UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||||

| ¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Hercules Technology Growth Capital, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

HERCULES TECHNOLOGY GROWTH CAPITAL, INC.

400 Hamilton Avenue, Suite 310

Palo Alto, California 94301

(650) 289-3060

April 29, 2009

Dear Stockholder:

You are cordially invited to attend the 2009 Annual Meeting of Stockholders of Hercules Technology Growth Capital, Inc. to be held on Wednesday, June 3, 2009 at 10:00 a.m., Eastern Time, at our Boston office at 31 St. James Avenue, Suite 790, Boston, Massachusetts 02116. The phone number of our Boston office is (617) 314-9973.

Details regarding the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

It is important that your shares be represented at the annual meeting, and you are encouraged to vote your shares as soon as possible. The enclosed proxy card contains instructions for voting over the Internet, by telephone or by returning your proxy card via mail in the envelope provided. Your vote is important.

Sincerely yours,

/s/ Manuel A. Henriquez

Manuel A. Henriquez

Chairman of the Board, President

and Chief Executive Officer

HERCULES TECHNOLOGY GROWTH CAPITAL, INC.

400 Hamilton Avenue, Suite 310

Palo Alto, California 94301

(650) 289-3060

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 3, 2009

To the Stockholders of Hercules Technology Growth Capital, Inc.:

The 2009 Annual Meeting of Stockholders of Hercules Technology Growth Capital, Inc., a Maryland Corporation (the “Company”), will be held at our Boston office at 31 St. James Avenue, Suite 790, Boston, Massachusetts 02116 on Wednesday, June 3, 2009, at 10:00 a.m. Eastern Time for the following purposes:

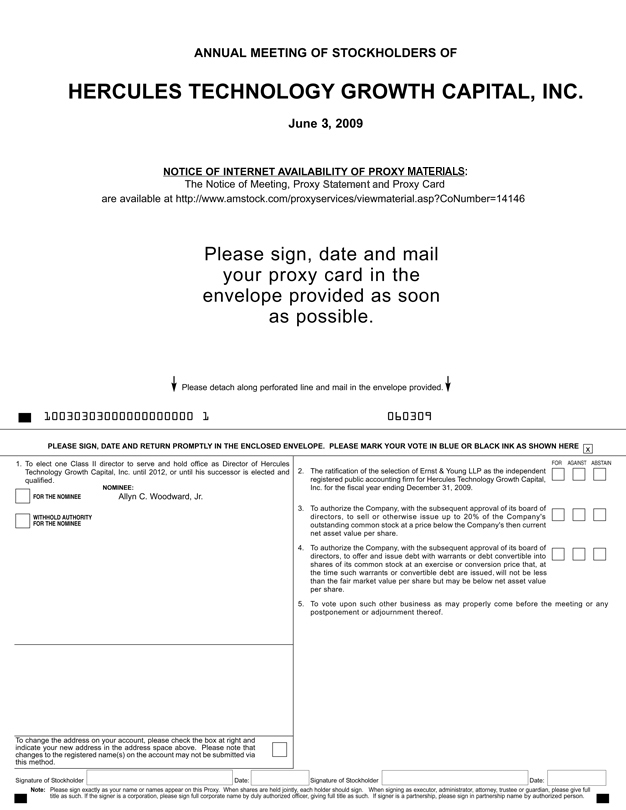

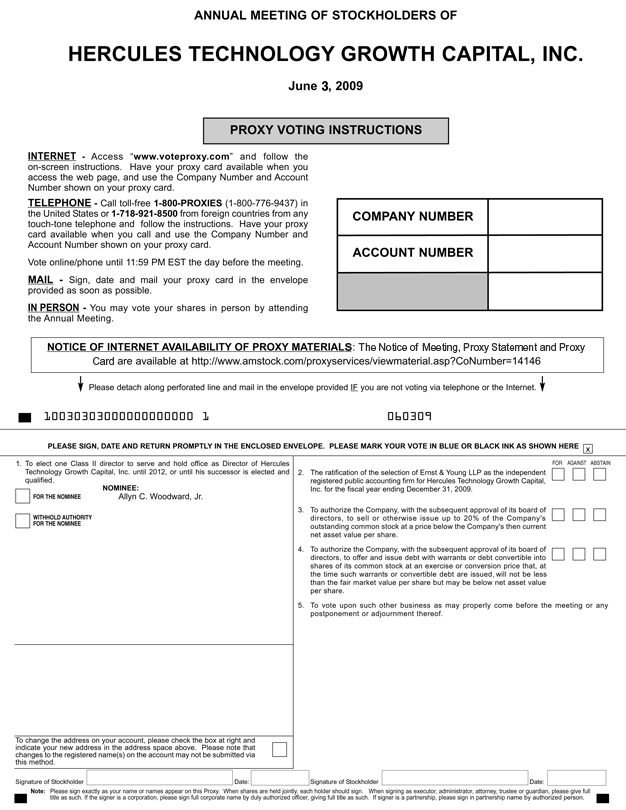

| 1. | To elect one director of the Company who will serve for three years or until his successor is elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009; |

| 3. | To approve a proposal to authorize the Company, with the subsequent approval of its Board of Directors (the “Board”), to sell or otherwise issue up to 20% of the Company’s outstanding common stock at a price below the Company’s then current net asset value (“NAV”) per share; |

| 4. | To approve a proposal to authorize the Company, with the subsequent approval of its Board, to offer and issue debt with warrants or debt convertible into shares of its common stock at an exercise or conversion price that, at the time such warrants or convertible debt are issued will not be less than the fair market value per share but may be below NAV; and |

| 5. | To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

The enclosed proxy statement is also available at http://www.amstock.com/proxyservices/viewmaterial.asp?conumber=14146. This website also includes copies of the form of proxy and the Company’s Annual Report to stockholders. Stockholders may request a copy of the proxy statement and the Company’s Annual Report by contacting our main office at (650) 289-3060.

You have the right to receive notice of and to vote at the meeting if you were a stockholder of record at the close of business on April 20, 2009. Whether or not you expect to be present in person at the meeting, please sign the enclosed proxy and return it promptly in the self-addressed envelope provided. As a registered stockholder, you may also vote your proxy electronically by telephone or over the Internet by following the instructions included with your proxy card. Instructions are shown on the proxy card. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the annual meeting, the annual meeting may be adjourned in order to permit further solicitation of the proxies by the Company.

By Order of the Board,

/s/ Scott Harvey

Scott Harvey

Secretary and Chief Legal Officer

April 29, 2009

This is an important meeting. To ensure proper representation at the meeting, please complete, sign, date and return the proxy card in the enclosed, self-addressed envelope. Even if you vote your shares prior to the meeting, you still may attend the meeting and vote your shares in person.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| Q: | Why did you send me this proxy statement? |

| A: |

We sent you this proxy statement and the enclosed proxy card because the Board of the Company is soliciting your proxy to vote at the 2009 Annual Meeting of Stockholders. The meeting will be held at our Boston office at 31 St. James Avenue, Suite 790, Boston, Massachusetts 02116 on Wednesday, June 3, 2009, at 10:00 a.m. |

This proxy statement summarizes the information regarding the matters to be voted upon at the meeting. However, you do not need to attend the meeting to vote your shares. You may simply complete, sign, and return the enclosed proxy card or vote your shares by telephone or over the Internet, if eligible to do so, in accordance with the instructions contained on the proxy card.

On April 20, 2009, the date for determining stockholders entitled to vote at the meeting (the “Record Date”), there were 35,326,944 shares of common stock of the Company outstanding. If you owned shares of our common stock at the close of business on the Record Date, you are entitled to one vote for each share of common stock you owned as of that date. We began mailing this proxy statement on or about April 29, 2009 to all stockholders entitled to vote their shares at the meeting.

| Q: | How do I vote by proxy and how many votes do I have? |

| A: | If you properly sign and date the accompanying proxy card, and the Company receives it in time for the meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. If you sign the proxy card, but do not make specific choices, the shares represented by such proxy will be voted as recommended by the Board. If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via the Internet or by telephone. A large number of banks and brokerage firms participate in the American Stock Transfer and Trust Company’s (“AST”) online program. This program provides eligible stockholders who receive a copy of the Company’s Annual Report on Form 10-K and proxy statement, either by paper or electronically, the opportunity to vote via the Internet or by telephone. If the entity holding your shares participates in AST’s program, your voting form will provide instructions. If your voting form does not reference Internet or telephone voting information, please complete and return the paper proxy card in the pre-addressed, postage-paid envelope provided. |

If you sign the proxy card but do not make specific choices, the shares represented by such proxy will be voted as recommended by the Board. If any other matter is presented, the shares represented by such proxy will be voted in accordance with the best judgment of the person or persons exercising authority conferred by the proxy at the meeting.

You have one vote for each share of common stock that you own on the Record Date. The proxy card indicates the number of shares that you owned on the Record Date.

| Q: | What does it mean if I receive more than one proxy card? |

| A: | If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted. |

| Q: | May my broker vote for me? |

| A: | Under the rules of the Financial Industry Regulatory Authority, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the |

1

| shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules of the New York Stock Exchange, non-routine matters are generally those involving a contest or a matter that may substantially affect the rights or privileges of stockholders. |

| Q: | May I revoke my proxy? |

| A: | Yes. You may change your mind after you send in your proxy card or authorize your shares by telephone, via the Internet or at the meeting by following these procedures. To revoke your proxy: |

| • | Send in another signed proxy card with a later date; |

| • | Send a letter revoking your proxy to Scott Harvey, Secretary and Chief Legal Officer, at Hercules Technology Growth Capital, Inc., 400 Hamilton Avenue, Suite 310, Palo Alto, California, 94301; |

| • | Vote again by telephone or Internet, if eligible to do so, by following the instructions included on the enclosed proxy card; or |

| • | Obtaining proper written authority from the institution or broker holding your shares and attending the meeting and vote in person. |

| Q: | How do I vote in person? |

| A: | If you plan to attend the meeting and vote in person, we will give you a proxy card when you arrive. If your shares are held in the name of your broker, bank, or other nominee, you must bring an account statement or letter from that broker, bank, or nominee. The account statement or letter must show that you were the direct or indirect beneficial owner of the shares on April 20, 2009, the Record Date for voting. Alternatively, you may contact the person in whose name your shares are registered and obtain a proxy from that person and bring it to the meeting. |

| Q: | What are abstentions and broker non-votes? |

| A: | An abstention represents the action by a stockholder to refrain from voting “for” or “against” a proposal. “Broker non-votes” represent votes that could have been cast on a particular matter by a broker, as a stockholder of record, but that were not cast because the broker (i) lacked discretionary voting authority on the matter and did not receive voting instructions from the beneficial owner of the shares, or (ii) had discretionary voting authority but nevertheless refrained from voting on the matter. Broker non-votes are considered “No Votes” for stockholder proposal 3. |

| Q: | What is the quorum requirement for the meeting? |

| A: | A quorum of stockholders must be present for any business to be conducted at the meeting. The quorum requirement for holding the meeting and transacting business is the presence in person or by proxy of a majority of our outstanding shares entitled to be voted. Abstentions and broker non-votes will be treated as shares present for quorum purposes. On the Record Date, there were 35,326,944 shares outstanding and entitled to vote. Thus, 17,663,473 must be represented by stockholders present at the meeting or by proxy to have a quorum. |

| Q: | Who is paying for the costs of soliciting these proxies? |

| A: | The Company will pay all the costs of soliciting these proxies, including the preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. In addition to the solicitation of proxies by mail, our officers and employees also may solicit proxies by telephone, fax or other electronic means of communication, or in person. The Company has also retained AST to assist in the solicitation of proxies for its customary fee estimated at $3,000 plus out-of-pocket expenses. |

2

| Q: | How do I find out the results of the voting at the annual meeting? |

| A: | Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report on Form 10-Q for the second quarter of fiscal year 2009. |

| Q: | Who should I call if I have any questions? |

| A: | If you have any questions about the meeting, voting or your ownership of the Company’s common stock, please call us at (650) 289-3060 or send an e-mail to Scott Harvey, Secretary and Chief Legal Officer, at sharvey@htgc.com. |

3

| 5 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| Security Ownership of Certain Beneficial Owners and Management |

7 | |

| 9 | ||

| 10 | ||

| 12 | ||

| 13 | ||

| 15 | ||

| 16 | ||

| 18 | ||

| 18 | ||

| 34 | ||

| 35 | ||

| Proposal 2—Ratification of Selection of Independent Auditors |

37 | |

| 40 | ||

| 46 | ||

| 49 |

4

HERCULES TECHNOLOGY GROWTH CAPITAL, INC.

400 Hamilton Avenue, Suite 310

Palo Alto, California 94301

(650) 289-3060

PROXY STATEMENT

2009 Annual Meeting of Stockholders

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Hercules Technology Growth Capital, Inc. a Maryland Corporation (the “Company,” “we,” “us” or “our”), for use at the Company’s 2009 Annual Meeting of Stockholders to be held on Wednesday, June 3, 2009, at 10:00 a.m. at our Boston office at 31 St. James Avenue, Suite 790, Boston, Massachusetts 02116, and at any postponements or adjournments thereof. This proxy statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008 are first being sent to stockholders on or about April 29, 2009.

We encourage you to vote your shares, either by voting in person at the meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card, and the Company receives it in time for the meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. This proxy statement is also available via the Internet at http://www.amstock.com/proxyservices/viewmaterial.asp?conumber=14146. The website also includes electronic copies of the form of proxy and the Company’s Annual Report. If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via the Internet or by telephone. A large number of banks and brokerage firms participate in the American Stock Transfer and Trust Company’s (“AST”) online program. This program provides eligible stockholders who receive a copy of the Company’s Annual Report on Form 10-K and proxy statement, either by paper or electronically, the opportunity to vote via the Internet or by telephone. If the entity holding your shares participates in AST’s program, your voting form will provide instructions. If your voting form does not reference Internet or telephone voting information, please complete and return the paper proxy card in the pre-addressed, postage-paid envelope provided.

A quorum of stockholders must be present for any business to be conducted at the meeting. The presence at the meeting, in person or by proxy, of a majority of our outstanding shares entitled to be voted as of the Record Date will constitute a quorum. Abstentions and broker non-votes will be treated as shares present for quorum purposes. On the Record Date there were 35,326,944 shares outstanding and entitled to vote. Thus 17,663,473 must be represented by stockholders present at the meeting or by proxy to have a quorum.

If a quorum is not present at the meeting, the stockholders who are represented may adjourn the meeting until a quorum is present. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought, to permit further solicitation of proxies.

5

Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the meeting, including the cost of preparing, printing, and mailing this proxy statement, the accompanying Notice of Annual Meeting of Stockholders, and the proxy card. We have requested that brokers, nominees, fiduciaries and other persons holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners. We will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person and by telephone or facsimile transmission by directors, officers or regular employees of the Company (for which no director, officer or regular employee will receive any additional or special compensation). The Company has also retained AST to assist in the solicitation of proxies for an estimated fee of $3,000, plus out-of-pocket expenses.

Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised. Any such notice of revocation should be provided in writing signed by the stockholder in the same manner as the proxy being revoked and delivered to the Company’s proxy tabulator.

Election of Directors. The election of a director requires the affirmative vote of the holders of a plurality of the shares of stock outstanding and entitled to vote thereon.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast at the meeting in person or by proxy is required to ratify the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm. Abstentions will not be counted as votes cast and will have no effect on the result of the vote.

Approval of the proposal to authorize the Company to sell or otherwise issue up to 20% of the Company’s outstanding common stock at a price below the Company’s then current NAV per share. Approval of this proposal requires the affirmative vote of: a majority of outstanding shares of common stock entitled to vote at the meeting, as defined below; and a majority of the outstanding shares of common stock entitled to vote at the meeting which are not held by affiliated persons of the Company.

For purposes of this proposal, the Investment Company Act of 1940 (the “1940 Act”) defines “a majority of outstanding shares” as (i) 67% or more of the voting securities present at such meeting if the holders of more than 50% of the outstanding voting securities of such company are present or represented by proxy; or (ii) 50% of the outstanding voting securities of such company, whichever is less. Abstentions and broker non-votes will have the effect of a vote against this proposal.

Approval to authorize the Company to offer and issue debt securities with warrants or debt convertible into shares of its common stock at an exercise or conversion price that, at the time such warrants or convertible debt are issued, will not be less than the fair market value per share but may be below NAV. Approval of this proposal requires the affirmative vote of a majority of the votes cast at the meeting in person or by proxy. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote.

Also, a stockholder vote may be taken on one or more of the proposals in this proxy statement prior to any such adjournment if there are sufficient votes for approval of such proposal(s).

6

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 20, 2009, the beneficial ownership of each current director, each nominee for director, the Company’s executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and includes voting or investment power with respect to the securities. Common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of April 20, 2009 are deemed to be outstanding and beneficially owned by the person holding such options or warrants. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Percentage of ownership is based on 35,326,944 shares of common stock outstanding as of April 20, 2009.

Unless otherwise indicated, to our knowledge, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned by the stockholder, except to the extent authority is shared by spouses under applicable law, and maintains an address c/o Hercules Technology Growth Capital, Inc., 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301.

The Company’s directors are divided into two groups—interested directors and independent directors. Interested directors are “interested persons” as defined in Section 2(a)(19) of the 1940 Act.

| Name and Address of Beneficial Owner |

Number of Shares Owned Beneficially(1) |

Percentage of Class |

|||

| Interested Director |

|||||

| Manuel A. Henriquez(2) |

2,091,953 | 5.9 | % | ||

| Independent Directors |

|||||

| Robert P. Badavas(3) |

61,399 | * | |||

| Joseph W. Chow(4) |

75,038 | * | |||

| Allyn C. Woodward, Jr.(5) |

68,321 | * | |||

| Executive Officers |

|||||

| Samir Bhaumik(6) |

265,068 | * | |||

| Scott Harvey(7) |

265,155 | * | |||

| David M. Lund(8) |

177,521 | * | |||

| Parag I Shah(9) |

404,928 | 1.1 | % | ||

| Executive officers and directors as a group(10) |

3,436,989 | 9.7 | % | ||

| Other |

|||||

| T. Rowe Price Associates, Inc.(11) 100 E. Pratt Street Baltimore, MD 21202 |

2,347,100 | 6.6 | % | ||

| Putnam Investment Management, Inc.(11) One Post Office Square Boston, MA |

1,748,821 | 5.0 | % | ||

| * | Less than 1% |

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. |

| (2) | Includes 1,288,829 shares of common stock that can be acquired upon the exercise of outstanding options and 142,187 shares of restricted stock. Includes shares of the Company’s common stock held by certain trusts controlled by Mr. Henriquez. |

7

| (3) | Includes 6,667 shares of common stock that can be acquired upon the exercise of outstanding options and 6,111 shares of restricted stock. |

| (4) | Includes 794 shares of common stock that can be acquired upon the exercise of outstanding 5-year warrants, 6,667 shares of common stock that can be acquired upon the exercise of outstanding options and 6,111 shares of restricted stock. |

| (5) | Includes 3,333 shares of common stock that can be acquired upon the exercise of outstanding options and 2,500 shares of restricted stock. |

| (6) | Includes 3,797 shares of common stock that can be acquired upon the exercise of outstanding 5-year warrants, 179,070 shares of common stock that can be acquired upon the exercise of outstanding options and 50,250 shares of restricted common stock. |

| (7) | Includes 4,279 shares of common stock that can be acquired upon the exercise of outstanding 5-year warrants, 213,840 shares of common stock that can be acquired upon the exercise of outstanding options and 31,250 shares of restricted common stock. |

| (8) | Includes 129,113 shares of common stock that can be acquired upon the exercise of outstanding options and 37,000 shares of restricted common stock. |

| (9) | Includes 2,994 shares of common stock that can be acquired upon the exercise of outstanding 5-year warrants, 290,858 shares of common stock that can be acquired upon the exercise of outstanding options and 77,000 shares of restricted common stock. |

| (10) | Includes 11,864 shares of common stock that can be acquired upon the exercise of outstanding 5-year warrants, 2,118,377 shares of common stock that can be acquired upon the exercise of outstanding options and 352,409 shares of restricted stock. |

| (11) | Information about the beneficial ownership of our principal stockholders is derived from filings made by them with the SEC. |

The following table sets forth as of April 20, 2009, the dollar range of our securities owned by our directors and employees primarily responsible for day-to-day management of our investment portfolio.

| Name |

Dollar Range of Equity Securities Beneficially Owned(1) | |

| Independent Directors: |

||

| Robert P. Badavas |

over $100,000 | |

| Joseph W. Chow |

over $100,000 | |

| Allyn C. Woodward, Jr. |

over $100,000 | |

| Interested Director: |

||

| Manuel A. Henriquez |

over $100,000 | |

| Other Executive Officers: |

||

| Samir Bhaumik |

over $100,000 | |

| Scott Harvey |

$50,001 – $100,000 | |

| David M. Lund |

$50,001 – $100,000 | |

| Parag I Shah |

over $100,000 | |

| (1) | Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Securities Exchange Act of 1934. |

8

PROPOSAL 1: ELECTION OF DIRECTORS

Board of Directors

The number of directors on our Board is currently fixed at four directors.

Our Board is divided into three classes. Class I directors hold office initially for a term expiring at the annual meeting of stockholders to be held in 2011, Class II directors hold office for a term expiring at the annual meeting of stockholders to be held in 2009 and Class III directors hold office for a term expiring at the annual meeting of stockholders to be held in 2010. Each director holds office for the term to which he or she is elected and until his or her successor is duly elected and qualified. Messrs. Badavas and Chow’s terms expire in 2011, Mr. Henriquez’s term expires in 2010, and Mr. Woodward’s term expires in 2009.

Mr. Woodward has been nominated for re-election for a three year term expiring in 2012. Mr. Woodward is not being nominated as a director for election pursuant to any agreement or understanding between such person and the Company. Mr. Woodward is an “independent director” of the Company as defined under the 1940 Act.

A stockholder can vote for or withhold his or her vote from the nominee. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of the nominee named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that the person named below will be unable or unwilling to serve.

Required Vote

This proposal requires the affirmative vote of the holders of a plurality of the shares of stock outstanding and entitled to vote thereon.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE NOMINEE NAMED IN THIS PROXY STATEMENT.

9

Information about the Directors and Executive Officers

Certain information, as of April 20, 2009, with respect to the nominee for re-election at the meeting, as well as each of the current directors and executive officers, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, and the year in which each person became a director of the Company.

The business address of each nominee and director listed below is c/o Hercules Technology Growth Capital, Inc., 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301.

| Name |

Age | Positions | ||

| Interested Director: |

||||

| Manuel A. Henriquez(1) |

45 | Co-founder, Chairman of the Board, President and Chief Executive Officer | ||

| Independent Directors: |

||||

| Robert P. Badavas(2)(3)(4)(5) |

56 | Director | ||

| Joseph W. Chow(2)(3)(4)(5) |

56 | Director | ||

| Allyn C. Woodward, Jr.(2)(3)(4)(5) |

68 | Director | ||

| Executive Officers: |

||||

| Samir Bhaumik |

45 | Senior Managing Director and Technology Group Head | ||

| Scott Harvey |

54 | Co-founder, Secretary, Chief Legal Officer and Chief Compliance Officer | ||

| David M. Lund |

55 | Vice President of Finance and Chief Financial Officer | ||

| Parag I. Shah |

37 | Senior Managing Director and Life Sciences Group Head | ||

| (1) | Mr. Henriquez is an interested person, as defined in section 2(a)(19) of the 1940 Act, of the Company due to his position as an executive officer of the Company. |

| (2) | Member of the audit committee. |

| (3) | Member of the valuation committee. |

| (4) | Member of the compensation committee. |

| (5) | Member of the nominating and corporate governance committee. |

Director Nominee

Independent Director

The following director is “independent” under the Nasdaq Stock Market rules and is not an “interested director” as defined in Section 2(a)(19) of the 1940 Act.

Allyn C. Woodward, Jr. has served as a director since February 2004. Mr. Woodward was Vice Chairman of Adams Harkness Financial Group (AHFG-formerly Adams, Harkness & Hill) from April 2001 until January 2006 when AHFG was sold to Canaccord, Inc. He previously served as President of AHFG from 1995 to 2001. AHFG was an independent institutional research, brokerage and investment banking firm headquartered in Boston, MA. Prior to joining AHFG, Mr. Woodward worked for Silicon Valley Bank from April 1990 to April 1995, initially as Executive Vice President and Co-founder of the Wellesley, MA office and more recently as Senior Executive Vice President and Chief Operating Officer of the parent bank in California. Silicon Valley Bank is a commercial bank, headquartered in Santa Clara, CA whose principal lending focus is directed toward the technology, healthcare and venture capital industries. Prior to joining Silicon Valley Bank, Mr. Woodward was Senior Vice President and Group Manager of the Technology group at Bank of New England, Boston, MA where he was employed from 1963-1990. Mr. Woodward is currently the Chairman of the Board of Directors and a member of the Compensation Committee of Lecroy Corporation. He is also a former Director of Viewlogic and

10

Cayenne Software, Inc. Mr. Woodward serves on the Board of three private companies and is on the Board of Advisors of five venture capital funds. Mr. Woodward is on the Board of Overseers and a member of the Finance Committee of Newton Wellesley Hospital, a 250 bed hospital located in Newton, MA. Mr. Woodward is on the Board of Overseers and the Investment Committee and the Finance Committee of Babson College in Babson Park, MA. Mr. Woodward graduated from Babson College with a degree in finance and accounting. He also graduated from the Stonier Graduate School of Banking at Rutgers University.

Current Directors

Interested Director

The following director is an “interested director” because he is the Company’s Chairman and Chief Executive Officer.

Manuel A. Henriquez is a co-founder of the Company and has been our Chairman and Chief Executive Officer since December 2003 and our President since April 2005. Prior to co-founding our company, Mr. Henriquez was a Partner at VantagePoint Venture Partners, a $2.5 billion multi-stage technology venture fund, from August 2000 through July 2003. Prior to VantagePoint Venture Partners, Mr. Henriquez was the President and Chief Investment Officer of Comdisco Ventures, a division of Comdisco, Inc., a leading technology and financial services company, from November 1999 to March 2000. Prior to that, from March 1997 to November 1999, Mr. Henriquez was a Managing Director of Comdisco Ventures. Mr. Henriquez was a senior member of the investment team at Comdisco Ventures that originated over $2.0 billion of equipment lease, debt and equity transactions from 1997 to 2000. Mr. Henriquez received a B.S. in Business Administration from Northeastern University.

Independent Directors

Each of the following directors are “independent” under the Nasdaq Stock Market rules and is not an “interested director” as defined in Section 2(a)(19) of the 1940 Act.

Robert P. Badavas has served as a director since March 2006. Mr. Badavas is the President and Chief Executive Officer of TAC Worldwide, a staffing and business services company owned by RADIA Holdings (formerly known as Goodwill Group) of Japan. From November 2003 until becoming president and CEO in December 2005, he was the Executive Vice President and Chief Financial Officer of TAC Worldwide. Prior to joining TAC Worldwide, Mr. Badavas was Senior Principal and Chief Operating Officer of Atlas Venture, a venture capital fund management company, from September 2001 to September 2003. Prior to joining Atlas Venture, he was Senior Corporate Adviser to the Office of the Chairman of Aether Systems, Inc., a provider of wireless data products and services, from September 2000 to June 2001. Prior to that, he was Chief Executive Officer of Cerulean Technology, Inc., a provider of mobile information systems applications, from December 1995 until Aether Systems, Inc. acquired the company in September 2000. From 1986 to October 1995, Mr. Badavas was Senior Vice President and Chief Financial Officer, among other capacities, of Chipcom Corporation, a provider of computer networking intelligent switching systems. Mr. Badavas was previously a board member and Chairman of the Audit Committee for RSA Security, Inc. until its acquisition by EMC Corporation in September 2006. Mr. Badavas currently serves on the board of directors of Airvana, Inc. and Constant Contact, Inc., and is the Chairman of the audit committees of both Airvana and Constant Contact. He was previously a director and Chairman of the Audit Committee of ON Technology, until ON Technology was acquired by Symantec, Inc. in 2004 and is a former director of Renaissance Worldwide, until its acquisition by a privately-held company in 2001. Mr. Badavas is a Trustee of both Bentley University in Waltham, MA and Hellenic College/Holy Cross School of Theology in Brookline, MA. He is also Chairman of the Board of The Learning Center for the Deaf in Framingham, MA. Mr. Badavas is a graduate of Bentley University with a BS in Accounting and Finance.

Joseph W. Chow has served as a director since February 2004. Mr. Chow is Executive Vice President at State Street Corporation responsible for the development of business strategies for emerging economies. He serves on State Street’s Asia Pacific Executive Board and European Executive Board. Previously, he was Head

11

of Risk and Corporate Administration, having retired from the company in August 2003 and rejoined in July 2004. Prior to August 2003, Mr. Chow was Executive Vice President and Head of Credit and Risk Policy at State Street. Before joining State Street, Mr. Chow worked at Bank of Boston in various international and corporate banking roles from 1981 to 1990 and specialized in the financing of emerging-stage high technology companies. Mr. Chow is a graduate of Brandeis University with a B.A. in Economics. He also received an M.C.P. from the Massachusetts Institute of Technology and an M.S. in Management (finance) from the MIT Sloan School of Management.

The compensation committee engages an outside compensation consultant to review the competitiveness and effectiveness of our director compensation program relative to market practices within comparison group companies based on market size, industries, geographic regions and other factors, as discussed in the Compensation Discussion and Analysis. The compensation committee historically has retained Watson Wyatt Worldwide, Inc. to act as its compensation consultant regarding independent director compensation. The consultant recommends to the compensation committee the mix of cash versus equity compensation to be offered as well as the types of long-term incentives to be granted.

The following table discloses the cash, equity awards and other compensation earned, paid or awarded, as the case may be, to each of our directors during the fiscal year ended December 31, 2008.

| Name |

Fees Earned or Paid in Cash ($) |

Restricted Stock Awards ($)(2) |

Option Awards ($)(3) |

All Other Compensation ($)(5) |

Total ($) | |||||||||||

| Robert P. Badavas |

$ | 257,096 | (1) | $ | 17,620 | $ | 3,915 | $ | 5,222 | $ | 278,631 | |||||

| Joseph W. Chow |

$ | 127,000 | $ | 17,620 | $ | 3,915 | $ | 5,222 | $ | 148,535 | ||||||

| Allyn C. Woodward, Jr. |

$ | 142,000 | $ | 15,036 | $ | 4,355 | $ | 3,645 | $ | 161,391 | ||||||

| Manuel A. Henriquez(4) |

— | — | — | — | — | |||||||||||

| (1) | Represents $134,096 in additional retainer fees. Mr. Badavas elected to receive a portion of the additional retainer fee as 6,668 shares of our common stock stock in lieu of cash. The total value of the shares issued to Mr. Badavas for services in fiscal 2008 was $69,864. |

| (2) | During 2008 we granted Messrs. Badavas and Chow total restricted stock awards of 5,000 shares each. See the discussion set forth under “2006 Non-Employee Director Plan” below. The column represents the dollar amount recognized as an expense during 2008 for financial statement reporting purposes with respect to restricted stock awarded to directors during 2008 and in prior years. Restricted stock awarded to directors are charged to expense in the Company’s financial statements as earned based on the fair market value of such awards as determined on their grant dates in accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 123R, “Share Based Payments”. See Note 1 to the Company’s Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2008 regarding assumptions underlying valuation of equity awards. |

| (3) | During 2008 we granted Messrs. Badavas and Chow total stock option awards of 15,000 shares each. See the discussion set forth under “2006 Non-Employee Director Plan” below. This column represents the portion of the grant date fair value of the stock option grants made to the directors in 2008 and prior years that was recognized as expense for financial reporting purposes during 2008 in accordance with the provisions of SFAS No. 123R, “Share-based Payments.” See Note 1 to the Company’s Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2008 regarding assumptions underlying valuation of equity awards. |

| (4) | As an employee director, Mr. Henriquez does not receive any compensation for his service as a director. The compensation Mr. Henriquez receives as Chief Executive officer of the company is disclosed in the Summary Compensation Table as set forth herein. |

| (5) | Represents dividends paid on unvested restricted stock awards during 2008. |

12

As compensation for serving on our Board, each of our independent directors receives an annual fee of $50,000 and the chairperson of each committee receives an additional $15,000 annual fee. Each independent director also receives $2,000 for each Board or committee meeting they attend, whether in person or telephonically. Employee directors and non-independent directors will not receive compensation for serving on the Board. In addition, we reimburse our directors for their reasonable out-of-pocket expenses incurred in attending Board meetings.

On July 26, 2006, our Board approved an additional retainer fee to be paid to non-interested directors. Messrs. Chow and Woodward received their retainer fee, however, Mr. Badavas continues to be paid the retainer fee on a quarterly basis through September 30, 2009 due to joining the Board subsequent to the other directors. Mr. Badavas received an additional $134,096, and elected to receive a portion of the retainer fee in stock in lieu of cash.

Directors do not receive any perquisites or other personal benefits from the Company.

Under current SEC rules and regulations applicable to business development companies (“BDC”), a BDC may not grant options and restricted stock to non-employee directors unless it receives exemptive relief from the SEC. The Company filed an exemptive relief request with the SEC to allow options and restricted stock to be issued to its non-employee directors, which was approved on October 10, 2007.

On June 21, 2007, the stockholders approved amendments to the 2004 Plan and the 2006 Non-Employee Director Plan (the “2006 Plan”) (collectively, the “2004 and 2006 Plans”) allowing for the grant of restricted stock. The 2004 and 2006 Plans limit the combined maximum amount of restricted stock that may be issued under both of the 2004 and 2006 Plans to 10% of the outstanding shares of the Company’s stock on the effective date of the 2004 and 2006 Plans plus 10% of the number of shares of stock issued or delivered by the Company during the terms of the 2004 and 2006 Plans. See the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2008.

The Board has established an audit committee, a valuation committee, a compensation committee, and a nominating and corporate governance committee. A brief description of each committee is included in this proxy and the charters of the audit, compensation, and nominating and corporate governance committees are available on the Investor Relations section of the Company’s web site at www.htgc.com.

During 2008, the Board held 17 Board meetings and 23 committee meetings. All of the directors attended all of the Board meetings. All of the directors attended all of the meetings of the respective committees on which they served; therefore all directors attended at least 75% of the respective committee meetings on which they serve. Each director makes a diligent effort to attend all Board and committee meetings, as well as the Annual Meeting of Stockholders. Each of the directors attended the Company’s 2008 Annual Meeting of Stockholders in person.

Audit Committee. Our Board has established an audit committee. The audit committee is comprised of Messrs. Badavas, Chow and Woodward, each of whom is an independent director and satisfies the independence requirements for purposes of the rules promulgated by the Nasdaq Stock Market and the requirements to be a non-interested director as defined in Section 2(a)(19) of the 1940 Act. Mr. Badavas currently serves as chairman of the audit committee and is an “audit committee financial expert” as defined under the Nasdaq Stock Market rules. The audit committee is responsible for approving our independent accountants, reviewing with our independent accountants the plans and results of the audit engagement, approving professional services provided by our independent accountants, reviewing the independence of our independent accountants and reviewing the adequacy of our internal accounting controls. During the last fiscal year, the audit committee held six meetings.

13

Valuation Committee. Our Board has established a valuation committee. The valuation committee is comprised of Messrs. Badavas, Chow and Woodward, each of whom is an independent director and satisfies the independence requirements for purposes of the rules promulgated by the Nasdaq Stock Market and the requirements to be a non-interested director as defined in Section 2(a)(19) of the 1940 Act. Mr. Chow currently serves as chairman of the valuation committee. The valuation committee is responsible for reviewing and recommending to the full Board the fair value of debt and equity securities that are not publicly traded in accordance with established valuation procedures. The valuation committee may utilize the services of an independent valuation firm in arriving at fair value of these securities. During the last fiscal year, the valuation committee held five meetings.

Compensation Committee. Our Board has established a compensation committee. The compensation committee is comprised of Messrs. Badavas, Chow and Woodward, each of whom is an independent director and satisfies the independence requirements for purposes of the rules promulgated by the Nasdaq Stock Market and the requirements to be a non-interested director as defined in Section 2(a)(19) of the 1940 Act. Mr. Woodward currently serves as chairman of the compensation committee. The compensation committee determines compensation for our executive officers, in addition to administering our 2004 Plan and the 2006 Plan. During the last fiscal year, the compensation committee held eleven meetings.

Nominating and Corporate Governance Committee. Our Board has established a nominating and corporate governance committee. The nominating and corporate governance committee is comprised of Messrs. Badavas, Chow and Woodward, each of whom is an independent director and satisfies the independence requirements for purposes of the rules promulgated by the Nasdaq Stock Market and the requirements to be a non-interested director as defined in Section 2(a)(19) of the 1940 Act. Mr. Woodward currently serves as chairman of the nominating and corporate governance committee. The nominating and corporate governance committee will nominate to the Board for consideration candidates for election as directors to the Board. During the last fiscal year, the nominating and corporate governance committee held one meeting.

The nominating and corporate governance committee will consider qualified director nominees recommended by stockholders when such recommendations are submitted in accordance with the Company’s bylaws and any other applicable law, rule or regulation regarding director nominations. When submitting a nomination to the Company for consideration, a stockholder must provide certain information that would be required under applicable SEC rules, including the following minimum information for each director nominee: full name, age, and address; class, series and number of shares of stock of the Company beneficially owned by the nominee, if any; the date such shares were acquired and the investment intent of such acquisition; whether such stockholder believes the individual is an “interested person” of the Company, as defined in the 1940 Act; and all other information required to be disclosed in solicitations of proxies for election of directors in an election contest or is otherwise required. To date, the Company has not received any recommendations from stockholders requesting consideration of a candidate for inclusion among the committee’s slate of nominees in the Company’s proxy statement. See “Submission of Stockholder Proposals.”

In evaluating director nominees, the nominating and corporate governance committee considers the following factors:

| • | the appropriate size and the diversity of the Company’s Board; |

| • | whether or not the person is an “interested person” of the Company as defined in Section 2(a)(19) of the 1940 Act; |

| • | the needs of the Company with respect to the particular talents and experience of its directors; |

| • | the knowledge, skills and experience of nominees in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

| • | experience with accounting rules and practices; |

14

| • | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members; and |

| • | all applicable laws, rules, regulations, and listing standards. |

The nominating and corporate governance committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the nominating and corporate governance committee or the Board decides not to re-nominate a member for re-election, or if the nominating and corporate governance committee recommends to expand the size of the Board, the nominating and corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the nominating and corporate governance committee and Board provide suggestions as to individuals meeting the criteria of the nominating and corporate governance committee. Consultants may also be engaged to assist in identifying qualified individuals.

Communication with the Board

Stockholders with questions about the Company are encouraged to contact Hercules Technology Growth Capital, Inc.’s Investor Relations department at (650) 289-3060. However, if stockholders believe that their questions have not been addressed, they may communicate with the Company’s Board by sending their communications to Hercules Technology Growth Capital, Inc., c/o David M. Lund, Chief Financial Officer, 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301. All stockholder communications received in this manner will be delivered to one or more members of the Board.

Code of Ethics

The Company has adopted a code of ethics that applies to directors, officers and employees. The code of ethics is available on our website at www.htgc.com. We will report any amendments to or waivers of a required provision of the code of ethics on our website and in a Current Report on Form 8-K.

Compensation Committee Interlocks and Insider Participation

All members of the compensation committee are independent directors and none of the members are present or past employees of the Company. No member of the compensation committee: (i) has had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Exchange Act; or (ii) is an executive officer of another entity, at which one of our executive officers serves on the Board.

Information about Executive Officers who are not Directors

The following information, as of April 20, 2009, pertains to the Company’s executive officers who are not directors of the Company.

Non-director Executive Officers

Samir Bhaumik joined our Company in November 2004 as a Managing Director and was promoted to Senior Managing Director in June 2006. During March 2008 Mr. Bhaumik was elected by our Board to the position of Technology Group Head. Mr. Bhaumik previously served as Vice President—Western Region of the New York Stock Exchange from January 2003 to October 2004. Prior to working for the New York Stock Exchange, Mr. Bhaumik was Senior Vice President of Comerica Bank, previously Imperial Bank, from

15

April 1993 to January 2003. Mr. Bhaumik received a B.A. from San Jose State University and an M.B.A. from Santa Clara University. He serves on the advisory boards of Santa Clara University Leavey School of Business, Junior Achievement of Silicon Valley and the American Electronics Association-Bay Area council.

Scott Harvey is a co-founder of our Company and has been our Chief Legal Officer and Secretary since December 2003. Mr. Harvey has been our Chief Compliance Officer since February 2005. Mr. Harvey has over 23 years of legal and business experience with leveraged finance and financing public and private technology-related companies. Since July 2002, and prior to co-founding the Company, Mr. Harvey was in a diversified private law practice. Previously, Mr. Harvey was Deputy General Counsel of Comdisco, Inc., a leading technology and financial services company, from January 1997 to July 2002. From 1991 to 1997, Mr. Harvey served as Vice President of Marketing, Administration & Alliances with Comdisco, Inc. and was Corporate Counsel from 1983 to 1991. Mr. Harvey received a B.S. in Agricultural Economics from the University of Missouri, a J.D. and LLM in taxation from The John Marshall Law School and an M.B.A. from Illinois Institute of Technology.

David M. Lund joined our Company in July 2005 as Vice President of Finance and Corporate Controller, and was promoted to our Chief Financial Officer in October 2006, and is our principle financial and accounting officer. He has over 22 years of experience in finance and accounting serving companies in the technology sector. Prior to joining Hercules, Mr. Lund served as the Corporate Controller of Rainmaker, Inc., from January, 2005 to July, 2005; as the Corporate Controller for Centrillium Communications from January, 2003 to February, 2005; as the Chief Financial Officer and Vice President of Finance for APT Technologies from April, 2002 to January, 2003; as the Chief Financial Officer and Vice President of Scion Photonics from February, 2001, to March, 2002. Mr. Lund also served in public accounting with Ernst & Young LLP and Grant Thornton LLP. He received a B.S. degree in Business Administration with an emphasis in Accounting from San Jose State University and a B.S. degree in Business Administration with an emphasis in Marketing from California State University, Chico. Mr. Lund is a Certified Public Accountant in the State of California.

Parag I. Shah joined our Company in November 2004 as Managing Director of Life Sciences and was promoted to Senior Managing Director in June 2006. During March 2008 Mr. Shah was elected by our Board to the position of Life Science Group Head. Prior to joining Hercules, Mr. Shah served as Managing Director for Biogenesys Capital from April 2004 to November 2004. From April 2000 to April 2004, Mr. Shah was employed by Imperial Bank, where he served as a Senior Vice President in Imperial Bank’s Life Sciences Group, beginning in October 2000, which was acquired by Comerica Bank in early 2001. Prior to working at Comerica Bank, Mr. Shah was an Assistant Vice President at Bank Boston from January 1997 to March 2000. Bank Boston was acquired by Fleet Bank in 1999. Mr. Shah completed his Masters degrees in Technology, Management and Policy as well as his Bachelor’s degree in Molecular Biology at the Massachusetts Institute of Technology (MIT). During his tenure at MIT, Mr. Shah conducted research at the Whitehead Institute for Biomedical Research and was chosen to serve on the Whitehead Institute’s Board of Associates in 2003.

Certain Relationships and Related Transactions

In August 2000, Mr. Henriquez acquired an interest in JMP Group LLC, the ultimate parent entity of the lead underwriter in our initial public offering. Mr. Henriquez’s interest represents approximately 0.1% of the fully-diluted equity of JMP Group LLC.

In February 2004, we issued and sold 400 shares of our Series A-1 preferred stock to JMP Group LLC, the ultimate parent entity of JMP Securities LLC, for an aggregate purchase price of $2.5 million and, in connection with such sale, we paid a $175,000 placement fee to JMP Securities LLC. In addition, we issued and sold 100 shares of our Series A-2 preferred stock to an entity related to Mr. Henriquez for an aggregate purchase price of $125,000, and we issued and sold 100 shares of our Series A-2 preferred stock to Mr. Howard for an aggregate purchase price of $125,000. Our Series A-1 preferred stock held a liquidation preference over our Series A-2

16

preferred stock and also carried separate, preferential voting rights. In June 2004, each share of Series A-1 preferred stock and Series A-2 preferred stock was exchanged for 208.3333 units with the same terms as the units sold in our June 2004 private offering.

In connection with the issuance of our Series A-1 preferred stock and Series A-2 preferred stock, we entered into a registration rights agreement with the holders of our Series A-1 preferred stock and Series A-2 preferred stock. In June 2004, in connection with the conversion of the Series A preferred stock, the registration rights agreement entered into in connection with the issuance of our preferred stock was terminated and the shares of our common stock issued upon conversion were included in the registration rights agreement entered into in connection with our June 2004 private offer.

In connection with our June 2004 private offering, we agreed to obtain the approval of each of JMP Asset Management LLC and Farallon Capital Management, L.L.C. for each investment made by us. Though this arrangement was terminated in connection with our election to be regulated as a BDC, under the terms of the letter agreements described above, we have agreed to indemnify, to the maximum extent permitted by Maryland law and the 1940 Act, representatives of JMP Asset Management LLC and Farallon Capital Management, L.L.C. in connection with their activities in evaluating our investment opportunities prior to our election to be regulated as a BDC on terms similar to those afforded to our directors and officers under our charter and bylaws.

In conjunction with the Company’s Rights offering completed on April 21, 2006, the Company agreed to pay JMP Securities LLC a fee of approximately $700,000 as co-manager of the offering.

In conjunction with the Company’s public offering completed on December 7, 2006, the Company agreed to pay JMP Securities LLC a fee of approximately $1.2 million as co-manager of the offering.

In conjunction with the Company’s public offering completed on June 4, 2007 and the related over-allotment exercise, the Company agreed to pay JMP Securities LLC a fee of approximately $1.6 million as co-manager of the offering.

In connection with the sale of public equity investments, the Company paid JMP Securities LLC approximately $80,000 and $22,200 in brokerage commissions during the years ended December 31, 2008 and 2007, respectively.

In the ordinary course of business, we enter into transactions with portfolio companies that may be considered related party transactions. In order to ensure that we do not engage in any prohibited transactions with any persons affiliated with us, we have implemented certain policies and procedures whereby our executive officers screen each of our transactions for any possible affiliations, close or remote, between the proposed portfolio investment, us, companies controlled by us and our employees and directors.

We will not enter into any agreements unless and until we are satisfied that no affiliations prohibited by the 1940 Act exist or, if such affiliations exist, we have taken appropriate actions to seek Board review and approval or exemptive relief for such transaction. The Board reviews these procedures on an annual basis.

In addition, our code of ethics, which is signed by all employees and directors, requires that all employees and directors avoid any conflict, or the appearance of a conflict, between an individual’s personal interests and the interests of the Company. Pursuant to the code of ethics which is available on our website at www.htgc.com, each employee and director must disclose any conflicts of interest, or actions or relationships that might give rise to a conflict, to the audit committee. The audit committee is charged with monitoring and making recommendations to the Board regarding policies and practices relating to corporate governance. Certain actions or relationships that might give rise to a conflict of interest are reviewed and approved by the Board.

17

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act and the disclosure requirements of Item 405 of SEC Regulation S-K require that our directors and executive officers, and any persons holding more than 10% of any class of our equity securities report their ownership of such equity securities and any subsequent changes in that ownership to the SEC, the Nasdaq Stock Market and to us. Based solely on a review of the written statements and copies of such reports furnished to us by our executive officers, directors and greater than 10% beneficial owners, we believe that during fiscal 2008 all Section 16(a) filing requirements applicable to the executive officers, directors and stockholders were timely satisfied.

Compensation Discussion and Analysis

Overview of the Compensation Program

The compensation committee oversees the Company’s compensation policies and programs, approves the compensation of our executive officers and administers our equity incentive programs. This compensation discussion and analysis presents the details regarding compensation approved by the compensation committee and paid for the fiscal year ended December 31, 2008 to the named executive officers (“NEOs”) presented below and included in the summary compensation table:

| • | Manuel A. Henriquez, Chief Executive Officer (“CEO”) |

| • | David M. Lund, Chief Financial Officer |

| • | Scott Harvey, Chief Legal Officer |

| • | Samir Bhaumik, Senior Managing Director and Technology Group Head |

| • | Parag I. Shah, Senior Managing Director and Life Science Group Head |

In addition, this compensation discussion and analysis explains the compensation committee’s rationale and considerations that led to the executive compensation decisions affecting the Company’s NEOs.

Compensation Philosophy

The compensation and benefit programs of the Company adopted by our compensation committee are designed with the goal of providing compensation that is fair, reasonable and competitive and are intended to help us align the compensation paid to our NEOs with corporate and executive performance goals that have been established to achieve both our short-term and long-term objectives. The key elements of our compensation philosophy include:

| • | designing compensation programs that enable us to attract and retain the best talent in the industries in which we compete; |

| • | using long-term equity retention and incentive awards to align employee and stockholder interests; |

| • | aligning executive compensation packages with the Company’s performance; and |

| • | ensuring that our compensation program complies with the requirements of the Investment Company Act of 1940. |

We have designed compensation programs based on the following:

| • | Achievement of Corporate Objectives and Executive Performance Factors—We believe that the best way to align compensation with the interests of our stockholders is to link executive compensation with individual performance and contribution along with the achievements of certain corporate objectives. |

18

| The compensation committee determines executive compensation consistent with the achievement of certain corporate objectives and executive performance factors that have been established to achieve short-term and long-term objectives of the Company. |

| • | Discretionary Annual Bonus Pool—Over the course of the year, the compensation committee, together with input from our CEO, develops a range of amounts likely to be available for the discretionary annual cash bonus pool. The range for this bonus pool is dependent upon the Company’s current financial outlook and executive performance contributing to achieving our corporate objectives, does not utilize specified targets and is subject to the sole discretion of the compensation committee. This range is further refined during our third and fourth fiscal quarters into a specified pool to be used for discretionary annual cash bonuses for our NEOs. If executive performance exceeds expectation and performance goals established during the year, compensation levels for the NEOs may exceed the specified pool amount at the discretion of our compensation committee. If executive performance falls below expectations, compensation levels may fall below the specified pool amount. |

| • | Competitiveness and Market Alignment—Our compensation and benefits programs are designed to be competitive with those provided by companies with whom we compete for investment professionals and to be sufficient to attract and retain the best talent for top performers within the industries in which we compete. We compete for talent with venture capital funds, private equity firms, mezzanine lenders, hedge funds and other specialty finance companies including certain specialized commercial banks. Thus, we believe that our employee compensation benefit plans should be designed to be competitive in the businesses in which we compete sufficient to attract and retain talent. Our benefit programs, which include general health and welfare benefits, consisting of life, long-term and short-term disability, health, dental, vision insurance benefits and the opportunity to participate in our defined contribution 401(k) plan, are designed to provide competitive benefits and are not based on performance. As part of its annual review process, the compensation committee reviews the competitiveness of the Company’s current compensation levels of its NEOs relative to that of our comparative group companies identified herein with a third-party compensation consultant. |

| • | Alignment with Requirements of the 1940 Act—Our compensation program must align with the requirements of the 1940 Act, which imposes certain limitations on the structure of a BDC’s compensation program. For example, the 1940 Act prohibits a BDC from maintaining an incentive stock option award plan and a profit sharing arrangement simultaneously. As a result, if a BDC has an incentive stock option award plan, such as we do, it is prohibited from using specific measurements commonly applied to non-BDC companies or a profit sharing arrangement such as a carried interest formula, a common form of compensation in the private equity industry, as a form of compensation. These limitations and other similar restrictions imposed by the 1940 Act limit the compensation arrangements that we can utilize in order to attract and retain our NEOs. |

Components of Total Compensation

The compensation committee determined that the compensation packages for 2008 for our NEOs should consist of the following three key components:

| • | annual base salary; |

| • | annual cash bonus based on corporate and executive performance factors; and |

| • | long-term equity incentive and retention awards in the form of stock option and/or restricted stock awards. |

Annual Base Salary

Base salary is designed to provide a minimum, fixed level of cash compensation to our NEOs in order to attract and retain experienced executive officers who can drive the achievement of our goals and objectives. While our NEOs initial base salaries are determined by an assessment of competitive market levels for

19

comparable experience and responsibilities, the performance factors used in determining changes in base salary include individual performance, changes in role and/or responsibility and changes in the market environment.

Annual Cash Bonus

The annual cash bonus is designed to reward our NEOs that have achieved certain corporate objectives and executive performance factors. The amount of the annual cash bonus is determined by the compensation committee on a discretionary basis and is dependent on the achievement of certain executive performance factors, as described herein under the heading “Assessment of Corporate Performance” during the year. The compensation committee established these performance factors because it believes they are related to our achievement of both short-term and long-term corporate objectives and the creation of stockholder value.

Long-Term Equity Incentive and Retention Awards

The compensation committee’s principal goals in awarding incentive stock options and/or restricted stock are to retain executive officers as well as align each NEO’s interests with our success and the long-term financial interests of its stockholders by linking a portion of the NEO’s compensation with the performance of the Company and the value delivered to stockholders. The compensation committee evaluates a number of criteria, including the past service of each NEO, the present and potential performance contributions of such NEO to our success, years of service, position, and such other factors as the compensation committee believes to be relevant in connection with accomplishing the purposes of the long-term goals of the Company. The compensation committee neither assigns a formula, nor assigns specific weights to any of these factors when making its determination of the NEOs’ long-term incentive awards. The compensation committee awards incentive stock options and/or restricted stock on a subjective basis, and such awards depend in each case on the performance of the NEO under consideration, and in the case of new hires, on their potential performance.

Option awards under the 2004 Plan are generally awarded upon initial employment and on an annual basis thereafter. Options generally vest, subject to continued employment, one-third after one year of the date of grant and ratably over the succeeding 24 months.

In May, 2007, we received SEC exemptive relief, and our stockholders approved amendments to the 2004 and 2006 Plans, permitting us to grant restricted stock awards. Restricted stock awards granted under the 2004 Plan were previously awarded annually and vest subject to continued employment one fourth each year over a four year period beginning with the first anniversary of such grant. In 2009, restricted stock awards vest subject to continued employment one fourth on the one year anniversary of the date of grant and ratably over the remaining 36 months.

The 2004 and 2006 Plans limit the combined maximum amount of restricted stock that may be issued under both 2004 and 2006 Plans to 10% of the outstanding shares of our stock on the effective date of the 2004 and 2006 Plans plus 10% of the number of shares of stock issued or delivered by our Company during the terms of the 2004 and 2006 Plans. The approved amendments further specify that no one person will be granted awards of restricted stock relating to more than 25% of the shares available for issuance under the 2004 Plan. Further, the amount of voting securities that would result from the exercise of all our outstanding warrants, options and rights, together with any restricted stock issued pursuant to the 2004 and 2006 Plans, at the time of issuance will not exceed 25% of our outstanding voting securities, except that if the amount of voting securities that would result from such exercise of all of our outstanding warrants, options and rights issued to our directors and executive officers, together with any restricted stock issued pursuant to the 2004 and 2006 Plans, would exceed 15% of our outstanding voting securities, then the total amount of voting securities that would result from the exercise of all outstanding warrants, options and rights, together with any restricted stock issued pursuant to the 2004 and 2006 Plans, at the time of issuance will not exceed 20% of our outstanding voting securities. Eligibility includes all of our NEOs. Each grant of restricted stock under the 2004 Plan to our NEOs will contain such terms and conditions, including consideration and vesting, as our Board deems appropriate and as allowed for within the provisions of the 2004 Plan.

20

We believe that by having two forms of long term equity incentive rewards we are able to reward stockholder value creation in different ways. Stock options have exercise prices equal to the market price of our common stock on the date of the grant and reward employees only if our stock price increases. Restricted stock, although affected by both stock price increases and decreases, maintains value during periods of market volatility.

Benefits and Perquisites

Our NEOs receive the same benefits and perquisites as other full-time employees. Our benefit program is designed to provide competitive benefits and is not based on performance. Other than the benefits described below, our NEOs do not receive any other benefits, including retirement benefits, or perquisites from the Company. Our NEOs and other full-time employees receive general health and welfare benefits, which consist of life, long-term and short-term disability, health, dental, vision insurance benefits and the opportunity to participate in our defined contribution 401(k) plan. During 2008, our 401(k) plan provided for a match of contributions by the Company for up to $3,000 per full-time employee. In January, 2009, our Board approved an increase for a match of contributions by the Company for up to $6,500 per full-time employee.

Tax and Accounting Implications

Stock-Based Compensation. We account for stock-based compensation, including options and restricted shares granted pursuant to our 2004 and 2006 Plans in accordance with the requirements of SFAS No. 123R. Under the provisions of SFAS No. 123R, we estimate the fair value of our employee stock awards at the date of grant using the Black-Scholes option-pricing model, which requires the use of certain subjective assumptions. The most significant of these assumptions are our estimates on the expected term, volatility and forfeiture rates of the awards. The expected stock price volatility assumption was determined using an historical index which combines the volatility of our stock with selected BDC stocks over the relevant term for our outstanding equity instruments. We use this historical index due to the limited history of our stock. Forfeitures are not estimated due to our limited history but are reversed in the period in which forfeiture occurs. As required under the accounting rules, we review our valuation assumptions at each grant date and, as a result, are likely to change our valuation assumptions used to value employee stock-based awards granted in future periods.

Deductibility of Executive Compensation. When analyzing both total compensation and individual elements of compensation paid to our NEOs, the compensation committee considers the income tax consequences to the Company of its compensation policies and procedures. The compensation committee intends to balance its objective of providing compensation to our NEOs that is fair, reasonable, and competitive with the Company’s capability to take an immediate compensation expense deduction. The Board believes that the best interests of the Company and its stockholders are served by executive compensation programs that encourage and promote the Company’s principal compensation philosophy, enhancement of stockholder value, and permit the compensation committee to exercise discretion in the design and implementation of compensation packages. Accordingly, the Company may from time to time pay compensation to its NEOs that may not be fully tax deductible. Stock options granted under our stock plan generally intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) may exceed the deductibility of non-performance-based compensation paid to certain covered employees whose compensation exceeds $1 million in any year. Also, the restricted stock awards we may grant or have granted to date are not eligible for this deduction. We will continue to review the Company’s executive compensation plans periodically to determine what changes, if any, should be made as a result of the limitation on deductibility.

21

Establishing Compensation Levels

Role of the Compensation Committee

The compensation committee is comprised entirely of independent directors who are also non-employee directors as defined in Rule 16b-3 under the Securities Exchange Act of 1934, independent directors as defined by the Nasdaq Stock Market rules, and are not “interested persons” of our Company, as defined by Section 2(a)(19) of the 1940 Act. The compensation committee currently consists of Messrs. Woodward (Chairman), Badavas and Chow.