Votes Required

The affirmative vote of (i) a “majority of the outstanding shares” of common stock entitled to vote at the Special Meeting, and (ii) a majority of the outstanding shares of common stock entitled to vote at the Special Meeting which are not held by persons affiliated with the Company. Under the Investment Company Act of 1940, as amended (the “Investment Company Act”), “a majority of the outstanding shares” is defined as the lesser of: (i) 67% or more of the voting securities present at the Special Meeting if the holders of more than 50% of our outstanding voting securities are present or represented by proxy; or (ii) more than 50% of our outstanding voting securities. Abstentions and broker non-votes, if any, will have the effect of a vote against this proposal.

Submitting Voting Instructions for Shares Held Through a Broker, Bank, Trustee or Nominee

If you hold shares of the Company’s common stock through a broker, bank, trustee or nominee and want to participate in the Special Meeting, you must follow the instructions you receive from your broker, bank, trustee or nominee. Please instruct your broker, bank, trustee or nominee so your vote can be counted.

Discretionary Voting

Brokers, banks, trustees and nominees have discretionary authority to vote on “routine” matters, but not on “non-routine” matters. The Proposal being considered by the Company at the Special Meeting is a “non-routine” matter. If you hold your shares in “street name” through a broker, bank, trustee or nominee and do not provide your broker, bank, trustee or nominee who holds such shares of record with specific instructions regarding how to vote on the Proposal, your broker will not be permitted to exercise voting discretion with respect to the Proposal.

Please note that to be sure your vote is counted on the Proposal, you should instruct your broker, bank, trustee or nominee how to vote your shares. If you do not provide voting instructions, your shares will not be voted at the Special Meeting and will not be counted as present for quorum purposes.

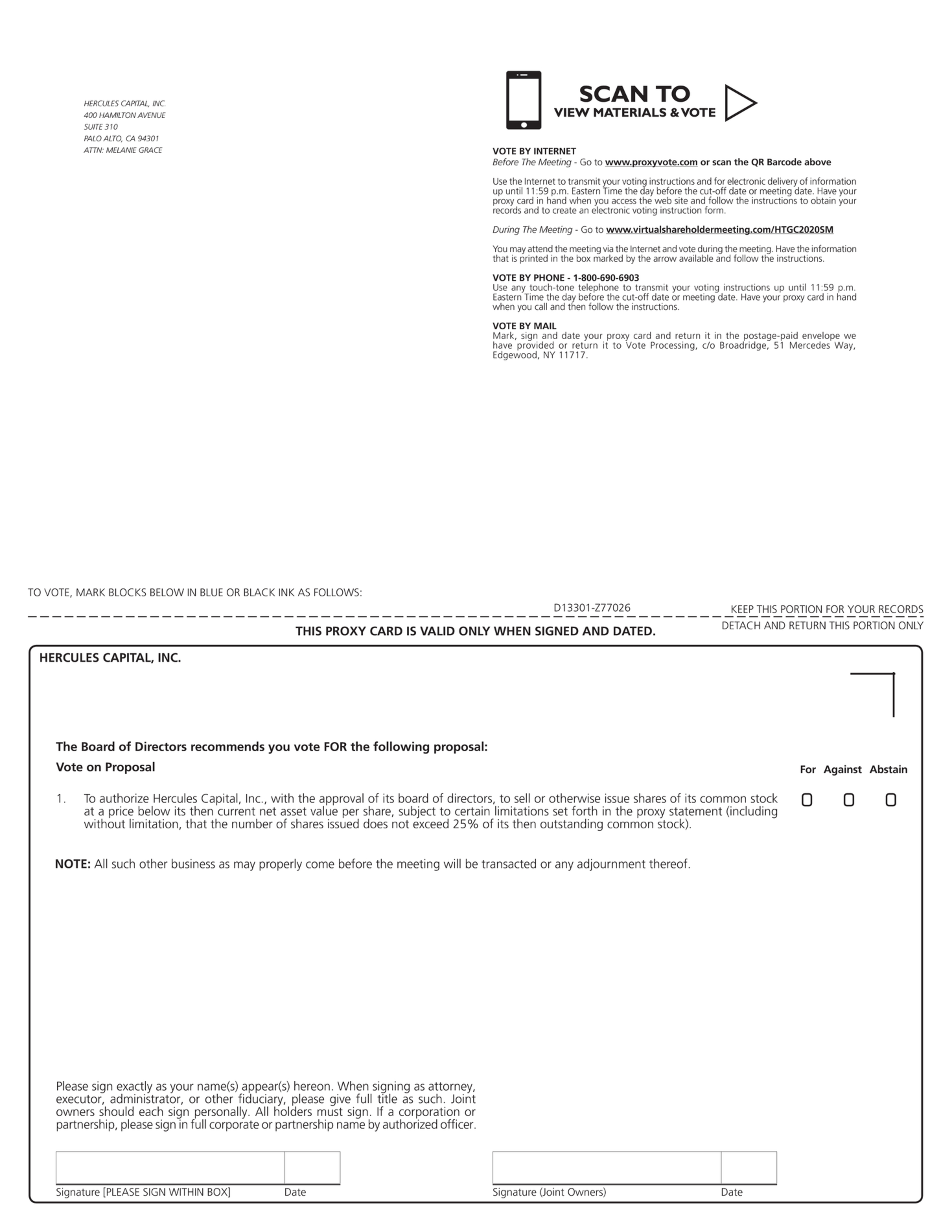

Authorizing a Proxy for Shares Held in Your Name

If you are a record holder of shares of the Company’s common stock, you may authorize a proxy to vote on your behalf by following the instructions provided on the enclosed proxy card. Authorizing your proxy will not limit your right to participate in the virtual Special Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your instructions. If you authorize a proxy without indicating your voting instructions, the proxyholder will vote your shares according to the Board’s recommendations. Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their instructions have been properly recorded. Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned a proxy card.

Receipt of Multiple Proxy Cards

Some of the Company’s stockholders hold their shares in more than one account and may receive a separate proxy card or voting instruction form for each of those accounts. To ensure that all of your shares are represented at the Special Meeting, we recommend that you vote by following the instructions on each proxy card or voting instruction form that you receive.

Revoking Your Proxy

If you are a stockholder of record of the Company, you can revoke your proxy at any time before it is exercised by: (i) delivering a written revocation notice that is received prior to the Special Meeting to Hercules Capital, Inc. 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301 Attn: Melanie Grace, Secretary; (ii) submitting a later-dated proxy that we receive before the conclusion of voting at the Special Meeting; or (iii) participating in person (virtually) at the Special Meeting and voting your shares. If you hold shares of the Company’s common stock through a broker, bank, trustee or nominee, you must follow the instructions you receive from them in order to revoke your voting instructions.

Appraisal Rights

Stockholders who vote against the Proposal will not have appraisal or other similar rights.