In determining that Mss. Woo Ho, Foster and Crowell and Messrs. Badavas, Fallon, Hoffman and Koenig are independent, our Board, through the Governance Committee, considered the financial services, commercial, family and other relationships between each director and his or her immediate family members or affiliated entities, on the one hand, and Hercules and its subsidiaries, on the other hand.

Communication with the Board

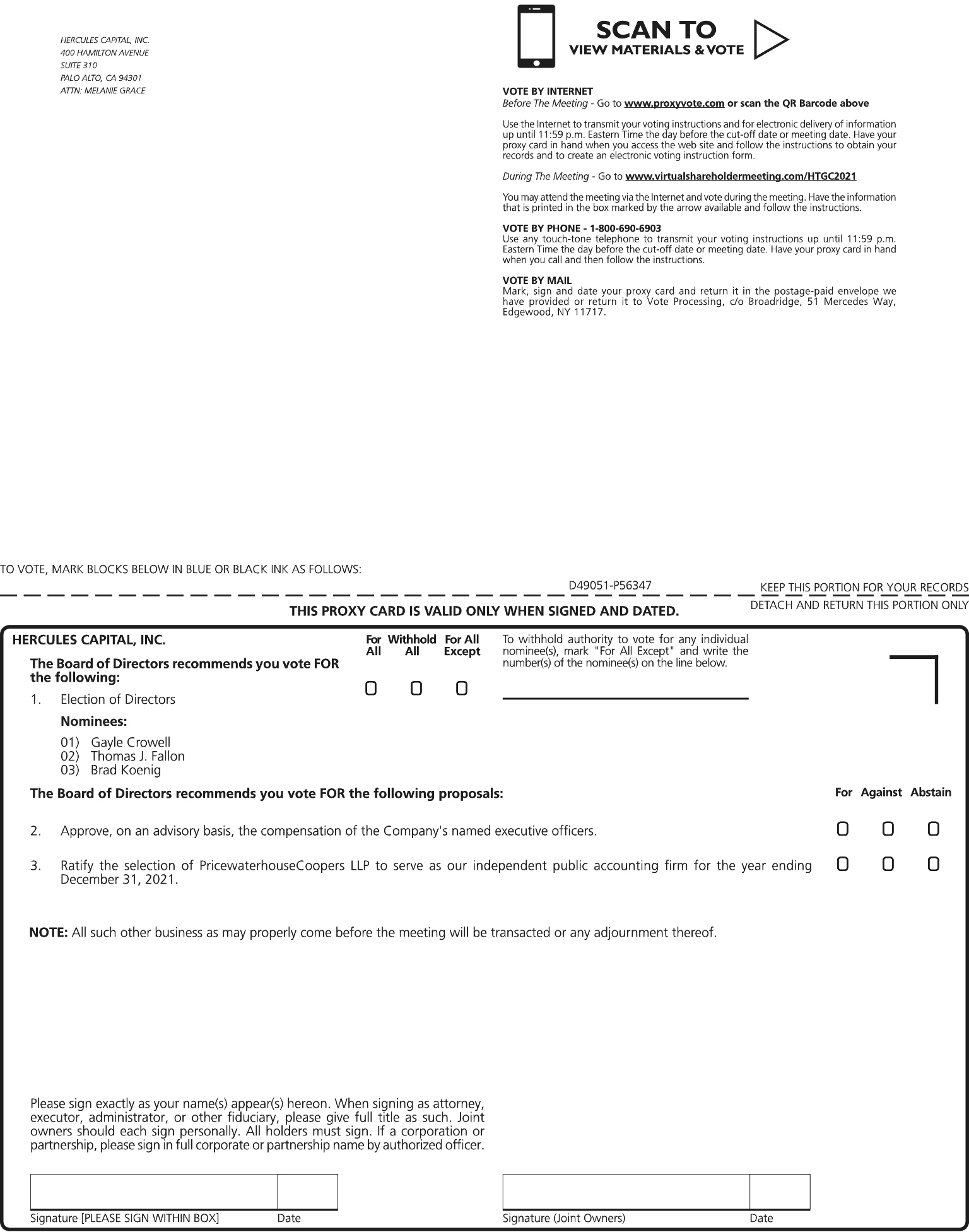

We believe that communications between our Board, our stockholders and other interested parties are an important part of our corporate governance process. Stockholders with questions about Hercules are encouraged to contact Michael Hara, Investor Relations at (650) 433-5578. However, if stockholders believe that their questions have not been addressed, they may communicate with our Board by sending their communications to Hercules Capital, Inc., c/o Melanie Grace, Secretary, 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301. All stockholder communications received in this manner will be delivered to one or more members of our Board.

Mr. Badavas currently serves as chairman of our Board, and he presides over executive sessions of the independent directors. Parties may communicate directly with Mr. Badavas by sending their communications to Hercules Capital, Inc., c/o Melanie Grace, Secretary at the above address. All communications received in this manner will be delivered to Mr. Badavas.

All communications involving accounting, internal accounting controls and auditing matters, possible violations of, or non-compliance with, applicable legal and regulatory requirements or our code of ethics, or retaliatory acts against anyone who makes such a complaint or assists in the investigation of such a complaint, will be referred to Melanie Grace, Secretary. The communication will be forwarded to the chair of our Audit Committee if our secretary determines that the matter has been submitted in conformity with our whistleblower procedures or otherwise determines that the communication should be so directed. The acceptance and forwarding of a communication to any director does not imply that the director owes or assumes any duty to the person submitting the communication, all such duties being only as prescribed by applicable law.

Code of Business Conduct and Ethics

Our code of business conduct and ethics requires that our directors and executive officers avoid any conflict, or the appearance of a conflict, between an individual’s personal interests and the interests of Hercules. Pursuant to our code of business conduct and ethics, which is available on the Governance Documents page of our website at http://investor.htgc.com/governance-documents, each director and executive officer must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to our Audit Committee. Certain actions or relationships that might give rise to a conflict of interest are reviewed and approved by our Board.

Availability of Corporate Governance Documents

To learn more about our corporate governance and to view our corporate governance guidelines, code of business conduct and ethics, and the charters of our Audit Committee, Compensation Committee, and Governance Committee, please visit the Investor Relations page of our website at http://investor.htgc.com/governance-documents under “Governance Documents.” Copies of these documents are also available in print and free of charge by writing to Hercules Capital, Inc., c/o Melanie Grace, Secretary, 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301.

Compensation Committee Interlocks and Insider Participation

All members of our Compensation Committee are independent directors and none of the members are present or past employees of the Company. No member of our Compensation Committee: (i) has had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Exchange Act; or (ii) is an executive officer of another entity at which one of our executive officers serves on the Board.

Certain Relationships and Related Transactions

We have established a written policy to govern the review, approval and monitoring of transactions involving the Company and certain persons related to Hercules. As a BDC, the 1940 Act restricts us from participating in transactions with any persons affiliated with Hercules, including our officers, directors, and employees and any person controlling or under common control with us.