

• |

|

|

Senior Partner and Chief Operating Officer, Atlas Venture, an international venture capital firm (2001-2003) |

||

|

• |

|

|

Chief Executive Officer at Cerulean Technology, Inc., as venture capital backed wireless application software company (1995-2001) |

||

|

• |

|

|

Certified Public Accountant, PwC (1974-1983) |

||

|

|

|

|

|

|

|

Public Directorships: |

|

|

• |

|

|

Constant Contact, Inc., including chairman of the audit committee, a provider of email and other engagement marketing products and services for small and medium sized organizations, acquired by Endurance International Group Holdings, Inc. (2007-2016) |

|

|

|

|

|

|

|

Private Directorships: |

|

|

• |

|

|

Polyvinyl Films, Inc., director, a leading manufacturer and distributer of food-grade film products for consumer, retail, and food-service markets worldwide (since 2019) |

|

|

|

|

|

|

|

Prior Directorships: |

|

|

• |

|

|

PlumChoice, a venture-backed technology, software and services company |

|

• |

|

|

Arivana, Inc., a telecommunications infrastructure company—publicly traded until its acquisition by SAC Capital |

||

|

• |

|

|

On Technology, an IT software infrastructure company—publicly traded until its acquisition by Symantec |

||

|

• |

|

|

Renaissance Worldwide; an IT services and solutions company—publicly traded until its acquisition by Aquent |

||

|

|

|

|

|

|

|

Other Experience: |

|

|

• |

|

|

Trustee Emeritus, Bentley University (2005-2019); Board Chair (2018-2019); Vice Chair (2013-2018) |

|

• |

|

|

Board of Trustees Executive Committee and Corporate Treasurer, Hellenic College/Holy Cross School of Theology (2002-2018) |

||

|

• |

|

|

Trustee Emeritus, The Learning Center for the Deaf; Board Chair (1995-2005) |

||

|

• |

|

|

Master Professional Director Certification, American College of Corporate Directors |

||

|

• |

|

|

National Association of Corporate Directors |

||

|

• |

|

|

Annunciation Greek Orthodox Cathedral of New England, Parish Council President (since 2016) |

||

|

|

|

|

|

|

|

Education: |

|

|

• |

|

|

Bachelor’s degree in Accounting and Finance from Bentley University |

PROPOPOSAL 1 |

14 |

Skills/ Qualifications: |

|

|

Mr. Badavas’ key areas of skill/qualifications include, but are not limited to: |

|||

|

|

|

• |

|

|

Client Industries—extensive experience in software, business and technology enabled services and venture capital |

|

|

|

• |

|

|

Leadership/Strategy—significant experience as a senior corporate executive in private and public companies, including tenure as chief executive officer, chief financial officer and chief operating officer |

|

|

|

• |

|

|

Finance, IT and Other Business Strategy and Enterprise Risk Management—prior experience as a CEO directing business strategy and as a CFO directing IT, financing and accounting, strategic alliances and human resources and evaluation of enterprise risk in such areas |

|

|

|

• |

|

|

Enterprise Risk Management—experience in managing enterprise risk as CEO |

|

|

|

• |

|

|

Governance—extensive experience as an executive and director of private and public companies with governance matters |

|

|

|

• |

|

|

Strategic Planning—experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies |

|

|

|

• |

|

|

Mergers and Acquisitions—experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration activities |

|

PROPOPOSAL 1 |

15 |

Pam Randhawa |

|

|

Board Committee: |

|

|

Independent: |

|

|

|

• Governance |

|

|

Yes |

Ms. Randhawa, 53, currently serves as the CEO and Founder of Emipiriko Corporation since 2010. She has served as a director on our Board since November 2021 and her term expires in 2023.

Business Experience: |

|

|

• |

|

|

CEO and Founder of Emipiriko Corporation, a biotechnology startup (2010-present) |

|||

|

• |

|

|

Co-Founder, AgroGreen Biofuels, renewable energy startup (2010-2012) |

|||||

|

• |

|

|

Vice President, Strategic Development, Sermo, a healthcare technology company (2008-2009) |

|||||

|

• |

|

|

Vice President, Marketing, Phase Forward, a life sciences technology company (2005-2007) |

|||||

|

|

|

|

|

|

|

|

|

|

Other Business Experience: |

|

|

• |

|

|

Director of Massachusetts Life Sciences Center, a Massachusetts Investment Fund to promote the life sciences sector (2016-present) |

|||

|

• |

|

|

Chair and Director of Massachusetts Biotechnology Council, an industry association for biotechnology (2017-present) |

|||||

|

|

|

|

|

|

|

|

|

|

Non-Profit/ Government Leadership: |

|

|

• |

|

|

Member, The World Economic Forum’s Global Future Council on Biotechnology (2018-2020) |

|||

|

• |

|

|

Chair, National Science Foundation and National Institution of Justice, Industrial Advisory Board of Center for Advanced Research in Forensic Science (2019-2020) |

|||||

|

• |

|

|

Member, the Economic Development Planning Council for the State of Massachusetts (2019) |

|||||

|

• |

|

|

Member, Boston Women’s Workforce Council, a public-private partnership between the Mayor’s Office and Greater Boston employers dedicated to eliminating the gender/racial wage gap (2016-2020) |

|||||

|

|

|

|

|

|

|

|

|

|

Education: |

|

|

• |

|

|

BA in Economics from University of Rajasthan |

|||

|

• |

|

|

MPM from Carnegie Mellon University |

|||||

Skills/ Qualifications: |

|

|

Ms. Randhawa’s key areas of skill/qualifications include, but are not limited to: |

|||

|

|

|

• |

|

|

Client Industries—Experience with venture capital-backed companies in general, and our specific portfolio company industries – technology, life sciences, middle market, and sustainable and renewable technology |

|

|

|

• |

|

|

Leadership/Strategy—Experience as a CEO, President, entrepreneur and senior executive leading teams and establishing and executing successful business strategies |

|

|

|

• |

|

|

Finance, IT and Other Business Processes—Experience related to finance, IT, sales, business development, marketing, or other key business processes |

|

|

|

• |

|

|

Enterprise Risk Management—Experience with enterprise risk management processes and functions, including compliance and operational |

|

|

|

• |

|

|

Governance—Experience with corporate governance issues |

|

|

|

• |

|

|

Strategic Planning—Experience with senior executive-level strategic planning for publicly-traded companies, private companies, non-profit and government |

|

|

|

• |

|

|

Mergers and Acquisitions—Experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration activities |

|

||||||

Gayle Crowell |

|

|

Board Committee: |

|

Independent: |

|

|

|

• Compensation (Chair) • Governance |

|

Yes |

Ms. Crowell, 71, formerly served as Senior Operating Consultant at Warburg Pincus, a global private equity firm focused on growth investing from 2002 to 2019. She has served as a director on our Board since February 2019 and her term expires in 2024.

PROPOPOSAL 1 |

16 |

Business Experience: |

|

|

• |

|

|

President and CEO, RightPoint Software (acquired by E.piphany), developed customer relationship management software (1998-2000) |

|

• |

|

|

Senior Vice President and General Manager, ViewStar (acquired by Mosaix), a network based process automation software encompassing workflow automation, document image processing and information management company (1994-1998) |

||

|

• |

|

|

Group Director, Oracle Corporation, a computer technology corporation (1990-1992) |

||

|

• |

|

|

Vice President of Sales, DSC, a networking company (1989-1990) |

||

|

• |

|

|

Vice President of Sales, Cubix Corporation, a company that designs, engineers and manufactures computer hardware systems (1985-1989) |

||

|

|

|

|

|

|

|

Public Directorships: |

|

|

• |

|

|

Envestnet (member of audit committee and nominating and governance committee), a leading provider of integrated portfolio, practice management, and reporting solutions to financial advisors and institutions (since 2016) |

|

• |

|

|

Pliant Therapeutics (chair of information security and compliance committee, member of compensation committee and nominating and governance committee), a clinical stage biopharmaceutical company that discovers, develops and commercializes novel therapies for the treatment of fibrosis (since 2019) |

||

|

|

|

|

|

|

|

Private Directorships: |

|

|

• |

|

|

Lead Director, GTreasury, an integrated digital treasury management platform that allows companies to manage liquidity risk, market risk, counter party and credit risk (since 2021) |

|

|

|

• |

|

|

Executive Chair, Instinct Science, a provider of cloud-based, electronic medical records and practice management systems for the modern veterinary office and hospital (since 2022) |

|

|

|

|

|

|

|

Prior Directorships: |

|

|

• |

|

|

Dude Solutions, the leading provider of cloud-based operations management software to optimize facilities, assets and workflow (since 2014) |

|

• |

|

|

Resman, a property management platform of owners, operators and investors across the multifamily, affordable and commercial real estate marketplaces (2020-2021) |

||

|

• |

|

|

MercuryGate, a developer of a transportation management system and offers a software that enables shippers, carriers, brokers, freight forwarders and third party logistics providers to plan, monitor and track shipments (2014-2018) |

||

|

• |

|

|

Yodlee, the leading data aggregation and data analytics platform, helps consumers live better financial lives through innovative products and services delivered through financial institutions and FinTech companies (2002-2015) |

||

|

• |

|

|

Coyote Logistics, a third-party logistics provider that combines a centralized marketplace with freight and transportation solutions to empower your business (2011-2015) |

||

|

• |

|

|

SRS (2004-2013) |

||

|

• |

|

|

TradeCard, a SaaS collaboration product that was designed to allow companies to manage their extended supply chains including tracking movement of goods and payments (2009-2013) |

||

|

|

|

|

|

|

|

Other |

|

|

• |

|

|

Member, National Association of Corporate Directors (NACD) |

Experience: |

|

|

• |

|

|

Member, Women Corporate Directors (WCD) |

|

|

|

|

|

|

|

Education: |

|

|

• |

|

|

Bachelor of Science from University of Nevada Reno |

PROPOPOSAL 1 |

17 |

Skills/ Qualifications: |

|

|

Ms. Crowell’s key areas of skill/qualifications include, but are not limited to: |

|||

|

|

|

• |

|

|

Client Industries—significant experience in venture capital and technology |

|

|

|

• |

|

|

Banking/Financial Services—held a variety of key executive and management positions at large global financial institutions |

|

|

|

• |

|

|

Leadership/Strategy—extensive experience as a director and executive with broad operational experience in investments and finance |

|

|

|

• |

|

|

Finance, IT and other Business Processes—extensive experience in commercial lending, sales marketing as well as other key business processes |

|

|

|

• |

|

|

Enterprise Risk Management—experience in managing enterprise risk as CEO |

|

|

|

• |

|

|

Governance—experienced in both corporate governance and executive compensation for both public and private companies |

|

|

|

• |

|

|

Strategic Planning—experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies |

|

|

|

• |

|

|

Mergers and Acquisitions—experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration activities |

|

||||||

PROPOPOSAL 1 |

18 |

Thomas J. Fallon |

|

|

Board Committee: |

|

|

Independent: |

|

|

|

• Governance • Compensation |

|

|

Yes |

Mr. Fallon, 60, has been the Executive Vice President - Business Development of Sanmina Corporation, an American electronics manufacturing services provider, since 2022. He formally served as Chief Executive Officer of Infinera Corporation, a global supplier of innovative networking solutions, from 2010 to 2020). He has served as a director on our Board since July 2014 and his term expires in 2024.

Business Experience: |

|

|

• |

|

|

Executive Vice President - Business Development, Sanmina Corporation (2022-present) |

|

• |

|

|

Chief Executive Officer, Infinera Corporation (2010-2020) |

||

|

• |

|

|

Chief Operating Officer, Infinera Corporation (2006-2009) |

||

|

• |

|

|

Vice President of Engineering and Operations, Infinera Corporation (2004-2006) |

||

|

|

|

|

|

|

|

Other Business Experience: |

|

|

• |

|

|

Vice President, Corporate Quality and Development Operations of Cisco Systems, Inc. (2003-2004) |

|

• |

|

|

General Manager of Cisco Systems’ Optical Transport Business Unit, VP Operations, VP Supply, various executive positions (1991-2003) |

||

|

|

|

|

|

|

|

Public Directorships: |

|

|

• |

|

|

Infinera Corporation, a global supplier of innovative networking solutions (since 2009) |

|

|

|

|

|

|

|

Prior Directorships: |

|

|

• |

|

|

Piccaro, a leading provider of solutions to measure greenhouse gas concentrations, trace gases and stable isotopes (2010-2016) |

|

|

|

|

|

|

|

Other Experience: |

|

|

• |

|

|

Member, Engineering Advisory Board of the University of Texas at Austin |

|

• |

|

|

Member, President’s Development Board University of Texas |

||

|

|

|

• |

|

|

Member, Technical Advisory Board Quantumscape |

|

|

|

|

|

|

|

Education: |

|

|

• |

|

|

Bachelor’s degree in Mechanical Engineering from the University of Texas at Austin |

|

• |

|

|

Master’s degree in Business Administration from the University of Texas at Austin |

Skills/ Qualifications: |

|

|

Mr. Fallon’s key areas of skill/qualifications include, but are not limited to: |

|||

|

|

|

• |

|

|

Client Industries—significant experience in venture capital and technology |

|

|

|

• |

|

|

Leadership/Strategy—extensive experience as a director and executive with broad operational experience in investments and finance |

|

|

|

• |

|

|

Finance, IT and other Business Processes—extensive experience in commercial lending, sales marketing as well as other key business processes |

|

|

|

• |

|

|

Enterprise Risk Management—experience in managing enterprise risk as CEO |

|

|

|

• |

|

|

Governance—experienced in both corporate governance and executive compensation for both public and private companies |

|

|

|

• |

|

|

Strategic Planning—experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies |

|

|

|

• |

|

|

Mergers and Acquisitions—experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration activities |

|

||||||

PROPOPOSAL 1 |

19 |

Brad Koenig |

|

|

Board Committee: |

|

|

Independent: |

|

|

|

• Audit |

|

|

Yes |

|

|

|

• Compensation |

|

|

|

Mr. Koenig, 63, has served as an adviser to the board of directors of AvePoint, Inc., a provider of managed IT services since 2021. He has served as a director on our Board since October 2017 and his term expires in 2024.

Business Experience: |

|

|

• |

|

|

Chief Executive Officer of FoodyDirect.com, an online marketplace that features foods from the top restaurants, bakeries and artisan purveyors around the country when the company was acquired by Goldbelly, Inc. (2011-2018) |

|

• |

|

|

Head of Global Technology Investment Banking at Goldman Sachs, a leading global investment banking, securities and investment management firm (1990-2005) |

||

|

• |

|

|

Co-Head of Global Technology, Media and Telecommunications at Goldman Sachs (2002-2005) |

||

|

|

|

|

|

|

|

Private Directorships: |

|

|

• |

|

|

Theragenics Corporation, medical device company serving the surgical products and prostate cancer treatment markets (since 2013) |

|

|

|

|

|

|

|

Prior |

|

|

• |

|

|

Apex Tech Acquisition Corp, a blank check acquisition company or SPAC (2019-2021) |

Directorships: |

|

|

• |

|

|

SuRo Capital Corp. (f/k/a GSV Capital Corporation), identifies and invests in rapidly growing late stage vesture capital-backed private companies (2015-2017) |

|

• |

|

|

EveryAction Software, the leading technology provider to Democratic and progressive campaigns and organizations, offering clients an integrated platform of the best fundraising, compliance, field, organizing, digital and social networking products (2009-2018) |

||

|

|

|

|

|

|

|

Other Experience: |

|

|

• |

|

|

Adviser to Oak Hill Capital Management, a private equity firm |

|

|

|

|

|

|

|

Education: |

|

|

• |

|

|

Bachelor’s degree in Economics from Dartmouth College |

|

• |

|

|

Master’s degree in Business Administration from Harvard Business School |

Skills/ Qualifications: |

|

|

Mr. Koenig’s key areas of skill/qualifications include, but are not limited to: |

|||

|

|

|

• |

|

|

Client Industries—significant experience in venture capital and technology |

|

|

|

• |

|

|

Banking/Financial Services—experience with banking, mutual funds, or other financial services industries, including regulatory experience and specific knowledge of the Securities Act |

|

|

|

• |

|

|

Leadership/Strategy—extensive experience as a director and executive in both public and private companies |

|

|

|

• |

|

|

Governance—experience as the chairman of the governance committee with corporate governance issues, particularly in a publicly-traded company |

|

|

|

• |

|

|

Strategic Planning—experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies |

|

|

|

• |

|

|

Mergers and Acquisitions—experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration activities |

|

||||||

PROPOPOSAL 1 |

20 |

CORPORATE GOVERNANCE

Our business, property and affairs are managed under the direction of our Board. Members of our Board are kept informed of our business through discussions with our chairman and chief executive officer, our chief financial officer, our chief investment officer, our general counsel, and our other officers and employees, and by reviewing materials provided to them and participating in meetings of our Board and its committees.

Because our Board is committed to strong and effective corporate governance, it regularly monitors our corporate governance policies and practices to ensure we meet or exceed the requirements of applicable laws, regulations and rules, and the NYSE’s listing standards. The Board has adopted a number of policies to support our values and good corporate governance, including corporate governance guidelines, Board committee charters, insider trading policy, code of ethics, code of business conduct and ethics, and related person transaction approval policy. The Board has approved corporate governance guidelines that provide a framework for the operation of the Board and address key governance practices. Examples of our corporate governance practices include:

Our Board will continue to review and update the corporate governance guidelines, corporate governance practices, and our corporate governance framework.

Board Leadership Structure

As of the date of this proxy statement, our Board is comprised of eight independent directors and one interested director, our CEO, including an independent chairman of the Board. In addition, each member of our Audit Committee, Compensation Committee, and Governance Committee is an independent director. Mr. Hoffman and Ms. Woo Ho, independent directors who chair the Audit and Governance Committees, respectively, will retire from the Board following the expiration of their current terms at the 2022 annual meeting. The Audit and Governance Committee chair positions will be filled by two other independent directors following Mr. Hoffman's and Ms. Woo Ho's retirement. Our Board and its committees remain in close contact with Hercules’ management and receive reports on various aspects of Hercules’ management and enterprise risk directly from our senior management and independent auditors. Our Board believes this provides an efficient and effective leadership model for the Company.

No single leadership model is right for all companies at all times. Our Board recognizes that depending on the circumstances, other leadership models, might be appropriate. Accordingly, our Board periodically reviews its leadership structure.

Board Oversight of Risk

While day-to-day risk management is primarily the responsibility of our management team, our Board, as a whole and through its committees, is responsible for oversight of the risk management processes.

Our Audit Committee has oversight responsibility not only for financial reporting with respect to our major financial exposures and the steps management has taken to monitor and control such exposures, but also for the effectiveness of management’s enterprise risk management process that monitors and manages key business risks facing our company. In

CORPORATE GOVERNANCE |

21 |

addition to our Audit Committee, the other committees of our Board consider the risks within their areas of responsibility. For example, our Compensation Committee considers the risks that may be posed by our executive compensation program.

Management provides regular updates throughout the year to our Board regarding the management of the risks they oversee at each regular meeting of our Board. Also, our Board receives presentations throughout the year from various department and business group heads that include discussion of significant risks as necessary. Additionally, our full Board reviews our short and long-term strategies, including consideration of significant risks facing our business and their potential impact.

During 2021, in addition to unanimous written consents, the Board held the following meetings:

|

Type of Meeting |

|

|

Number |

|

|||

|

|

|

|

Regular Meetings to address regular, quarterly business matters |

|

|

4 |

|

|

|

|

|

Other Meetings to address business matters that arise between quarters, such as fair valuing the portfolio investments, quarterly audit committee presentations and review and approval of earnings reports, among other matters |

|

|

0 |

|

Each director makes a diligent effort to attend all Board and committee meetings, as well as our annual meeting of stockholders. All directors attended at least 93% of the aggregate number of meetings of the Board and of the respective committees on which they served. Each of our then-serving directors attended our 2021 annual meeting of stockholders.

Board Committees

Our Board has established an Audit Committee, a Compensation Committee, and a Governance Committee. A brief description of each committee is included in this Proxy Statement and the charters of the Audit, Compensation, and Governance Committees are available on the Investor Relations page of our website at https://investor.htgc.com/corporate-governance/governance-documents.

As of the date of this Proxy Statement, the members of each of our Board Committees are as follows:

Audit |

|

Compensation |

|

Nominating and Governance |

Joseph F. Hoffman* (Chair) Robert P. Badavas Brad Koenig Wade Loo

|

|

Gayle Crowell (Chair) Thomas J. Fallon Brad Koenig Wade Loo

|

|

Doreen Woo Ho* (Chair) Gayle Crowell Thomas J. Fallon Joseph F. Hoffman Pam Randhawa |

* Mr. Hoffman and Ms. Woo Ho, independent directors who chair the Audit and Governance Committees, respectively, will retire from the Board following the expiration of their current terms at the 2022 annual meeting. The Audit and Governance Committee chair positions will be filled by two other independent directors following Mr. Hoffman's and Ms. Woo Ho's retirement.

Each of our directors who sits on a committee satisfies the independence requirements for purposes of the rules promulgated by the NYSE and the requirements to be a non-interested director as defined in Section 2(a)(19) of the 1940 Act. Mr. Hoffman, Chairman of the Audit Committee and Messrs. Badavas, Koenig and Loo, members of the Audit Committee, are each an “audit committee financial expert” as defined by applicable SEC rules.

Committee Governance

Each committee is governed by a charter that is approved by the Board, which sets forth each committee’s purpose and responsibilities. The Board reviews the committees’ charters, and each committee reviews its own charter, on at least an annual basis, to assess the charters’ content and sufficiency, with final approval of any proposed changes required by the full Board.

CORPORATE GOVERNANCE |

22 |

Committee Responsibilities and Meetings

The key oversight responsibilities of the Board’s committees, and the number of meetings held by each committee during 2021, are as follows:

Audit Committee |

|

|

Number of meetings held in 2021: 6 |

Compensation Committee |

|

|

Number of meetings held in 2021: 6 |

Nominating and Corporate Governance Committee |

|

|

Number of meetings held in 2021: 4 |

Director Independence

The NYSE’s listing standards and Section 2(a)(19) of the 1940 Act require that a majority of our Board and every member of our Audit, Compensation, and Governance Committees are “independent.” Under the NYSE’s listing standards and our corporate governance guidelines, no director will be considered to be independent unless and until our Board affirmatively determines that such director has no direct or indirect material relationship with our company or our management. Our Board reviews the independence of its members annually.

In determining that Mss. Woo Ho, Randhawa and Crowell and Messrs. Badavas, Fallon, Hoffman, Koenig and Loo are independent, our Board, through the Governance Committee, considered the financial services, commercial, family and other relationships between each director and his or her immediate family members or affiliated entities, on the one hand, and Hercules and its subsidiaries, on the other hand.

CORPORATE GOVERNANCE |

23 |

Communication with the Board

We believe that communications between our Board, our stockholders and other interested parties are an important part of our corporate governance process. Stockholders with questions about Hercules are encouraged to contact Michael Hara, Investor Relations at (650) 433-5578. However, if stockholders believe that their questions have not been addressed, they may communicate with our Board by sending their communications to Hercules Capital, Inc., c/o Kiersten Zaza Botelho, Secretary, 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301. All stockholder communications received in this manner will be delivered to one or more members of our Board.

Mr. Badavas currently serves as chairman of our Board, and he presides over executive sessions of the independent directors. Parties may communicate directly with Mr. Badavas by sending their communications to Hercules Capital, Inc., c/o Kiersten Zaza Botelho, Secretary at the above address. All communications received in this manner will be delivered to Mr. Badavas.

All communications involving accounting, internal accounting controls and auditing matters, possible violations of, or non-compliance with, applicable legal and regulatory requirements or our code of ethics, or retaliatory acts against anyone who makes such a complaint or assists in the investigation of such a complaint, will be referred to Kiersten Zaza Botelho, Secretary. The communication will be forwarded to the chair of our Audit Committee if our secretary determines that the matter has been submitted in conformity with our whistleblower procedures or otherwise determines that the communication should be so directed. The acceptance and forwarding of a communication to any director does not imply that the director owes or assumes any duty to the person submitting the communication, all such duties being only as prescribed by applicable law.

Code of Business Conduct and Ethics

Our code of business conduct and ethics requires that our directors and executive officers avoid any conflict, or the appearance of a conflict, between an individual’s personal interests and the interests of Hercules. Pursuant to our code of business conduct and ethics, which is available on the Governance Documents page of our website at https://investor.htgc.com/corporate-governance/governance-documents, each director and executive officer must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to our Audit Committee. Certain actions or relationships that might give rise to a conflict of interest are reviewed and approved by our Board.

Availability of Corporate Governance Documents

To learn more about our corporate governance and to view our corporate governance guidelines, code of business conduct and ethics, and the charters of our Audit Committee, Compensation Committee, and Governance Committee, please visit the Investor Relations page of our website at https://investor.htgc.com/corporate-governance/governance-documents under “Governance Documents.” Copies of these documents are also available in print and free of charge by writing to Hercules Capital, Inc., c/o Kiersten Zaza Botelho, Secretary, 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301.

Compensation Committee Interlocks and Insider Participation

All members of our Compensation Committee are independent directors and none of the members are present or past employees of the Company. No member of our Compensation Committee: (i) has had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Exchange Act; or (ii) is an executive officer of another entity at which one of our executive officers serves on the Board.

Certain Relationships and Related Transactions

We have established a written policy to govern the review, approval and monitoring of transactions involving the Company and certain persons related to Hercules. As a BDC, the 1940 Act restricts us from participating in transactions with any persons affiliated with Hercules, including our officers, directors, and employees and any person controlling or under common control with us.

In order to ensure that we do not engage in any prohibited transactions with any persons affiliated with Hercules, our officers screen each of our transactions for any possible affiliations, close or remote, between the proposed portfolio investment, Hercules, companies controlled by us and our employees and directors. We will not enter into any agreements unless and until we are satisfied that no affiliations prohibited by the 1940 Act exist or, if such affiliations exist, we have taken appropriate actions to seek Board review and approval or exemptive relief from the SEC for such transaction.

CORPORATE GOVERNANCE |

24 |

Anti-Hedging and Anti-Pledging Policy

Our Corporate Governance Guidelines prohibit directors, executive officers and employees from holding their shares of Hercules stock in a margin account or otherwise pledge such shares as collateral for a loan. Directors, officers and employees are also prohibited from engaging in hedging or monetization transactions in respect of Hercules stock, including through the use of financial instruments such as prepaid variable forward, equity swaps, collars and exchange funds.

Corporate Responsibility and Sustainability

We believe that environmental, social and governance factors are an important driver of long-term stockholder returns from both an opportunity and risk-mitigation perspective. Our investment strategy is centered around financing growth-oriented companies in both technology and life sciences. Many of these companies are on the cutting edge of developing new and innovative technologies or are advancing novel drug candidates that have the possibility of providing significant benefits to patients in a variety of areas, including those with unmet needs. Several of these companies are focused on sustainable and responsible products and services, and we are proud to support their efforts. We believe the inclusion of factors related to sustainable and responsible investments provides meaningful value to our employees, portfolio companies, stockholders and community.