UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 814-00702

Hercules Technology Growth Capital, Inc.

(Exact name of Registrant as specified in its charter)

| Maryland | 74-3113410 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

400 Hamilton Avenue, Suite 310

Palo Alto, California 94301

(Address of principal executive offices)

(650) 289-3060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Shares, par value $0.001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer, large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $125.5 million based upon a closing price of $13.51 reported for such date by the NASDAQ Select Global Market. Common shares held by each executive officer and director and by each person who owns 5% or more of the outstanding common shares have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding common shares of the registrant as of March 6, 2008 was 32,542,747.

DOCUMENTS INCORPORATED BY REFERENCE

Documents incorporated by reference: Portions of Hercules Technology Growth Capital, Inc.’s Proxy Statement for its 2008 Annual Meeting of Shareholders to be held on May 29, 2008 are incorporated by reference into Part III of this Annual Report on Form 10-K.

HERCULES TECHNOLOGY GROWTH CAPITAL, INC.

FORM 10-K

ANNUAL REPORT

Hercules Technology Growth Capital, Inc., our logo and other trademarks of Hercules Technology Growth Capital, Inc. are the property of Hercules Technology Growth Capital, Inc. All other trademarks or trade names referred to in this Annual Report on Form 10-K are the property of their respective owners.

In this Annual Report on Form 10-K, or Annual Report, the “Company,” “HTGC,” “we,” “us” and “our” refer to Hercules Technology Growth Capital, Inc. and its wholly owned subsidiaries and its affiliated securitization trusts unless the context otherwise requires.

PART I

GENERAL

We are a specialty finance company that provides debt and equity growth capital to technology-related and life-science companies at all stages of development from seed and emerging growth to expansion and established stages of development, including select publicly listed companies and lower middle market companies. We primarily finance privately-held companies backed by leading venture capital and private equity firms and also may finance certain select publicly-traded companies that lack access to public capital or are sensitive to equity ownership dilution as well as lower middle market companies. We source our investments through our principal office located in Silicon Valley, as well as our additional offices in the Boston, Boulder, Chicago, Columbus, and San Diego areas.

Our goal is to be the leading structured mezzanine capital provider of choice for venture capital and private equity-backed technology-related and life science companies requiring sophisticated and customized financing solutions. Our strategy is to evaluate and invest in a broad range of companies active in the technology and life science industries and to offer a full suite of growth capital products up and down the capital structure. We invest primarily in structured mezzanine debt and, to a lesser extent, in senior debt and equity investments. We use the term “structured mezzanine debt investment” to refer to any debt investment, such as a senior or subordinated secured loan, that is coupled with an equity component, including warrants, options or rights to purchase common or preferred stock. Our structured mezzanine debt investments will typically be secured by some or all of the assets of the portfolio company.

We focus our investments in companies active in the technology industry sub-sectors characterized by products or services that require advanced technologies, including computer software and hardware, networking systems, semiconductors, semiconductor capital equipment, information technology infrastructure or services, Internet consumer and business services, telecommunications, telecommunications equipment, renewable or alternative energy, media and life sciences. Within the life sciences sub-sector, we focus on medical devices, bio-pharmaceutical, drug discovery, drug delivery, health care services and information systems companies. We refer to all of these companies as “technology-related” companies and intend, under normal circumstances, to invest at least 80% of the value of our assets in such businesses.

Our primary business objectives are to increase our net income, net operating income and net asset value by investing in structured mezzanine debt and equity of venture capital and private equity backed technology-related companies with attractive current yields and the potential for equity appreciation and realized gains. Our structured debt investments typically include warrants or other equity interests, giving us the potential to realize equity-like returns on a portion of our investments. In some cases, we receive the right to make additional equity investments in our portfolio companies in connection with future equity financing rounds. Capital that we provide directly to venture capital and private equity backed technology-related companies is generally used for growth and in select cases for acquisitions or recapitalizations.

Our portfolio is comprised of, and we anticipate that our portfolio will continue to be comprised of, investments in technology-related companies at various stages of their development. Consistent with regulatory

requirements, we invest primarily in United States based companies and to a lesser extent in foreign companies. To date, our emphasis has been on private companies following or in connection with their first institutional

1

round of equity financing, which we refer to as emerging-growth companies, private companies in later rounds of financing, which we refer to as expansion-stage companies and in private companies in one of their final rounds of equity financing prior to a liquidity event or select publicly-traded companies that lack access to public capital or are sensitive to equity ownership dilution, which we refer to as established-stage companies.

CORPORATE HISTORY AND OFFICES

We are a Maryland Corporation formed in December 2003 that began investment operations in September 2004. We are an internally managed, non-diversified, closed-end investment company that has elected to be treated as a business development company under the Investment Company Act of 1940 Act. As a business development company, we are required to meet various regulatory tests. A business development company is required to invest at least 70% of its total assets in “qualifying assets,” including securities of private U.S. companies, cash, cash equivalents, U.S. government securities and high-quality debt investments that mature in one year or less. A business development company also must meet a coverage ratio of total net assets to total senior securities, which include all of our borrowings (including accrued interest payable) except for debentures issued by the Small Business Administration, and any preferred stock we may issue in the future, of at least 200%. See “Item 1. Business—Regulation as a Business Development Company”.

From incorporation through December 31, 2005, we were taxed as a corporation under Subchapter C of the Internal Revenue Code of 1986 or as amended (the “Code”). We have elected to be treated for federal income tax purposes as a regulated investment company, or “RIC,” under the Code. In order to continue to qualify as a RIC for federal income tax purposes, we must meet certain requirements, including certain minimum distribution requirements. See “Item 1. Business—Certain United States Federal Income Tax Considerations.”

Our principal executive offices are located at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301 and our telephone number is (650) 289-3060. We also have additional offices in the Boston, Boulder, Chicago, Columbus, and San Diego areas. We maintain a website on the Internet at www.herculestech.com. Information contained in our website is not incorporated by reference into this Annual Report, and you should not consider that information as part of this Annual Report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and our current reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our website as soon as reasonably practicable after we file them with, or furnish them to, the Securities and Exchange Commission (“SEC”). These reports are also available on the SEC’s website at www.sec.gov.

2

OUR MARKET OPPORTUNITY

We believe that technology-related companies compete in one of the largest and most rapidly growing sectors of the U.S. economy and that continued growth is supported by ongoing innovation and performance improvements in technology products as well as the adoption of technology across virtually all industries in response to competitive pressures. We believe that an attractive market opportunity exists for a specialty finance company focused primarily on structured mezzanine investments in technology-related companies for the following reasons:

| • | Technology-related companies have generally been underserved by traditional lending sources; |

| • | Unfulfilled demand exists for structured debt financing to technology-related companies; |

| • | Structured mezzanine debt products are less dilutive and complement equity financing from venture capital and private equity funds; and |

| • | Valuations currently assigned to technology-related companies in private financing rounds, while increasing in recent years, still provide a good opportunity for attractive capital returns. |

Technology-Related Companies Underserved by Traditional Lenders. We believe many viable technology-related companies backed by financial sponsors have been unable to obtain sufficient growth financing from traditional lenders, including financial services companies such as commercial banks and finance companies, in part because traditional lenders have continued to consolidate and have adopted a more risk-averse approach to lending that has resulted in tightened credit standards in recent years. More importantly, we believe traditional lenders are typically unable to underwrite the risk associated with financial sponsor-backed emerging-growth or expansion-stage companies effectively.

The unique cash flow characteristics of many technology-related companies include significant research and development expenditures and high projected revenue growth thus often making such companies difficult to evaluate from a credit perspective. In addition, the balance sheets of emerging-growth and expansion-stage companies often include a disproportionately large amount of intellectual property assets, which can be difficult to value. Finally, the speed of innovation in technology and rapid shifts in consumer demand and market share add to the difficulty in evaluating technology-related companies.

Due to the difficulties described above, we believe traditional lenders are generally refraining from entering the structured mezzanine debt marketplace for emerging-growth and expansion-stage companies, instead preferring the risk-reward profile of senior debt. Traditional lenders generally do not have flexible product offerings that meet the needs of technology-related companies. The financing products offered by traditional lenders typically impose on borrowers many restrictive covenants and conditions, including limiting cash outflows and requiring a significant depository relationship to facilitate rapid liquidation.

Unfulfilled Demand for Structured Debt Financing to Technology-Related Companies. Private debt capital in the form of structured debt financing from specialty finance companies continues to be an important source of funding for technology-related companies. We believe that the level of demand for structured debt financing to emerging-growth and expansion-stage companies is a function of the level of annual venture equity investment activity. In 2007, venture capital-backed companies received, in approximately 2,648 transactions, equity financing in an aggregate amount of approximately $29.9 billion, representing an 8% increase over the preceding year, as reported by Dow Jones VentureOne. In addition, overall, the median round size in 2007 was $7.6 million, up from $7.0 million in 2006, and the highest annual median since 2000. For the third year in a row, equity investors are focusing more than a third of their investment activity on early-stage financings. Overall, seed- and first-round deals made up 38% of the deal flow in 2007, and later-stage deals made up roughly 50% of all capital invested. As a result, we believe a range of $23 billion to $28 billion in annual equity investments to venture-backed companies will be sustainable in future years.

3

We believe that demand for structured debt financing is currently under served, in part because historically the largest debt capital providers to technology-related companies exited the market during 2001. In addition, lending requirements of traditional lenders have recently become more stringent due to the credit and liquidity crisis that impacted certain financial institutions beginning in the summer of 2007 related to the sub-prime market, real estate market and consumer debt market, which we do not have exposure to as a financial lender. We therefore believe this is an opportune time to be active in the structured lending market for technology-related companies.

Structured Mezzanine Debt Products Complement Equity Financing From Venture Capital and Private Equity Funds. We believe that technology-related companies and their financial sponsors will continue to view structured debt securities as an attractive source of capital because it augments the capital provided by venture capital and private equity funds. We believe that our structured mezzanine debt products provide access to growth capital that otherwise may only be available through incremental investments by existing equity investors. As such, we provide portfolio companies and their financial sponsors with an opportunity to diversify their capital sources. Generally, we believe emerging-growth and expansion-stage companies target a portion of their capital to be debt in an attempt to achieve a higher valuation through internal growth. In addition, because financial sponsor-backed companies have recently been more mature prior to reaching a liquidity event, we believe our investments could provide the debt capital needed to grow or recapitalize during the extended period prior to liquidity events.

Lower Valuations for Private Technology-Related Companies. During the downturn in technology industries that began in 2000, the markets saw sharp and broad declines in valuations of venture capital and private equity-backed technology-related companies. According to Dow Jones VentureOne, median pre-money valuations for venture capital-backed companies in 2000 was $25.0 million declining to a low of $10.0 million in 2003. As of December 31, 2007 median pre-money valuations for venture capital-backed companies in 2007 was $16.0 million compared to $18.5 million in 2006. This decrease was attributed to lower valuations in certain areas such as medical software, information services, software and consumer products offset by increases in other industry segments such as health care services, retail, electronics and computers. We believe the valuations currently assigned to venture capital and private equity-backed technology-related companies in private financing rounds are still reasonably valued and should allow us to continue to build a portfolio of equity-related securities at attractive valuation levels.

OUR BUSINESS STRATEGY

Our strategy to achieve our investment objective includes the following key elements:

Leverage the Experience and Industry Relationships of Our Management Team and Investment Professionals. We have assembled a team of experienced investment professionals with extensive experience as venture capitalists, commercial lenders, and originators of structured debt and equity investments in technology-related companies. Our investment professionals have, on average, more than 15 years of experience as equity investors in, and/or lenders to, technology-related companies. In addition, our team members have originated structured mezzanine investments in over 200 technology-related companies, representing over $2.0 billion in investments, and have developed a network of industry contacts with investors and other participants within the venture capital and private equity communities. In addition, members of our management team also have operational, research and development and finance experience with technology-related companies. We have established contacts with leading venture capital and private equity fund sponsors, public and private companies, research institutions and other industry participants, which should enable us to identify and attract well-positioned prospective portfolio companies.

We concentrate our investing activities in industries in which our investment professionals have investment experience. We believe that our focus on financing technology-related companies will enable us to leverage our expertise in structuring prospective investments, to assess the value of both tangible and intangible assets, to evaluate the business prospects and operating characteristics of technology-related companies and to identify and originate potentially attractive investments with these types of companies.

4

Mitigate Risk of Principal Loss and Build a Portfolio of Equity-Related Securities. We expect that our investments have the potential to produce attractive risk adjusted returns through current income, in the form of interest and fee income, as well as capital appreciation from equity-related securities. We believe that we can mitigate the risk of loss on our debt investments through the combination of loan principal amortization, cash interest payments, relatively short maturities, security interests in the assets of our portfolio companies, covenants requiring prospective portfolio companies to have certain amounts of available cash at the time of our investment and the continued support from a venture capital or private equity firm at the time we make our investment.

In addition, historically our structured debt investments typically include warrants or other equity interests, giving us the potential to realize equity-like returns on a portion of our investment. In addition, we expect, in some cases, to receive the right to make additional equity investments in our portfolio companies in connection with future equity financing rounds. We believe these equity interests will create the potential for meaningful long-term capital gains in connection with the future liquidity events of these technology-related companies.

Provide Customized Financing Complementary to Financial Sponsors’ Capital. We offer a broad range of investment structures and possess expertise and experience to effectively structure and price investments in technology-related companies. Unlike many of our competitors that only invest in companies that fit a specific set of investment parameters, we have the flexibility to structure our investments to suit the particular needs of our portfolio companies. We offer customized financing solutions ranging from senior debt to equity capital, with a focus on structured mezzanine debt.

We use our relationships in the financial sponsor community to originate investment opportunities. Because venture capital and private equity funds typically invest solely in the equity securities of their portfolio companies, we believe that our debt investments will be viewed as an attractive source of capital, both by the portfolio company and by the portfolio company’s financial sponsor. In addition, we believe that many venture capital and private equity fund sponsors encourage their portfolio companies to use debt financing for a portion of their capital needs as a means of potentially enhancing equity returns, minimizing equity dilution and increasing valuations prior to a subsequent equity financing round or a liquidity event.

Invest at Various Stages of Development. We provide growth capital to technology-related companies at all stages of development, from emerging-growth companies, to expansion-stage companies and established-stage companies. We believe that this provides us with a broader range of potential investment opportunities than those available to many of our competitors, who generally focus their investments on a particular stage in a company’s development. Because of the flexible structure of our investments and the extensive experience of our investment professionals, we believe we are well positioned to take advantage of these investment opportunities at all stages of prospective portfolio companies’ development.

Benefit from Our Efficient Organizational Structure. We believe that the perpetual nature of our corporate structure enables us to be a long-term partner for our portfolio companies in contrast to traditional mezzanine and investment funds, which typically have a limited life. In addition, because of our access to the equity markets, we believe that we may benefit from a lower cost of capital than that available to private investment funds. We are not subject to requirements to return invested capital to investors nor do we have a finite investment horizon. Capital providers that are subject to such limitations are often required to seek a liquidity event more quickly than they otherwise might, which can result in a lower overall return on an investment.

Deal Sourcing Through Our Proprietary Database. We have developed a proprietary and comprehensive structured query language-based (SQL) database system to track various aspects of our investment process including sourcing, originations, transaction monitoring and post-investment performance. As of December 31, 2007, our proprietary SQL-based database system included over 14,500 technology-related companies and over 3,800 venture capital private equity sponsors/investors, as well as various other industry contacts. This proprietary SQL system allows us to maintain, cultivate and grow our industry relationships while providing us with comprehensive details on companies in the technology-related industries and their financial sponsors.

5

OUR INVESTMENTS AND OPERATIONS

We invest in debt securities and, to a lesser extent, equity securities, with a particular emphasis on structured mezzanine debt.

We generally seek to invest in companies that have been operating for at least six to 12 months prior to the date of our investment. We anticipate that such entities may, at the time of investment, be generating revenues or will have a business plan that anticipates generation of revenues within 24 to 48 months. Further, we anticipate that on the date of our investment we will obtain a lien on available assets, which may or may not include intellectual property, and these companies will have sufficient cash on their balance sheet to amortize their debt for at least six to 15 months following our investment. We generally require that a prospective portfolio company, in addition to having sufficient capital to support leverage, demonstrate an operating plan capable of generating cash flows or raising the additional capital necessary to cover its operating expenses and service its debt.

We expect that our investments will generally range from $1.0 million to $30.0 million. Our debt investments generally have an average initial principal balance of between $1.0 million and $15.0 million and have maturities of two to seven years, with an expected average term of three years. We typically structure our debt securities to provide for amortization of principal over the life of the loan, but may include an interest-only period of 3 to 18 months for emerging growth and expansion-stage companies and longer for established-stage companies, and our loans will be collateralized by a security interest in the borrower’s assets, although we may not have the first claim on these assets and the assets may not include intellectual property. Our debt investments carry fixed or variable contractual interest rates typically ranging from Prime rate to 14.0%. In addition to the cash yields received on our loans, in some instances, certain loans may also include any of the following: end of term payments, exit fees, balloon payment fees, success fees, payment-in-kind (“PIK”) provisions or prepayment fees, which we may be required to include in income prior to receipt. We also generate revenue in the form of commitment and facility fees.

In addition, the majority of our venture capital-backed companies structured mezzanine debt investments generally have equity enhancement features, typically in the form of warrants or other equity-related securities designed to provide us with an opportunity for potential capital appreciation. The warrants typically will be immediately exercisable upon issuance and generally will remain exercisable for the lesser of seven years or three years after an initial public offering. The exercise prices for the warrants varies from nominal exercise prices to exercise prices that are at or above the current fair market value of the equity for which we receive warrants. We may structure warrants to provide minority rights provisions and put rights upon the occurrence of certain events. We generally target a total annualized return (including interest, fees and value of warrants) of 12% to 25% for our debt investments.

Typically, our debt and equity investments take one of the following forms:

| • | Structured Mezzanine Debt. We seek to invest a majority of our assets in structured mezzanine debt of prospective portfolio companies. Traditional “mezzanine” debt is a layer of high-coupon financing between debt and equity that most commonly takes the form of subordinated debt coupled with warrants, combining the cash flow and risk characteristics of both senior debt and equity. However, our structured mezzanine investments may be the only debt capital on the balance sheet of our portfolio companies, and in many cases we have a first priority security interest in all of our portfolio company’s assets, or in certain investments we review a negative pledge on intellectual property. Our structured mezzanine debt investments typically have maturities of between two and seven years, with full amortization for emerging-growth or expansion-stage companies and longer deferred amortization for select established-stage companies. Our structured mezzanine debt investments generally carry a contractual interest rate between Prime rate and 14% and may include an additional end-of-term payment, are in an amount between $3.0 million and $25.0 million with an average initial principal |

6

| balance of between $3.0 million and $15.0 million (although this investment size may vary proportionately as the size of our capital base changes) and have an average term of three years. In some cases we collateralize our investments by obtaining security interests in our portfolio companies’ assets, which may include their intellectual property. In other cases we may prohibit a company from pledging or otherwise encumbering their intellectual property. We may structure our mezzanine debt investments with restrictive affirmative and negative covenants, default penalties, prepayment penalties, lien protection, equity calls, change-in-control provisions or board observation rights. |

| • | Senior Debt. We seek to invest a limited portion of our assets in senior debt. Senior debt may be collateralized by accounts receivable and/or inventory financing of prospective portfolio companies. Senior debt has a senior position with respect to a borrower’s scheduled interest and principal payments and holds a first priority security interest in the assets pledged as collateral. Senior debt also may impose covenants on a borrower with regard to cash flows and changes in capital structure, among other items. Our senior debt investments carry a contractual interest rate between Prime rate and 12%, are in an amount between $1.0 million and $7.0 million with an average initial principal balance of $3.0 million, and have an average term of under three years. We generally collateralize our investments by obtaining security interests in our portfolio companies’ assets, which may include their intellectual property. In other cases we may obtain a negative pledge covering a company’s intellectual property. Our senior loans, in certain instances, may be tied to the financing of specific assets. In connection with a senior debt investment, we may also provide the borrower with a working capital line-of-credit that will carry an interest rate ranging from the Prime rate to 12%, generally maturing in one to two years, and will be secured by accounts receivable and/or inventory. In connection with a senior debt investment, we may also provide the borrower with a working capital line-of-credit at fixed rates or variable rates based on the Prime rate or LIBOR plus a spread, generally maturing in one or two years, and will be secured by accounts receivable and / or inventory. |

| • | Equipment Loans. We intend to invest a limited portion of our assets in equipment-based loans to early-stage prospective portfolio companies. Equipment-based loans are secured by a first priority security interest in the assets financed. These loans are generally for amounts up to $3.0 million, carry a contractual interest rate between Prime and Prime plus 400 basis points, and have an average term between three and four years. Equipment loans may also include end of term payments. |

| • | Equity-Related Securities. The equity-related securities we hold consist primarily of warrants or other equity interests generally obtained in connection with our structured debt investments. In addition to the warrants received as a part of a structured debt financing, we typically receive the right to make equity investments in a portfolio company in connection with the next equity financing round for that company. We may also on certain debt investments have the right to convert a portion of the debt investment into equity. These rights will provide us with the opportunity to further enhance our returns over time through opportunistic equity investments in our portfolio companies. These equity-related investments are typically in the form of preferred or common equity and may be structured with a dividend yield, providing us with a current return, and with customary anti-dilution protection and preemptive rights. In the future, we may achieve liquidity through a merger or acquisition of a portfolio company, a public offering of a portfolio company’s stock or by exercising our right, if any, to require a portfolio company to buy back the equity-related securities we hold. We may also make stand alone direct equity investments into portfolio companies in which we may not have any debt investment in the company. |

7

A comparison of the typical features of our various investment alternatives is set forth in the chart below.

| Senior Debt | Structured Mezzanine Debt |

Equipment Loans | Equity Securities | |||||

| Typical Structure | Term or revolving debt |

Term debt with warrants |

Term debt with warrants |

Preferred stock or common stock | ||||

| Investment Horizon | Usually under 3 years |

Long term, ranging from 2 to 7 years, with an average of 3 years |

Ranging from 3 to 4 years |

Long term | ||||

| Ranking/Security | Senior/First lien | Senior or junior lien |

Secured by underlying equipment |

None/unsecured | ||||

| Covenants | Generally borrowing base and financial |

Less restrictive; Mostly financial; Maintenance-based |

None | None | ||||

| Risk Tolerance | Low | Medium/High | High | High | ||||

| Coupon/Dividend | Cash pay—floating or fixed rate |

Cash pay—fixed and floating rate; Payment-in-kind in limited cases |

Cash pay-floating or fixed rate and may include Payment-in-kind |

Generally none | ||||

| Customization or Flexibility | Little to none | More flexible | Little to none |

Flexible | ||||

| Equity Dilution | None to low | Low | Low | High | ||||

Investment Criteria

We have identified several criteria that we believe are important in achieving our investment objective with respect to prospective portfolio companies. These criteria, while not inclusive, provide general guidelines for our investment decisions.

Portfolio Composition. While we generally focus our investments in venture capital and private equity-backed technology-related companies, we seek to diversify across various financial sponsors as well as across various stages of companies’ development and various technology industry sub-sectors and geographies.

Continuing Support from One or More Financial Sponsors. We generally invest in companies in which one or more established financial sponsors have previously invested and continue to make a contribution to the management of the business. We believe that having established financial sponsors with meaningful commitments to the business is a key characteristic of a prospective portfolio company. In addition, we look for representatives of one or more financial sponsors to maintain seats on the Board of Directors of a prospective portfolio company as an indication of such commitment.

Company Stage of Development. While we invest in companies at various stages of development, we generally require that prospective portfolio companies be beyond the seed stage of development and generally have received or anticipate to have commitments for their first institutional round of equity financing. We expect a prospective portfolio company to demonstrate progress in its product development or demonstrate a path towards its ability to commence revenue generation or increase its revenues and operating cash flow over time.

8

The anticipated growth rate of a prospective portfolio company is a key factor in determining the value that we ascribe to any warrants or other equity securities that we may acquire in connection with an investment in debt securities.

Operating Plan. We generally require that a prospective portfolio company, in addition to having sufficient access to capital to support leverage, demonstrate an operating plan capable of generating cash flows or the ability to raise the additional capital necessary to cover its operating expenses and service its debt for a specific period. Specifically, we require that a prospective portfolio company demonstrate at the time of our proposed investment that it has cash on its balance sheet, or is in the process of completing a financing so that it will have cash on its balance sheet, sufficient to support its operations for a minimum of 6 to 15 months.

Security Interest. In many instances we seek a first priority security interest in all of the portfolio company’s tangible and intangible assets as collateral for our debt investment, subject in some cases to permitted exceptions. In other cases we may prohibit a company from pledging or otherwise encumbering their intellectual property. Although we do not intend to operate as an asset-based lender, the estimated liquidation value of the assets, if any, collateralizing the debt securities that we hold is an important factor in our credit analysis and subject to assumptions that may change over the life of the investment. We evaluate both tangible assets, such as accounts receivable, inventory and equipment, and intangible assets, such as intellectual property, customer lists, networks and databases.

Covenants. Our investments may include one or more of the following covenants; cross-default and material adverse change provisions, require the portfolio company to provide periodic financial reports and operating metrics and will typically limit the portfolio company’s ability to incur additional debt, sell assets, dividend recapture, engage in transactions with affiliates and consummate an extraordinary transaction, such as a merger or recapitalization without our consent. In addition, we may require other performance or financial based covenants, as we deem appropriate.

Exit Strategy. Prior to making a debt investment that is accompanied by an equity-related security in a prospective portfolio company, we analyze the potential for that company to increase the liquidity of its equity through a future event that would enable us to realize appreciation in the value of our equity interest. Liquidity events may include an initial public offering, a private sale of our equity interest to a third party, a merger or an acquisition of the company or a purchase of our equity position by the company or one of its stockholders.

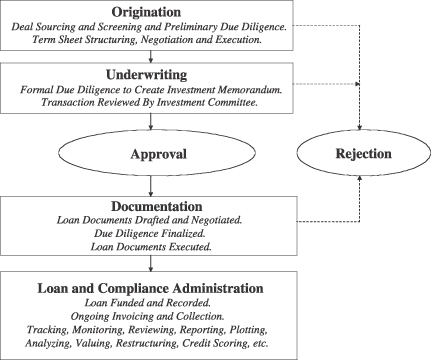

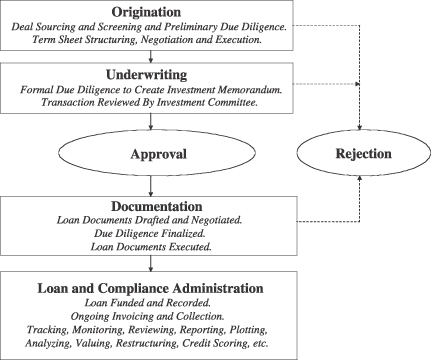

Investment Process

We have organized our management team around the four key elements of our investment process:

| • | Origination; |

| • | Underwriting; |

| • | Documentation; and |

| • | Loan and Compliance Administration. |

9

Our investment process is summarized in the following chart:

Origination

The origination process for our investments includes sourcing, screening, preliminary due diligence and deal structuring and negotiation, all leading to an executed non-binding term sheet. Our investment origination team, which consists of 21 investment professionals, is headed by our Senior Managing Directors of Technology and Life Science, and our Chief Executive Officer. The origination team is responsible for sourcing potential investment opportunities and members of the investment origination team use their extensive relationships with various leading financial sponsors, management contacts within technology-related companies, trade sources, technology conferences and various publications to source prospective portfolio companies. Our investment origination team is divided into technology and life-sciences sub-teams to better source potential portfolio companies.

In addition, we have developed a proprietary and comprehensive SQL-based database system to track various aspects of our investment process including sourcing, originations, transaction monitoring and post-investment performance. As of December 31, 2007, our proprietary SQL-based database system included over 14,500 technology-related companies and over 3,800 venture capital private equity sponsors/investors, as well as various other industry contacts. This proprietary SQL system allows our origination team to maintain, cultivate and grow our industry relationships while providing our origination team with comprehensive details on companies in the technology-related industries and their financial sponsors.

If a prospective portfolio company generally meets certain underwriting criteria, we perform preliminary due diligence, which may include high level company and technology assessments, evaluation of its financial sponsors’ support, market analysis, competitive analysis, evaluation of select management, risk analysis and transaction size, pricing, return analysis and structure analysis. If the preliminary due diligence is satisfactory, and the origination team recommends moving forward, we then structure, negotiate and execute a non-binding term sheet with the potential portfolio company. Upon execution of a term sheet, the investment opportunity moves to the underwriting process to complete formal due diligence review and approval.

10

Underwriting

The underwriting review includes formal due diligence and approval of the proposed investment in the portfolio company.

Due Diligence. Our due diligence on a prospective investment is typically completed by two or more investment professionals which we define as the underwriting team. The underwriting team for a proposed investment consists of the deal sponsor who possesses specific industry knowledge and is responsible for originating and managing the transaction, other investment professional(s) who perform due diligence, credit and corporate financial analyses and, as needed, our Chief Legal Officer. To ensure consistent underwriting, we generally use our standardized due diligence methodologies, which include due diligence on financial performance and credit risk as well as an analysis of the operations and the legal and applicable regulatory framework of a prospective portfolio company. The members of the underwriting team work together to conduct due diligence and understand the relationships among the prospective portfolio company’s business plan, operations and financial performance.

As part of our evaluation of a proposed investment, the underwriting team prepares an investment memorandum for presentation to the investment committee. In preparing the investment memorandum, the underwriting team typically interviews with select key management of the company and select financial sponsors and assembles information necessary to the investment decision. If and when appropriate, the investment professionals may also contact industry experts and customers, vendors or, in some cases, competitors of the company.

Approval Process. The sponsoring managing director or principal presents the investment memorandum to our investment committee for consideration. The unanimous approval of our investment committee is required before we proceed with any investment. The members of our investment committee are our Chief Executive Officer, our Chief Legal Officer and our Chief Financial Officer. The investment committee generally meets weekly and more frequently on an as-needed basis. Our investment committee process is generally the same at our wholly-owned subsidiary Hercules Technology II, L.P. (“HT II”) except that our two Senior Managing Directors are also members of the committee. The senior Managing Directors abstain from voting with respect to investments they originate.

Documentation

Our documentation group, headed by our Chief Legal Officer, administers the front-end documentation process for our loans. This group is responsible for documenting the term sheet approved by the investment committee to memorialize the transaction with a portfolio company. This group negotiates loan documentation and, subject to the approval of the Chief Legal Officer and/or the Associate General Counsel, final documents are prepared for execution by all parties. The documentation group generally uses the services of external law firms to complete the necessary documentation.

Loan and Compliance Administration

Our loan and compliance administration group, headed by our Chief Financial Officer, administers loans and tracks covenant compliance, if applicable, of our investments and oversees periodic reviews of our critical functions to ensure adherence with our internal policies and procedures. After funding of a loan in accordance with the investment committee’s approval, the loan is recorded in our loan administration software and our SQL-based database system. The loan and compliance administration group is also responsible for ensuring timely interest and principal payments and collateral management and advises the investment committee on the financial performance and trends of each portfolio company, including any covenant violations that occur, to aid us in assessing the appropriate course of action for each portfolio company and evaluating overall portfolio quality. In addition, the loan and compliance administration group advises the investment committee and the Valuation Committee of the board, accordingly, regarding the credit and investment grading for each portfolio company as well as changes in the value of collateral that may occur.

11

The loan and compliance administration group monitors our portfolio companies in order to determine whether the companies are meeting our financing criteria and their respective business plans and also monitors the financial trends of each portfolio company from its monthly or quarterly financial statements to assess the appropriate course of action for each company and to evaluate overall portfolio quality. In addition, our management team closely monitors the status and performance of each individual company through our SQL-based database system and periodic contact with our portfolio companies’ management teams and their respective financial sponsors.

Credit and Investment Grading System. Our loan and compliance administration group uses an investment grading system to characterize and monitor our outstanding loans. Our loan and compliance administration group monitors and, when appropriate, recommends changes to investment grading. Our investment committee reviews the recommendations and/or changes to the investment grading, which are submitted on a quarterly basis to the Valuation Committee and our Board of Directors for approval.

From time to time we will identify investments that require closer monitoring or become workout assets. We develop a workout strategy for workout assets and our investment committee monitors the progress against the strategy. We will incur losses from our investing activities, however we work with our troubled portfolio companies in order to recover as much of our investments as is practicable.

We use the following investment grading system approved by our Board of Directors:

| Grade 1. | Loans involve the least amount of risk in our portfolio. The borrower is performing above expectations, and the trends and risk profile is generally favorable. |

| Grade 2. | The borrower is performing as expected and the risk profile is neutral to favorable. All new loans are initially graded 2. |

| Grade 3. | The borrower may be performing below expectations, and the loan’s risk has increased materially since origination. We increase procedures to monitor a borrower that may have limited amounts of cash remaining on the balance sheet, is approaching its next equity capital raise within the next three to six months, or if the estimated fair value of the enterprise may be lower than when the loan was originated. We will generally lower the loan grade to a level 3 even if the company is performing in accordance to plan as it approaches the need to raise additional cash to fund its operations. Once the borrower closes its new equity capital raise, we may increase the loan grade back to grade 2. |

| Grade 4. | The borrower is performing materially below expectations, and the loan risk has substantially increased since origination. Loans graded 4 may experience some partial loss or full return of principal but are expected to realize some loss of interest which is not anticipated to be repaid in full, which, to the extent not already reflected, may require the fair value of the loan to be reduced to the amount we anticipate will be recovered. Grade 4 investments are closely monitored. |

| Grade 5. | The borrower is in workout, materially performing below expectations and a significant risk of principal loss is probable. Loans graded 5 will experience some partial principal loss or full loss of remaining principal outstanding is expected. Grade 5 loans will require the fair value of the loans be reduced to the amount, if any, we anticipate will be recovered. |

At December 31, 2007, our investments had a weighted average investment grading of 2.20.

Managerial Assistance

As a business development company, we offer, and provide upon request, managerial assistance to our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. We may receive fees for these services.

12

ASSET MANAGEMENT

We may engage in the asset management business by providing investment advisory services to funds that may be formed in the future. Such funds may focus on our lower yielding assets, such as senior debt, equipment based only financing or equity only funding. We may contribute assets currently in our portfolio to the extent that our management and Board of Directors deems it appropriate. We may, from time to time, serve as the investment manager of such funds and may receive management and other fees for such services. Such funds may have overlapping investment objectives and may invest in asset classes similar to those targeted by us.

COMPETITION

Our primary competitors provide financing to prospective portfolio companies and include non-bank financial institutions, federally or state chartered banks, venture debt funds, financial institutions, venture capital funds, private equity funds, investment funds and investment banks. Many of these entities have greater financial and managerial resources than we have, and the 1940 Act imposes certain regulatory restrictions on us as a business development company to which many of our competitors are not subject. However, we believe that few of our competitors possess the expertise to properly structure and price debt investments to venture capital and private equity backed technology-related companies. We believe that our specialization in financing technology-related companies will enable us to assess the value of intellectual property assets, evaluate the business prospects and operating characteristics of prospective portfolio companies and, as a result, identify investment opportunities that produce attractive risk-adjusted returns. For additional information concerning the competitive risks we face, see “Item 1A. Risk Factors—Risks Related to our Business and Structure—We operate in a highly competitive market for investment opportunities, and we may not be able to compete effectively.”

CORPORATE STRUCTURE

We are a Maryland corporation and an internally-managed, non-diversified, closed-end investment company that has elected to be regulated as a business development company under the 1940 Act. Hercules Technology II, L.P. (“HT II”), our wholly-owned subsidiary, is licensed under the Small Business Investment Act of 1958 as a Small Business Investment Company. Hercules Technology SBIC Management, LLC (“HTM”), another wholly-owned subsidiary, functions as the general partner of our subsidiary HT II. Hercules Funding I LLC, our wholly owned subsidiary, and Hercules Funding Trust I function as vehicles to collateralize loans under our securitized credit facility with Citigroup Global Markets Realty Corp. In December 2006, we established Hydra Management LLC and Hydra Management Co., Inc. an investment manager and an investment management company, respectively.

Our principal executive offices are located at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301. We also have offices in: Boston, Massachusetts; Boulder, Colorado; Chicago, Illinois; Columbus, Ohio; and San Diego, California.

BROKERAGE ALLOCATIONS AND OTHER PRACTICES

Because we generally acquire and dispose of our investments in privately negotiated transactions, we rarely use brokers in the normal course of business. In those cases where we do use a broker, we do not execute transactions through any particular broker or dealer, but will seek to obtain the best net results for Hercules, taking into account such factors as price (including the applicable brokerage commission or dealer spread), size of order, difficulty of execution, and operational facilities of the firm and the firm’s risk and skill in positioning blocks of securities. While we generally seek reasonably competitive execution costs, we may not necessarily pay the lowest spread or commission available. Subject to applicable legal requirements, we may select a broker based partly upon brokerage or research services provided to us. In return for such services, we may pay a higher commission than other brokers would charge if we determine in good faith that such commission is reasonable in

13

relation to the services provided. For the years ended December 31, 2007 and 2006 we paid approximately $22,200 and $12,100 in brokerage commissions, respectively.

EMPLOYEES

As of December 31, 2007, we had 38 employees, including 21 investment and portfolio management professionals all of whom have extensive prior experience working on financing transactions for technology-related companies. We intend to expand our management team, financial analyst group and operational personnel to support our growing portfolio of companies. We may also hire additional managing directors if our business indicates the need to expand the team to take advantage of growing market opportunities.

REGULATION AS A BUSINESS DEVELOPMENT COMPANY

The following discussion is a general summary of the material prohibitions and descriptions governing business development companies generally. It does not purport to be a complete description of all of the laws and regulations affecting business development companies.

A business development company is a unique kind of investment company that primarily focuses on investing in or lending to private companies and making managerial assistance available to them. A business development company provides stockholders with the ability to retain the liquidity of a publicly-traded stock, while sharing in the possible benefits of investing in emerging-growth or expansion-stage privately-owned companies. The 1940 Act contains prohibitions and restrictions relating to transactions between business development companies and their directors and officers and principal underwriters and certain other related persons and requires that a majority of the directors be persons other than “interested persons,” as that term is defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a business development company unless approved by a majority of our outstanding voting securities. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (i) 67% or more of such company’s shares present at a meeting if more than 50% of the outstanding shares of such company are present or represented by proxy, or (ii) more than 50% of the outstanding shares of such company.

Qualifying Assets

Under the 1940 Act, a business development company may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company’s total assets. The principal categories of qualifying assets relevant to our proposed business are the following:

| (1) | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer which: |

| (a) | is organized under the laws of, and has its principal place of business in, the United States; |

| (b) | is not an investment company (other than a small business investment company wholly owned by the business development company) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| (c) | does not have any class of securities listed on a national securities exchange. |

| (2) | Securities of any eligible portfolio company which we control. |

| (3) | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy |

14

| and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| (4) | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company. |

| (5) | Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities. |

| (6) | Cash, cash equivalents, U.S. Government securities or high-quality debt securities maturing in one year or less from the time of investment. |

In October 2006, the SEC re-proposed rules providing for an additional definition of eligible portfolio company. As re-proposed, the rule would expand the definition of eligible portfolio company to include certain public companies that list their securities on a national securities exchange. The SEC sought comment regarding the application of this proposed rule to companies with: (1) a public float of less than $75 million; (2) a market capitalization of less than $150 million; or (3) a market capitalization of less than $250 million. There is no assurance that such proposal will be adopted or what the final proposal will entail.

Significant Managerial Assistance

In order to count portfolio securities as qualifying assets for the purpose of the 70% test discussed above, a business development company must either control the issuer of the securities or must offer to make available significant managerial assistance; except that, where the business development company purchases such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available significant managerial assistance means, among other things, any arrangement whereby the business development company, through its directors, officers or employees, offers to provide and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company through monitoring of portfolio company operations, selective participation in board and management meetings, consulting with and advising a portfolio company’s officers or other organizational or financial guidance.

Temporary Investments

Pending investment in other types of qualifying assets, as described above, our investments may consist of cash, cash equivalents, U.S. government securities or high quality debt securities maturing in one year or less from the time of investment, which we refer to, collectively, as temporary investments, so that 70% of our assets are qualifying assets. Typically, we invest in U.S. treasury bills or in repurchase agreements, provided that such agreements are fully collateralized by cash or securities issued by the U.S. government or its agencies. A repurchase agreement involves the purchase by an investor, such as us, of a specified security and the simultaneous agreement by the seller to repurchase it at an agreed upon future date and at a price which is greater than the purchase price by an amount that reflects an agreed-upon interest rate. There is no percentage restriction on the proportion of our assets that may be invested in such repurchase agreements. However, if more than 25% of our total assets constitute repurchase agreements from a single counterparty, we would not meet the diversification tests imposed on us by the Code in order to qualify as a RIC for federal income tax purposes. Thus, we do not intend to enter into repurchase agreements with a single counterparty in excess of this limit. We will monitor the creditworthiness of the counterparties with which we enter into repurchase agreement transactions.

Warrants and Options

Under the 1940 Act, a business development company is subject to restrictions on the amount of warrants, options, restricted stock or rights to purchase shares of capital stock that it may have outstanding at any time. In particular, the amount of capital stock that would result from the conversion or exercise of all outstanding

15

warrants, options or rights to purchase capital stock cannot exceed 25% of the business development company’s total outstanding shares of capital stock. This amount is reduced to 20% of the business development company’s total outstanding shares of capital stock if the amount of warrants, options or rights issued pursuant to an executive compensation plan would exceed 15% of the business development company’s total outstanding shares of capital stock. We have received exemptive relief from the SEC permitting us to issue stock options and restricted stock to our employees and directors subject to the above conditions, among others. For a discussion regarding the conditions of this exemptive relief, see Note 6 to our consolidated financial statements.

Senior Securities; Coverage Ratio

We will be permitted, under specified conditions, to issue multiple classes of indebtedness and one class of stock senior to our common stock if our asset coverage, as defined in the 1940 Act, is at least equal to 200% immediately after each such issuance. In addition, while any senior securities remain outstanding, we must make provisions to prohibit any dividend distribution to our stockholders or the repurchase of such securities or shares unless we meet the applicable asset coverage ratios at the time of the dividend distribution or repurchase. We may also borrow amounts up to 5% of the value of our total assets for temporary or emergency purposes. For a discussion of the risks associated with the resulting leverage, see “Item 1A. Risk Factors—Risks Related to Our Business & Structure—Because we borrow money, there could be increased risk in investing in our company.”

Capital Structure

We are not generally able to issue and sell our common stock at a price below net asset value per share. We may, however, sell our common stock, at a price below the current net asset value of the common stock, or sell warrants, options or rights to acquire such common stock, at a price below the current net asset value of the common stock if our board of directors determines that such sale is in the best interests of the Company and our stockholders, and our stockholders approve our policy and practice of making such sales. We have included such a proposal in our proxy statement for our 2008 Annual Meeting of Stockholders. In any such case, the price at which our securities are to be issued and sold may not be less than a price which, in the determination of our board of directors, closely approximates the market value of such securities (less any distributing commission or discount).

Code of Ethics

We have adopted and will maintain a code of ethics that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to the code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements. Our code of ethics will generally not permit investments by our employees in securities that may be purchased or held by us. We may be prohibited under the 1940 Act from conducting certain transactions with our affiliates without the prior approval of our directors who are not interested persons and, in some cases, the prior approval of the SEC.

Our code of ethics is posted on our website at www.herculestech.com and was filed with the SEC as an exhibit to the registration statement (Registration No. 333-126604) for our initial public offering. You may read and copy the code of ethics at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-202-942-8090. In addition, the code of ethics is available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of the code of ethics, after paying a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, D.C. 20549.

We may not change the nature of our business so as to cease to be, or withdraw our election as, a business development company unless authorized by vote of a “majority of the outstanding voting securities,” as defined in the 1940 Act. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (i) 67% or more of such company’s shares present at a meeting if more than 50% of the outstanding

16

shares of such company are present and represented by proxy or (ii) more than 50% of the outstanding shares of such company.

Privacy Principles

We are committed to maintaining the privacy of our stockholders and safeguarding their non-public personal information. The following information is provided to help you understand what personal information we collect, how we protect that information and why, in certain cases, we may share information with select other parties.

Generally, we do not receive any non-public personal information relating to our stockholders, although certain non-public personal information of our stockholders may become available to us. We do not disclose any non-public personal information about our stockholders or former stockholders to anyone, except as permitted by law or as is necessary in order to service stockholder accounts (for example, to a transfer agent).

We restrict access to non-public personal information about our stockholders to our employees with a legitimate business need for the information. We maintain physical, electronic and procedural safeguards designed to protect the non-public personal information of our stockholders.

Proxy Voting Policies and Procedures

We vote proxies relating to our portfolio securities in the best interest of our stockholders. We review on a case-by-case basis each proposal submitted to a stockholder vote to determine its impact on the portfolio securities held by us. Although we generally vote against proposals that may have a negative impact on our portfolio securities, we may vote for such a proposal if there exists compelling long-term reasons to do so.

Our proxy voting decisions are made by our investment committee, which is responsible for monitoring each of our investments. To ensure that our vote is not the product of a conflict of interest, we require that: (i) anyone involved in the decision making process disclose to our Chief Compliance Officer any potential conflict that he or she is aware of and any contact that he or she has had with any interested party regarding a proxy vote; and (ii) employees involved in the decision making process or vote administration are prohibited from revealing how we intend to vote on a proposal in order to reduce any attempted influence from interested parties.

Exemptive Relief

On June 21, 2005, we filed a request with the SEC for exemptive relief to allow us to take certain actions that would otherwise be prohibited by the 1940 Act, as applicable to business development companies. Specifically, we requested that the SEC permit us to issue stock options to our non-employee directors as contemplated by Section 61(a)(3)(B)(i)(II) of the 1940 Act. On February 15, 2007, we received approval from the SEC on this exemptive request. In addition, in June 2007, we filed an amendment to the February, 2007 order to adjust the number of shares issued to the non-employee directors. On October 10, 2007, we received approval from the SEC on this amended exemptive request.

On April 5, 2007, we received an exemptive relief from the SEC that permits us to exclude the indebtedness that our wholly-owned subsidiary, HT II, which is qualified as a small business investment company, issues to the Small Business Administration from the 200% asset coverage requirement applicable to us.

On May 2, 2007, we received approval from the SEC on our exemptive request. On June 21, 2007, our shareholders approved amendments permitting us to grant restricted stock to our officers, employees and directors.

Other

We will be periodically examined by the SEC for compliance with the 1934 Act and the 1940 Act.

17

We are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a business development company, we are prohibited from protecting any director or officer against any liability to our stockholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

We are required to adopt and implement written policies and procedures reasonably designed to prevent violation of the federal securities laws, review these policies and procedures annually for their adequacy and the effectiveness of their implementation. We have designated Mr. Harvey, our Chief Legal Officer, as our Chief Compliance Officer who is responsible for administering these policies and procedures.

Small Business Administration Regulations

HT II, our wholly-owned subsidiary, is licensed by the Small Business Administration (“SBA”) as a small business investment company (“SBIC”) under Section 301(c) of the Small Business Investment Act of 1958. The SBIC regulations currently limit the amount that is available to borrow by any SBIC to $127.2 million, subject to periodic adjustments by the SBA. There is no assurance that we will draw up to the maximum limit available under the SBIC program.

SBICs are designed to stimulate the flow of private capital to eligible small businesses. Under present SBA regulations, eligible small businesses include businesses that have a tangible net worth not exceeding $18 million and have average annual fully taxed net income not exceeding $6 million for the two most recent fiscal years. In addition, SBICs must devote 20% of its investment activity to “smaller” concerns as defined by the SBA. A smaller concern is one that has a tangible net worth not exceeding $6 million and has average annual fully taxed net income not exceeding $2 million for the two most recent fiscal years. SBA regulations also provide alternative size standard criteria to determine eligibility, which depend on the industry in which the business is engaged and are based on such factors as the number of employees and gross sales. According to SBA regulations, small business investment companies may make long-term loans to small businesses, invest in the equity securities of such businesses and provide them with consulting and advisory services. Through our wholly-owned subsidiary HT II, we plan to provide long-term loans to qualifying small businesses, and in connection therewith, make equity investments.

As of December 31, 2007, the assets held by HT II represented approximately 23% of the total assets of the Company.

In January 2005, we formed HT II and HTM. On September 27, 2006, HT II received final approval to be licensed as a Small Business Investment Company (“SBIC”). HT II is able to borrow funds against eligible pre-approved investments and additional deposits to regulatory capital. Currently, HT II has a commitment from the SBA to issue a total of $127.2 million of SBA guaranteed debentures, of which $55.1 million was outstanding as of December 31, 2007. There is no assurance that HT II will draw up to the maximum limit available under the SBIC program.

HT II will be periodically examined and audited by the SBA’s staff to determine its compliance with SBIC regulations.

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of the material federal income tax considerations applicable to us.

Conversion to Regulated Investment Company Status

Prior to 2006, we were taxed as a C Corporation under the Code. We operate to qualify as a regulated investment company, or RIC, under Subchapter M of the Code. If we qualify as a RIC and annually distribute to our stockholders in a timely manner at least 90% of our investment company taxable income, we will not be subject to federal income tax on the portion of our taxable income and capital gains we distribute to our

18

shareholders. Taxable income generally differs from net income as defined by generally accepted accounting principles due to temporary and permanent timing differences in the recognition of income and expenses, returns of capital and net unrealized appreciation or depreciation.

We have met the criteria specified below to qualify as a RIC, and elected to be treated as a RIC under Subchapter M of the Code with the filing of our federal tax return for 2006. As a RIC, we generally will not have to pay corporate taxes on any income we distribute to our stockholders as dividends, which allows us to reduce or eliminate our corporate level tax. Prior to the effective date of our RIC election, we were taxed as a regular corporation under Subchapter C of the Code. On December 31, 2005, we held assets with “built-in gain,” which are assets whose fair market value as of the effective date of the election exceeds their tax basis. We elected to recognize all of our net built-in gains at the time of the conversion and paid tax on the built-in gain with the filing of our 2005 tax return. In making this election, we marked our portfolio to market at the time of our RIC election and paid approximately $294,000 in tax on the resulting gains.

During 2007, we distributed $1.20 per share to our shareholders of which 100% was deemed to be a distribution of income and is considered ordinary income to our shareholders in 2007.

Taxation as a Regulated Investment Company

For any taxable year in which we:

| • | qualify as a RIC; and |

| • | distribute at least 90% of our net ordinary income and realized net short-term gains in excess of realized net long-term capital losses, if any (the “Annual Distribution Requirement”); |

we generally will not be subject to federal income tax on the portion of our investment company taxable income and net capital gain (i.e., net realized long-term capital gains in excess of net realized short-term capital losses) we distribute to stockholders with respect to that year. (However, as described above, we will be subject to federal income taxes on certain dispositions of assets that had built-in gains as of the effective date of our conversion to RIC status (unless we elect to be taxed on such gains as of such date). In addition, if we subsequently acquire built-in gain assets from a C corporation in a carryover basis transaction, then we may be subject to tax on the gains recognized by us on dispositions of such assets unless we make a special election to pay corporate-level tax on such built-in gain at the time the assets are acquired.) We will be subject to United States federal income tax at the regular corporate rates on any income or capital gain not distributed (or deemed distributed) to our stockholders.

In order to qualify as a RIC for federal income tax purposes and obtain the tax benefits of RIC status, in addition to satisfying the Annual Distribution Requirement, we must, among other things:

| • | have in effect at all times during each taxable year an election to be regulated as a business development company under the 1940 Act; |

| • | derive in each taxable year at least 90% of our gross income from (a) dividends, interest, payments with respect to certain securities loans, gains from the sale of stock or other securities, or other income derived with respect to our business of investing in such stock or securities and (b) net income derived from an interest in a “qualified publicly traded limited partnership” (the “90% Income Test”); and |