UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 814-00702

Hercules Technology Growth Capital, Inc.

(Exact name of Registrant as specified in its charter)

| Maryland | 74-3113410 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

400 Hamilton Avenue, Suite 310

Palo Alto, California 94301

(Address of principal executive offices)

(650) 289-3060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Shares, par value $0.001 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S- during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-T is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer, large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $430.5 million based upon a closing price of $10.84 reported for such date on the New York Stock Exchange. Common shares held by each executive officer and director and by each person who owns 5% or more of the outstanding common shares have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not intended and shall not be deemed to be an admission that, such persons are affiliates of the Registrant.

On February 25, 2013, there were 52,913,216 shares outstanding of the Registrant’s common stock, $0.001 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Documents incorporated by reference: Portions of the registrant’s Proxy Statement for its 2013 Annual Meeting of Shareholders to be filed within 120 days after the close of the registrant’s year end are incorporated by reference into Part III of this Annual Report on Form 10-K.

HERCULES TECHNOLOGY GROWTH CAPITAL, INC.

FORM 10-K

ANNUAL REPORT

| Page | ||||||

| Part I. | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

26 | |||||

| Item 1B. |

58 | |||||

| Item 2. |

58 | |||||

| Item 3. |

58 | |||||

| Item 4. |

58 | |||||

| Part II. | ||||||

| Item 5. |

59 | |||||

| Item 6. |

63 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

64 | ||||

| Item 7A. |

97 | |||||

| Item 8. |

100 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

180 | ||||

| Item 9A. |

180 | |||||

| Item 9B. |

181 | |||||

| Part III. | ||||||

| Item 10. |

182 | |||||

| Item 11. |

182 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

182 | ||||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

182 | ||||

| Item 14. |

182 | |||||

| Part IV. | ||||||

| Item 15. |

183 | |||||

| 190 | ||||||

Hercules Technology Growth Capital, Inc., our logo and other trademarks of Hercules Technology Growth Capital, Inc. are the property of Hercules Technology Growth Capital, Inc. All other trademarks or trade names referred to in this Annual Report on Form 10-K are the property of their respective owners.

In this Annual Report on Form 10-K, or Annual Report, the “Company,” “HTGC,” “we,” “us” and “our” refer to Hercules Technology Growth Capital, Inc. and its wholly owned subsidiaries and its affiliated securitization trusts unless the context otherwise requires.

| Item 1. | Business |

GENERAL

We are a specialty finance company focused on providing senior secured loans to venture capital-backed companies in technology-related markets, including technology, biotechnology, life science, and clean-technology industries at all stages of development. We source our investments through our principal office located in Silicon Valley, as well as through additional offices in Boston, MA, Boulder, CO and McLean, VA.

Our goal is to be the leading structured debt financing provider of choice for venture capital-backed companies in technology-related markets, requiring sophisticated and customized financing solutions. Our strategy is to evaluate and invest in a broad range of technology-related markets including technology, biotechnology, life science and clean technology industries and to offer a full suite of growth capital products up and down the capital structure. We invest primarily in structured debt with warrants and, to a lesser extent, in senior debt and equity investments. We use the term “structured debt with warrants” to refer to any debt investment, such as a senior or subordinated secured loan, that is coupled with an equity component, including warrants, options or rights to purchase common or preferred stock. Our structured debt with warrants investments will typically be secured by some or all of the assets of the portfolio company.

Our investment objective is to maximize our portfolio total return by generating current income from our debt investments and capital appreciation from our equity-related investments. Our primary business objectives are to increase our net income, net operating income and net asset value by investing in structured debt with warrants and equity of venture capital-backed companies in technology-related markets with attractive current yields and the potential for equity appreciation and realized gains. Our structured debt investments typically include warrants or other equity interests, giving us the potential to realize equity-like returns on a portion of our investments. Our equity ownership in our portfolio companies may represent a controlling interest. In some cases, we receive the right to make additional equity investments in our portfolio companies, including the right to convert some portion of our debt into equity, in connection with future equity financing rounds. Capital that we provide directly to venture capital-backed companies in technology-related markets is generally used for growth and general working capital purposes as well as in select cases for acquisitions or recapitalizations.

We also make investments in qualifying small businesses through two wholly-owned, small business investment company (“SBIC”) subsidiaries, Hercules Technology II, L.P. (“HT II”) and Hercules Technology III, L.P. (“HT III”). HT II and HT III hold approximately $154.4 million and $250.8 million in assets, respectively, and accounted for approximately 10.5% and 17.0% of our total assets prior to consolidation at December 31, 2012. We have issued $225.0 million in SBA-guaranteed debentures in our SBIC subsidiaries, which is the maximum amount allowed for a group of SBICs under common control. See “—Regulation—Small Business Administration Regulations” for additional information regarding our SBIC subsidiaries.

Our portfolio is comprised of, and we anticipate that our portfolio will continue to be comprised of, investments primarily in technology-related companies at various stages of their development. Consistent with regulatory requirements, we invest primarily in United States based companies and to a lesser extent in foreign companies.

1

We focus our investments in companies active in the technology industry sub-sectors characterized by products or services that require advanced technologies, including, but not limited to, computer software and hardware, networking systems, semiconductors, semiconductor capital equipment, information technology infrastructure or services, Internet consumer and business services, telecommunications, telecommunications equipment, renewable or alternative energy, media and life science. Within the life science sub-sector, we generally focus on medical devices, bio-pharmaceutical, drug discovery, drug delivery, health care services and information systems companies. Within the clean technology sub-sector, we focus on sustainable and renewable energy technologies and energy efficiency and monitoring technologies. We refer to all of these companies as “technology-related” companies and intend, under normal circumstances, to invest at least 80% of the value of our assets in such businesses.

CORPORATE HISTORY AND OFFICES

We are a Maryland Corporation formed in December 2003 that began investment operations in September 2004. We are an internally managed, non-diversified closed-end investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended, or the 1940 Act. As a business development company, we are required to comply with certain regulatory requirements. For instance, we generally have to invest at least 70% of our total assets in “qualifying assets,” including securities of private U.S. companies, cash, cash equivalents, U.S. government securities and high-quality debt investments that mature in one year or less. A business development company also must meet a coverage ratio of total net assets to total senior securities, which include all of our borrowings (including accrued interest payable) except for debentures issued by the Small Business Administration, or the SBA, and any preferred stock we may issue in the future, of at least 200% subsequent to each borrowing or issuance of senior securities. See “Item 1. Business—Regulation as a Business Development Company”.

From incorporation through December 31, 2005, we were taxed as a corporation under Subchapter C of the Internal Revenue Code, or the Code. As of January 1, 2006, we have elected to be treated for federal income tax purposes as a regulated investment company, or a RIC, under Subchapter M of the Code. Pursuant to this election, we generally will not have to pay corporate-level taxes on any income that we distribute to our stockholders. However, such an election and qualification to be treated as a RIC requires that we comply with certain requirements contained in Subchapter M of the Code. For example, a RIC must meet certain requirements, including source-of income, asset diversification and income distribution requirements. The income source requirement mandates that we receive 90% or more of our income from qualified earnings, typically referred to as “good income.”

Our principal executive offices are located at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301, and our telephone number is (650) 289-3060. We also have offices in Boston, MA, Boulder, CO and McLean, VA. We maintain a website on the Internet at www.htgc.com. Information contained on our website is not incorporated by reference into this Annual Report, and you should not consider that information to be part of this Annual Report.

We file annual, quarterly and current periodic reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, which we refer to as the Exchange Act. This information is available at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the operation of the SEC’s public reference room by calling the SEC at (202) 551-8090. In addition, the SEC maintains an Internet website, at www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers, including us, who file documents electronically with the SEC.

OUR MARKET OPPORTUNITY

We believe that technology-related companies compete in one of the largest and most rapidly growing sectors of the U.S. economy and that continued growth is supported by ongoing innovation and performance

2

improvements in technology products as well as the adoption of technology across virtually all industries in response to competitive pressures. We believe that an attractive market opportunity exists for a specialty finance company focused primarily on investments in structured debt with warrants in technology-related companies for the following reasons:

| • | Technology-related companies have generally been underserved by traditional lending sources; |

| • | Unfulfilled demand exists for structured debt financing to technology-related companies as the number of lenders has declined due to the recent financial market turmoil; and |

| • | Structured debt with warrants products are less dilutive and complement equity financing from venture capital and private equity funds. |

Technology-Related Companies are Underserved by Traditional Lenders. We believe many viable technology-related companies backed by financial sponsors have been unable to obtain sufficient growth financing from traditional lenders, including financial services companies such as commercial banks and finance companies because traditional lenders have continued to consolidate and have adopted a more risk-averse approach to lending. More importantly, we believe traditional lenders are typically unable to underwrite the risk associated with these companies effectively.

The unique cash flow characteristics of many technology-related companies include significant research and development expenditures and high projected revenue growth thus often making such companies difficult to evaluate from a credit perspective. In addition, the balance sheets of these companies often include a disproportionately large amount of intellectual property assets, which can be difficult to value. Finally, the speed of innovation in technology and rapid shifts in consumer demand and market share add to the difficulty in evaluating technology-related companies.

Due to the difficulties described above, we believe traditional lenders are generally refraining from entering the structured mezzanine marketplace, instead preferring the risk-reward profile of asset based lending. Traditional lenders generally do not have flexible product offerings that meet the needs of technology-related companies. The financing products offered by traditional lenders typically impose on borrowers many restrictive covenants and conditions, including limiting cash outflows and requiring a significant depository relationship to facilitate rapid liquidation.

Unfulfilled Demand for Structured Debt Financing to Technology-Related Companies. Private debt capital in the form of structured debt financing from specialty finance companies continues to be an important source of funding for technology-related companies. We believe that the level of demand for structured debt financing is a function of the level of annual venture equity investment activity.

We believe that demand for structured debt financing is currently underserved, in part because of the credit market collapse in 2008 and the resulting exit of debt capital providers to technology-related companies. The venture capital market for the technology-related companies in which we invest has been active and is continuing to show signs of increased investment activity. Therefore, to the extent we have capital available, we believe this is an opportune time to be active in the structured lending market for technology-related companies.

Structured Debt with Warrants Products Complement Equity Financing From Venture Capital and Private Equity Funds. We believe that technology-related companies and their financial sponsors will continue to view structured debt securities as an attractive source of capital because it augments the capital provided by venture capital and private equity funds. We believe that our structured debt with warrants product provides access to growth capital that otherwise may only be available through incremental investments by existing equity investors. As such, we provide portfolio companies and their financial sponsors with an opportunity to diversify their capital sources. Generally, we believe technology-related companies at all stages of development target a portion of their capital to be debt in an attempt to achieve a higher valuation through internal growth. In addition,

3

because financial sponsor-backed companies have reached a more mature stage prior to reaching a liquidity event, we believe our investments could provide the debt capital needed to grow or recapitalize during the extended period prior to liquidity events.

OUR BUSINESS STRATEGY

Our strategy to achieve our investment objective includes the following key elements:

Leverage the Experience and Industry Relationships of Our Management Team and Investment Professionals. We have assembled a team of experienced investment professionals with extensive experience as venture capitalists, commercial lenders, and originators of structured debt and equity investments in technology-related companies. Our investment professionals have, on average, more than 15 years of experience as equity investors in, and/or lenders to, technology-related companies. In addition, our team members have originated structured debt, debt with warrants and equity investments in over 220 technology-related companies, representing $3.4 billion in commitments from inception to December 31, 2012, and have developed a network of industry contacts with investors and other participants within the venture capital and private equity communities. In addition, members of our management team also have operational, research and development and finance experience with technology-related companies. We have established contacts with leading venture capital and private equity fund sponsors, public and private companies, research institutions and other industry participants, which should enable us to identify and attract well-positioned prospective portfolio companies.

We concentrate our investing activities generally in industries in which our investment professionals have investment experience. We believe that our focus on financing technology-related companies will enable us to leverage our expertise in structuring prospective investments, to assess the value of both tangible and intangible assets, to evaluate the business prospects and operating characteristics of technology-related companies and to identify and originate potentially attractive investments with these types of companies.

Mitigate Risk of Principal Loss and Build a Portfolio of Equity-Related Securities. We expect that our investments have the potential to produce attractive risk-adjusted returns through current income, in the form of interest and fee income, as well as capital appreciation from equity-related securities. We believe that we can mitigate the risk of loss on our debt investments through the combination of loan principal amortization, cash interest payments, relatively short maturities, security interests in the assets of our portfolio companies, and on select investment covenants requiring prospective portfolio companies to have certain amounts of available cash at the time of our investment and the continued support from a venture capital or private equity firm at the time we make our investment.

Historically our structured debt investments to technology-related companies typically include warrants or other equity interests, giving us the potential to realize equity-like returns on a portion of our investment. In addition, in some cases, we receive the right to make additional equity investments in our portfolio companies, including the right to convert some portion of our debt into equity, in connection with future equity financing rounds. We believe these equity interests will create the potential for meaningful long-term capital gains in connection with the future liquidity events of these technology-related companies.

Provide Customized Financing Complementary to Financial Sponsors’ Capital. We offer a broad range of investment structures and possess expertise and experience to effectively structure and price investments in technology-related companies. Unlike many of our competitors that only invest in companies that fit a specific set of investment parameters, we have the flexibility to structure our investments to suit the particular needs of our portfolio companies. We offer customized financing solutions ranging from senior debt to equity capital, with a focus on structured debt with warrants.

We use our relationships in the financial sponsor community to originate investment opportunities. Because venture capital and private equity funds typically invest solely in the equity securities of their portfolio

4

companies, we believe that our debt investments will be viewed as an attractive and complimentary source of capital, both by the portfolio company and by the portfolio company’s financial sponsor. In addition, we believe that many venture capital and private equity fund sponsors encourage their portfolio companies to use debt financing for a portion of their capital needs as a means of potentially enhancing equity returns, minimizing equity dilution and increasing valuations prior to a subsequent equity financing round or a liquidity event.

Invest at Various Stages of Development. We provide growth capital to technology-related companies at all stages of development, including select publicly listed companies and select lower middle market companies and established-stage companies. We believe that this provides us with a broader range of potential investment opportunities than those available to many of our competitors, who generally focus their investments on a particular stage in a company’s development. Because of the flexible structure of our investments and the extensive experience of our investment professionals, we believe we are well positioned to take advantage of these investment opportunities at all stages of prospective portfolio companies’ development.

Benefit from Our Efficient Organizational Structure. We believe that the perpetual nature of our corporate structure enables us to be a long-term partner for our portfolio companies in contrast to traditional mezzanine and investment funds, which typically have a limited life. In addition, because of our access to the equity markets, we believe that we may benefit from a lower cost of capital than that available to private investment funds. We are not subject to requirements to return invested capital to investors nor do we have a finite investment horizon. Capital providers that are subject to such limitations are often required to seek a liquidity event more quickly than they otherwise might, which can result in a lower overall return on an investment.

Deal Sourcing Through Our Proprietary Database. We have developed a proprietary and comprehensive structured query language-based (SQL) database system to track various aspects of our investment process including sourcing, originations, transaction monitoring and post-investment performance. As of December 31, 2012, our proprietary SQL-based database system included over 30,900 technology-related companies and approximately 8,100 venture capital, private equity sponsors/investors, as well as various other industry contacts. This proprietary SQL system allows us to maintain, cultivate and grow our industry relationships while providing us with comprehensive details on companies in the technology-related industries and their financial sponsors.

OUR INVESTMENTS AND OPERATIONS

We principally invest in debt securities and, to a lesser extent, equity securities, with a particular emphasis on structured debt with warrants.

We generally seek to invest in companies that have been operating for at least six to 12 months prior to the date of our investment. We anticipate that such entities may, at the time of investment, be generating revenues or will have a business plan that anticipates generation of revenues within 24 to 48 months. Further, we anticipate that on the date of our investment we will generally obtain a lien on available assets, which may or may not include intellectual property, and these companies will have sufficient cash on their balance sheet to operate as well as potentially amortize their debt for at least three to nine months following our investment. We generally require that a prospective portfolio company, in addition to having sufficient capital to support leverage, demonstrate an operating plan capable of generating cash flows or raising the additional capital necessary to cover its operating expenses and service its debt, for an additional six to 12 months subject to market conditions.

We expect that our investments will generally range from $1.0 million to $40.0 million. We typically structure our debt securities to provide for amortization of principal over the life of the loan, but may include an interest-only period of three to 12 months for emerging growth and expansion-stage companies and longer for established-stage companies. Our loans will be collateralized by a security interest in the borrower’s assets, although we may not have the first claim on these assets and the assets may not include intellectual property. Our debt investments carry fixed or variable contractual interest rates which generally ranged from Prime to

5

approximately 14.0% as of December 31, 2012. As of December 31, 2012, 98.5% of our loans were at floating rates or floating rates with a floor and 1.5% of the loans were at fixed rates. In addition to the cash yields received on our loans, in some instances, certain loans may also include any of the following: end of term payments, exit fees, balloon payment fees, commitment fees, success fees, payment-in-kind (“PIK”) provisions or prepayment fees, which we may be required to include in income prior to receipt. We also generate revenue in the form of commitment, facility fees and amendment fees.

In addition, the majority of our investments in the structured debt of venture capital-backed companies generally have equity enhancement features, typically in the form of warrants or other equity-related securities designed to provide us with an opportunity for potential capital appreciation. The warrants typically will be immediately exercisable upon issuance and generally will remain exercisable for the lesser of five to seven years or one to three years after completion of an initial public offering. The exercise prices for the warrants varies from nominal exercise prices to exercise prices that are at or above the current fair market value of the equity for which we receive warrants. We may structure warrants to provide minority rights provisions or on a very select basis put rights upon the occurrence of certain events. We generally target a total annualized return (including interest, fees and value of warrants) of 12% to 25% for our debt investments.

Typically, our structured debt and equity investments take one of the following forms:

| • | Structured Debt with Warrants. We seek to invest a majority of our assets in structured debt with warrants of prospective portfolio companies. Traditional “mezzanine” debt is a layer of high-coupon financing between debt and equity that most commonly takes the form of subordinated debt coupled with warrants, combining the cash flow and risk characteristics of both senior debt and equity. However, our investments in structured debt with warrants may be the only debt capital on the balance sheet of our portfolio companies, and in many cases we have a first priority security interest in all of our portfolio company’s assets, or in certain investments we may have a negative pledge on intellectual property. Our structured debt with warrants typically have maturities of between two and seven years, with full amortization after an interest only period for emerging-growth or expansion-stage companies and longer deferred amortization for select established-stage companies. Our structured debt with warrants generally carry a contractual interest rate between Prime and approximately 14.0% and may include an additional end-of-term payment or PIK. In most cases we collateralize our investments by obtaining security interests in our portfolio companies’ assets, which may include their intellectual property. In other cases we may prohibit a company from pledging or otherwise encumbering their intellectual property. We may structure our structured debt with warrants with restrictive affirmative and negative covenants, default penalties, prepayment penalties, lien protection, equity calls, change-in-control provisions or board observation rights. |

| • | Senior Debt. We seek to invest a limited portion of our assets in senior debt. Senior debt may be collateralized by accounts receivable and/or inventory financing of prospective portfolio companies. Senior debt has a senior position with respect to a borrower’s scheduled interest and principal payments and holds a first priority security interest in the assets pledged as collateral. Senior debt also may impose covenants on a borrower with regard to cash flows and changes in capital structure, among other items. We generally collateralize our investments by obtaining security interests in our portfolio companies’ assets, which may include their intellectual property. In other cases we may obtain a negative pledge covering a company’s intellectual property. Our senior loans, in certain instances, may be tied to the financing of specific assets. In connection with a senior debt investment, we may also provide the borrower with a working capital line-of-credit that will carry an interest rate ranging from Prime or LIBOR plus a spread with a floor, generally maturing in one to three years, and will be secured by accounts receivable and/or inventory. |

| • | Equipment Loans. We intend to invest a limited portion of our assets in equipment-based loans to early-stage prospective portfolio companies. Equipment-based loans are secured by a first priority security interest in only the specific assets financed. These loans are generally for amounts up to |

6

| $3.0 million but may be up to $15.0 million for certain clean technology venture investments, carry a contractual interest rate between Prime and Prime plus 9.0%, and have an average term between three and four years. Equipment loans may also include end of term payments. |

| • | Equity-Related Securities. The equity-related securities we hold consist primarily of warrants or other equity interests generally obtained in connection with our structured debt investments. In addition to the warrants received as a part of a structured debt financing, we typically receive the right to make equity investments in a portfolio company in connection with that company’s next round of equity financing. We may also on certain debt investments have the right to convert a portion of the debt investment into equity. These rights will provide us with the opportunity to further enhance our returns over time through opportunistic equity investments in our portfolio companies. These equity-related investments are typically in the form of preferred or common equity and may be structured with a dividend yield, providing us with a current return, and with customary anti-dilution protection and preemptive rights. In the future, we may achieve liquidity through a merger or acquisition of a portfolio company, a public offering of a portfolio company’s stock or by exercising our right, if any, to require a portfolio company to buy back the equity-related securities we hold. We may also make stand alone direct equity investments into portfolio companies in which we may not have any debt investment in the company. As of December 31, 2012, we held equity interests in 128 portfolio companies. |

A comparison of the typical features of our various investment alternatives is set forth in the chart below.

| Structured debt with warrants |

Senior Debt | Equipment Loans | Equity related Securities | |||||

| Typical Structure |

Term debt with warrants

|

Term or revolving debt | Term debt with warrants | Preferred stock or common stock | ||||

| Investment Horizon |

Long term, ranging from 2 to 7 years, with an average of 3 years

|

Usually under 3 years | Ranging from 3 to 4 years | Ranging from 3 to 7 years | ||||

|

Ranking/Security |

Senior secured, either first out or last out, or second lien

|

Senior/First lien | Secured only by underlying equipment | None/unsecured | ||||

| Covenants |

Less restrictive; Mostly financial

|

Generally borrowing base and financial

|

None | None | ||||

| Risk Tolerance |

Medium/High

|

Low | High | High | ||||

| Coupon/Dividend |

Cash pay—fixed and floating rate; Payment-in-kind in limited cases

|

Cash pay—floating or fixed rate | Cash pay-floating or fixed rate and may include Payment-in-kind | Generally none | ||||

|

Customization or Flexibility

|

More flexible | Little to none | Little to none | Flexible | ||||

| Equity Dilution

|

Low to medium | None to low | Low | High |

7

Investment Criteria

We have identified several criteria, among others, that we believe are important in achieving our investment objective with respect to prospective portfolio companies. These criteria, while not inclusive, provide general guidelines for our investment decisions.

Portfolio Composition. While we generally focus our investments in venture capital-backed companies in technology-related markets, we seek to diversify across various financial sponsors as well as across various stages of companies’ development and various technology industry sub-sectors and geographies. As of December 31, 2012, approximately 65.8% of the fair value of our portfolio was composed of investments in five industries: 20.8% was composed of investments in the drug discovery and development industry, 15.0% was composed of investments in the internet consumer and business services industry, 14.0% was composed of investments in the clean technology industry, 8.2% was composed of investments in the drug delivery industry and 7.8% was composed of investments in the software industry.

Continuing Support from One or More Financial Sponsors. We generally invest in companies in which one or more established financial sponsors have previously invested and continue to make a contribution to the management of the business. We believe that having established financial sponsors with meaningful commitments to the business is a key characteristic of a prospective portfolio company. In addition, we look for representatives of one or more financial sponsors to maintain seats on the Board of Directors of a prospective portfolio company as an indication of such commitment.

Company Stage of Development. While we invest in companies at various stages of development, we generally require that prospective portfolio companies be beyond the seed stage of development and generally have received or anticipate having commitments for their first institutional round of equity financing for early stage companies. We expect a prospective portfolio company to demonstrate progress in its product development or demonstrate a path towards revenue generation or increase its revenues and operating cash flow over time. The anticipated growth rate of a prospective portfolio company is a key factor in determining the value that we ascribe to any warrants or other equity securities that we may acquire in connection with an investment in debt securities.

Operating Plan. We generally require that a prospective portfolio company, in addition to having potential access to capital to support leverage, demonstrate an operating plan capable of generating cash flows or the ability to potentially raise the additional capital necessary to cover its operating expenses and service its debt for a specific period. Specifically, we require that a prospective portfolio company demonstrate at the time of our proposed investment that it has cash on its balance sheet, or is in the process of completing a financing so that it will have cash on its balance sheet, sufficient to support its operations for a minimum of six to 12 months.

Security Interest. In many instances we seek a first priority security interest in all of the portfolio companies’ tangible and intangible assets as collateral for our debt investment, subject in some cases to permitted exceptions. In other cases we may obtain a negative pledge prohibiting a company from pledging or otherwise encumbering their intellectual property. Although we do not intend to operate as an asset-based lender, the estimated liquidation value of the assets, if any, collateralizing the debt securities that we hold is an important factor in our credit analysis and subject to assumptions that may change over the life of the investment especially when attempting to estimate the value of intellectual property. We generally evaluate both tangible assets, such as accounts receivable, inventory and equipment, and intangible assets, such as intellectual property, customer lists, networks and databases.

Covenants. Our investments may include one or more of the following covenants: cross-default, or material adverse change provisions, require the portfolio company to provide periodic financial reports and operating metrics and will typically limit the portfolio company’s ability to incur additional debt, sell assets, dividend recapture, engage in transactions with affiliates and consummate an extraordinary transaction, such as a merger or recapitalization without our consent. In addition, we may require other performance or financial based covenants, as we deem appropriate.

8

Exit Strategy. Prior to making a debt investment that is accompanied by an equity-related security in a prospective portfolio company, we analyze the potential for that company to increase the liquidity of its equity through a future event that would enable us to realize appreciation in the value of our equity interest. Liquidity events may include an initial public offering, a private sale of our equity interest to a third party, a merger or an acquisition of the company or a purchase of our equity position by the company or one of its stockholders.

Investment Process

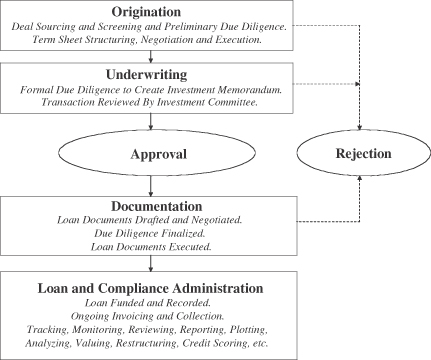

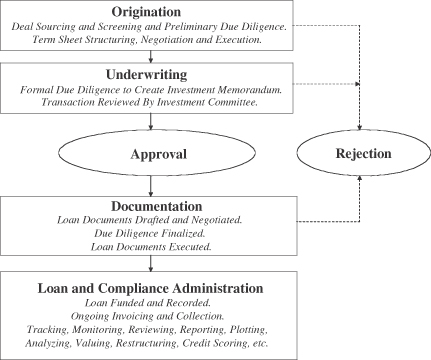

We have organized our management team around the four key elements of our investment process:

| • | Origination; |

| • | Underwriting; |

| • | Documentation; and |

| • | Loan and Compliance Administration. |

Our investment process is summarized in the following chart:

Origination

The origination process for our investments includes sourcing, screening, preliminary due diligence and deal structuring and negotiation, all leading to an executed non-binding term sheet. As of December 31, 2012, our investment origination team, which consists of approximately 31 investment professionals, is headed by our Senior Managing Directors of Technology, Clean Technology, and Life Science, and our Chief Executive Officer. The origination team is responsible for sourcing potential investment opportunities and members of the investment origination team use their extensive relationships with various leading financial sponsors, management contacts within technology-related companies, trade sources, technology conferences and various publications to source prospective portfolio companies. Our investment origination team is divided into middle market, technology, clean technology, and life science sub-teams to better source potential portfolio companies.

9

In addition, we have developed a proprietary and comprehensive SQL-based database system to track various aspects of our investment process including sourcing, originations, transaction monitoring and post-investment performance. As of December 31, 2012, our proprietary SQL-based database system included over 30,900 technology-related companies and approximately 8,100 venture capital private equity sponsors/investors, as well as various other industry contacts. This proprietary SQL system allows our origination team to maintain, cultivate and grow our industry relationships while providing our origination team with comprehensive details on companies in the technology-related industries and their financial sponsors.

If a prospective portfolio company generally meets certain underwriting criteria, we perform preliminary due diligence, which may include high level company and technology assessments, evaluation of its financial sponsors’ support, market analysis, competitive analysis, identify key management, risk analysis and transaction size, pricing, return analysis and structure analysis. If the preliminary due diligence is satisfactory, and the origination team recommends moving forward, we then structure, negotiate and execute a non-binding term sheet with the potential portfolio company. Upon execution of a term sheet, the investment opportunity moves to the underwriting process to complete formal due diligence review and approval.

Underwriting

The underwriting review includes formal due diligence and approval of the proposed investment in the portfolio company.

Due Diligence. Our due diligence on a prospective investment is typically completed by two or more investment professionals whom we define as the underwriting team. The underwriting team for a proposed investment consists of the deal sponsor who typically possesses general industry knowledge and is responsible for originating and managing the transaction, other investment professional(s) who perform due diligence, credit and corporate financial analyses and, as needed, our legal professionals. To ensure consistent underwriting, we generally use our standardized due diligence methodologies, which include due diligence on financial performance and credit risk as well as an analysis of the operations and the legal and applicable regulatory framework of a prospective portfolio company. The members of the underwriting team work together to conduct due diligence and understand the relationships among the prospective portfolio company’s business plan, operations and financial performance.

As part of our evaluation of a proposed investment, the underwriting team prepares an investment memorandum for presentation to the investment committee. In preparing the investment memorandum, the underwriting team typically interviews select key management of the company and select financial sponsors and assembles information necessary to the investment decision. If and when appropriate, the investment professionals may also contact industry experts and customers, vendors or, in some cases, competitors of the company.

Approval Process. The sponsoring managing director or principal presents the investment memorandum to our investment committee for consideration. The approval of a majority of our investment committee and an affirmative vote by our Chief Executive Officer is required before we proceed with any investment. The members of our investment committee are our Chief Executive Officer, our Chief Financial Officer, our Chief Credit Officer and the Senior Managing Directors of Technology, Clean Technology and Life Science. The investment committee generally meets weekly and more frequently on an as-needed basis. The Senior Managing Directors abstain from voting with respect to investments they originate.

Documentation

Our documentation group, currently headed by our Associate General Counsel, administers the front-end documentation process for our investments. This group is responsible for documenting the term sheet approved by the investment committee to memorialize the transaction with a prospective portfolio company. This group negotiates loan documentation and, subject to the approval of the Associate General Counsel, final documents are

10

prepared for execution by all parties. The documentation group generally uses the services of external law firms to complete the necessary documentation.

Loan and Compliance Administration

Our loan and compliance administration group, headed by our Chief Financial Officer and Chief Credit Officer, administers loans and tracks covenant compliance, if applicable, of our investments and oversees periodic reviews of our critical functions to ensure adherence with our internal policies and procedures. After funding of a loan in accordance with the investment committee’s approval, the loan is recorded in our loan administration software and our SQL-based database system. The loan and compliance administration group is also responsible for ensuring timely interest and principal payments and collateral management as well as advising the investment committee on the financial performance and trends of each portfolio company, including any covenant violations that occur, to aid us in assessing the appropriate course of action for each portfolio company and evaluating overall portfolio quality. In addition, the loan and compliance administration group advises the investment committee and the Valuation Committee of our Board of Directors, accordingly, regarding the credit and investment grading for each portfolio company as well as changes in the value of collateral that may occur.

The loan and compliance administration group monitors our portfolio companies in order to determine whether the companies are meeting our financing criteria and their respective business plans and also monitors the financial trends of each portfolio company from its monthly or quarterly financial statements to assess the appropriate course of action for each company and to evaluate overall portfolio quality. In addition, our management team closely monitors the status and performance of each individual company through our SQL-based database system and periodic contact with our portfolio companies’ management teams and their respective financial sponsors.

Credit and Investment Grading System. Our loan and compliance administration group uses an investment grading system to characterize and monitor our outstanding loans. Our loan and compliance administration group monitors and, when appropriate, recommends changes to investment grading. Our investment committee reviews the recommendations and/or changes to the investment grading, which are submitted on a quarterly basis to the Valuation Committee and our Board of Directors for approval.

From time to time, we will identify investments that require closer monitoring or become workout assets. We develop a workout strategy for workout assets and our investment committee monitors the progress against the strategy. We may incur losses from our investing activities, however, we work with our troubled portfolio companies in order to recover as much of our investments as is practicable, including possibly taking control of the portfolio company. There can be no assurance that principal will be recovered.

We use the following investment grading system approved by our Board of Directors:

| Grade 1. | Loans involve the least amount of risk in our portfolio. The borrower is performing above expectations, and the trends and risk profile is generally favorable. |

| Grade 2. | The borrower is performing as expected and the risk profile is neutral to favorable. All new loans are initially graded 2. |

| Grade 3. | The borrower may be performing below expectations, and the loan’s risk has increased materially since origination. We increase procedures to monitor a borrower that may have limited amounts of cash remaining on the balance sheet, is approaching its next equity capital raise within the next three to six months, or if the estimated fair value of the enterprise may be lower than when the loan was originated. We will generally lower the loan grade to a level 3 even if the company is performing in accordance to plan as it approaches the need to raise additional cash to fund its operations. Once the borrower closes its new equity capital raise, we may increase the loan grade back to grade 2 or maintain it at a grade 3 as the company continues to pursue its business plan. |

11

| Grade 4. | The borrower is performing materially below expectations, and the loan risk has substantially increased since origination. Loans graded 4 may experience some partial loss or full return of principal but are expected to realize some loss of interest which is not anticipated to be repaid in full, which, to the extent not already reflected, may require the fair value of the loan to be reduced to the amount we anticipate will be recovered. Grade 4 investments are closely monitored. |

| Grade 5. | The borrower is in workout, materially performing below expectations and a significant risk of principal loss is probable. Loans graded 5 will experience some partial principal loss or full loss of remaining principal outstanding is expected. Grade 5 loans will require the fair value of the loans be reduced to the amount, if any, we anticipate will be recovered. |

At December 31, 2012, our investments had a weighted average investment grading of 2.06.

Managerial Assistance

As a business development company, we are required to offer, and provide upon request, managerial assistance to our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. We may receive fees for these services.

COMPETITION

Our primary competitors provide financing to prospective portfolio companies and include non-bank financial institutions, federally or state chartered banks, venture debt funds, financial institutions, venture capital funds, private equity funds, investment funds and investment banks. Many of these entities have greater financial and managerial resources than we have, and the 1940 Act imposes certain regulatory restrictions on us as a business development company to which many of our competitors are not subject. However, we believe that few of our competitors possess the expertise to properly structure and price debt investments to venture capital-backed companies in technology-related markets. We believe that our specialization in financing technology-related companies will enable us to determine a range of potential values of intellectual property assets, evaluate the business prospects and operating characteristics of prospective portfolio companies and, as a result, identify investment opportunities that produce attractive risk-adjusted returns. For additional information concerning the competitive risks we face, see “Item 1A. Risk Factors—Risks Related to our Business and Structure—We operate in a highly competitive market for investment opportunities, and we may not be able to compete effectively.”

BROKERAGE ALLOCATIONS AND OTHER PRACTICES

Because we generally acquire and dispose of our investments in privately negotiated transactions, we rarely use brokers in the normal course of business. In those cases where we do use a broker, we do not execute transactions through any particular broker or dealer, but will seek to obtain the best net results for Hercules, taking into account such factors as price (including the applicable brokerage commission or dealer spread), size of order, difficulty of execution, and operational facilities of the firm and the firm’s risk and skill in positioning blocks of securities. While we generally seek reasonably competitive execution costs, we may not necessarily pay the lowest spread or commission available. Subject to applicable legal requirements, we may select a broker based partly upon brokerage or research services provided to us. In return for such services, we may pay a higher commission than other brokers would charge if we determine in good faith that such commission is reasonable in relation to the services provided.

12

EMPLOYEES

As of December 31, 2012, we had 56 employees, including approximately 31 investment and portfolio management professionals, all of whom have extensive experience working on financing transactions for technology-related companies.

REGULATION

The following discussion is a general summary of the material prohibitions and descriptions governing business development companies. It does not purport to be a complete description of all of the laws and regulations affecting business development companies.

A business development company primarily focuses on investing in or lending to private companies and making managerial assistance available to them. A business development company provides stockholders with the ability to retain the liquidity of a publicly-traded stock, while sharing in the possible benefits of investing in emerging-growth, expansion-stage or established-stage companies. The 1940 Act contains prohibitions and restrictions relating to transactions between business development companies and their directors and officers and principal underwriters and certain other related persons and requires that a majority of the directors be persons other than “interested persons,” as that term is defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a business development company unless approved by a majority of our outstanding voting securities. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (i) 67% or more of such company’s shares present at a meeting if more than 50% of the outstanding shares of such company are present or represented by proxy, or (ii) more than 50% of the outstanding shares of such company.

Qualifying Assets

Under the 1940 Act, a business development company may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company’s total assets. The principal categories of qualifying assets relevant to our proposed business are the following:

| (1) | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer which: |

| (a) | is organized under the laws of, and has its principal place of business in, the United States; |

| (b) | is not an investment company (other than a small business investment company wholly owned by the business development company) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| (c) | does not have any class of securities listed on a national securities exchange; or if it has securities listed on a national securities exchange such company has a market capitalization of less than $250 million; is controlled by the business development company and has an affiliate of a business development company on its board of directors; or meets such other criteria as may be established by the SEC. |

| (2) | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

13

| (3) | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company. |

| (4) | Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities. |

| (5) | Cash, cash equivalents, U.S. Government securities or high-quality debt securities maturing in one year or less from the time of investment. |

Control, as defined by the 1940 Act, is presumed to exist where a business development company beneficially owns more than 25% of the outstanding voting securities of the portfolio company.

We do not intend to acquire securities issued by any investment company that exceed the limits imposed by the 1940 Act. Under these limits, we generally cannot acquire more than 3% of the voting stock of any investment company (as defined in the 1940 Act), invest more than 5% of the value of our total assets in the securities of one such investment company or invest more than 10% of the value of our total assets in the securities of such investment companies in the aggregate. With regard to that portion of our portfolio invested in securities issued by investment companies, it should be noted that such investments might subject our stockholders to additional expenses.

Significant Managerial Assistance

In order to count portfolio securities as qualifying assets for the purpose of the 70% test discussed above, a business development company must either control the issuer of the securities or must offer to make available significant managerial assistance; except that, where the business development company purchases such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available significant managerial assistance means, among other things, any arrangement whereby the business development company, through its directors, officers or employees, offers to provide and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company through monitoring of portfolio company operations, selective participation in board and management meetings, consulting with and advising a portfolio company’s officers or other organizational or financial guidance.

Temporary Investments

Pending investment in other types of qualifying assets, as described above, our investments may consist of cash, cash equivalents, U.S. government securities or high quality debt securities maturing in one year or less from the time of investment, which we refer to, collectively, as temporary investments, so that 70% of our assets are qualifying assets. Typically, we invest in U.S. treasury bills or in repurchase agreements, provided that such agreements are fully collateralized by cash or securities issued by the U.S. government or its agencies. A repurchase agreement involves the purchase by an investor, such as us, of a specified security and the simultaneous agreement by the seller to repurchase it at an agreed upon future date and at a price which is greater than the purchase price by an amount that reflects an agreed-upon interest rate. There is no percentage restriction on the proportion of our assets that may be invested in such repurchase agreements. However, if more than 25% of our total assets constitute repurchase agreements from a single counterparty, we would not meet the diversification tests imposed on us by the Code in order to qualify as a RIC for federal income tax purposes. Thus, we do not intend to enter into repurchase agreements with a single counterparty in excess of this limit. We will monitor the creditworthiness of the counterparties with which we enter into repurchase agreement transactions.

14

Warrants and Options

Under the 1940 Act, a business development company is subject to restrictions on the amount of warrants, options, restricted stock or rights to purchase shares of capital stock that it may have outstanding at any time. In particular, the amount of capital stock that would result from the conversion or exercise of all outstanding warrants, options or rights to purchase capital stock cannot exceed 25% of the business development company’s total outstanding shares of capital stock. This amount is reduced to 20% of the business development company’s total outstanding shares of capital stock if the amount of warrants, options or rights issued pursuant to an executive compensation plan would exceed 15% of the business development company’s total outstanding shares of capital stock. We have received exemptive relief from the SEC permitting us to issue stock options and restricted stock to our employees and directors subject to the above conditions, among others. For a discussion regarding the conditions of this exemptive relief, see “—Exemptive Relief” below and Note 7 to our consolidated financial statements.

Senior Securities; Coverage Ratio

We will be permitted, under specified conditions, to issue multiple classes of indebtedness and one class of stock senior to our common stock if our asset coverage, as defined in the 1940 Act, is at least equal to 200% immediately after each such issuance. In addition, we may not be permitted to declare any cash dividend or other distribution on our outstanding common shares, or purchase any such shares, unless, at the time of such declaration or purchase, we have asset coverage of at least 200% after deducting the amount of such dividend, distribution, or purchase price. We may also borrow amounts up to 5% of the value of our total assets for temporary or emergency purposes. For a discussion of the risks associated with the resulting leverage, see “Item 1A. Risk Factors—Risks Related to Our Business & Structure—Because we borrow money, there could be increased risk in investing in our company.”

Capital Structure

We are not generally able to issue and sell our common stock at a price below net asset value per share. We may, however, sell our common stock, at a price below the current net asset value of the common stock, or sell warrants, options or rights to acquire such common stock, at a price below the current net asset value of the common stock if our board of directors determines that such sale is in the best interests of the Company and our stockholders have approved the practice of making such sales.

At our Annual Meeting of Stockholders on May 30, 2012, our stockholders approved a proposal authorizing us to sell up to 20% of our common stock at a price below the Company’s net asset value per share, subject to Board approval of the offering. If we were to issue shares at a price below net asset value, such sales would result in an immediate dilution to existing common stockholders, which would include a reduction in the net asset value per share as a result of the issuance. This dilution would also include a proportionately greater decrease in a stockholder’s interest in our earnings and assets and voting interest in us than the increase in our assets resulting from such issuance. In addition, if we determined to conduct additional offerings in the future there may be even greater discounts if we determine to conduct such offerings at prices below net asset value.

As a result, investors will experience further dilution and additional discounts to the price of our common stock. In any such case, the price at which our securities are to be issued and sold may not be less than a price which, in the determination of our board of directors, closely approximates the market value of such securities (less any distributing commission or discount).

Code of Ethics

We have adopted and will maintain a code of ethics that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to the code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such

15

investments are made in accordance with the code’s requirements. Our code of ethics will generally not permit investments by our employees in securities that may be purchased or held by us. We may be prohibited under the 1940 Act from conducting certain transactions with our affiliates without the prior approval of our directors who are not interested persons and, in some cases, the prior approval of the SEC.

Our code of ethics is posted on our website at www.htgc.com and was filed with the SEC as an exhibit to the registration statement (Registration No. 333-126604) for our initial public offering. You may read and copy the code of ethics at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. In addition, the code of ethics is available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may also obtain copies of the code of ethics, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549.

Privacy Principles

We are committed to maintaining the privacy of our stockholders and safeguarding their non-public personal information. The following information is provided to help you understand what personal information we collect, how we protect that information and why, in certain cases, we may share information with select other parties.

Generally, we do not receive any non-public personal information relating to our stockholders, although certain non-public personal information of our stockholders may become available to us. We do not disclose any non-public personal information about our stockholders or former stockholders, except as permitted by law or as is necessary in order to service stockholder accounts (for example, to a transfer agent).

We restrict access to non-public personal information about our stockholders to our employees with a legitimate business need for the information. We maintain physical, electronic and procedural safeguards designed to protect the non-public personal information of our stockholders.

Proxy Voting Policies and Procedures

We vote proxies relating to our portfolio securities in the best interest of our stockholders. We review on a case-by-case basis each proposal submitted to a stockholder vote to determine its impact on the portfolio securities held by us. Although we generally vote against proposals that may have a negative impact on our portfolio securities, we may vote for such a proposal if there exists compelling long-term reasons to do so.

Our proxy voting decisions are made by our investment committee, which is responsible for monitoring each of our investments. To ensure that our vote is not the product of a conflict of interest, we require that: (i) anyone involved in the decision making process disclose to our Chief Compliance Officer any potential conflict that he or she is aware of and any contact that he or she has had with any interested party regarding a proxy vote; and (ii) employees involved in the decision making process or vote administration are prohibited from revealing how we intend to vote on a proposal in order to reduce any attempted influence from interested parties.

Exemptive Relief

On June 21, 2005, we filed a request with the SEC for exemptive relief to allow us to take certain actions that would otherwise be prohibited by the 1940 Act, as applicable to business development companies. Specifically, we requested that the SEC permit us to issue stock options to our non-employee directors as contemplated by Section 61(a)(3)(B)(i)(II) of the 1940 Act. On February 15, 2007, we received approval from the SEC on this exemptive request. In addition, in June 2007, we filed an amendment to the February 2007 order to adjust the number of shares issued to the non-employee directors. On October 10, 2007, we received approval from the SEC on this amended exemptive request.

16

On April 5, 2007, we received an exemptive relief from the SEC that permits us to exclude the indebtedness of our wholly-owned subsidiaries that are small business investment companies from the 200% asset coverage requirement applicable to us.

On May 2, 2007, we received approval from the SEC on our exemptive request permitting us to issue restricted stock to our employees, officers and directors. On June 21, 2007, our shareholders approved amendments to the 2004 Equity Incentive Plan and 2006 Non-Employee Incentive Plan permitting such restricted grants.

On June 22, 2010 we received approval from the SEC regarding our request for exemptive relief that would permit our employees to exercise their stock options and restricted stock and pay any related income taxes using a cashless exercise program.

Other

We will be periodically examined by the SEC for compliance with the Securities Exchange Act of 1934 and the 1940 Act.

We are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a business development company, we are prohibited from protecting any director or officer against any liability to our stockholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

We are required to adopt and implement written policies and procedures reasonably designed to prevent violation of the federal securities laws, review these policies and procedures annually for their adequacy and the effectiveness of their implementation. We have designated Mr. Martitsch, our Associate General Counsel, as our Chief Compliance Officer who is responsible for administering these policies and procedures.

Recently, legislation was introduced in the U.S. House of Representatives which may revise certain regulations applicable to business development companies. The legislation provides for (i) increasing the amount of funds business development companies may borrow by reducing asset to debt limitations from 2:1 to 3:2, (ii) permitting business development companies to file registration statements with the U.S. Securities and Exchange Commission that incorporate information from already-filed reports by reference, (iii) utilizing other streamlined registration processes afforded to operating companies, and (iv) allowing business development companies to own investment adviser subsidiaries. There are no assurances as to when the legislation will be enacted by Congress, if at all, or, if enacted, what final form the legislation would take.

Small Business Administration Regulations

On September 27, 2006, HT II received a license to operate as a SBIC under the SBIC program and is able to borrow funds from the SBA against eligible investments and additional contributions to regulatory capital. Under the Small Business Investment Company Act and current SBA policy applicable to SBICs, a SBIC can have outstanding at any time SBA guaranteed debentures up to twice the amount of its regulatory capital. With our net investment of $38.0 million in HT II as of December 31, 2012, HT II has the capacity to issue a total of $76.0 million of SBA guaranteed debentures, subject to SBA approval, of which $76.0 million was outstanding as of December 31, 2012. As of December 31, 2012, HT II has paid the SBA commitment fees of approximately $1.5 million. As of December 31, 2012, we held investments in HT II in 51 companies with a fair value of approximately $132.6 million, accounting for approximately 14.6% of our total portfolio.

On May 26, 2010, HT III received a license to operate as a SBIC under the SBIC program and is able to borrow funds from the SBA against eligible investments and additional contributions to regulatory capital. With our net investment of $74.5 million in HT III as of December 31, 2012, HT III has the capacity to issue a total of $149.0 million of SBA guaranteed debentures, subject to SBA approval, of which $149.0 million was outstanding as of December 31, 2012. As of December 31, 2012, HT III has paid commitment fees of approximately $1.5 million. As of December 31, 2012, we held investments in HT III in 35 companies with a fair value of approximately $223.6 million, accounting for approximately 24.7% of our total portfolio.

17

We have issued $225.0 million in SBA-guaranteed debentures in HT II and HT III, which is the maximum amount allowed for a group of SBICs under common control.

SBICs are designed to stimulate the flow of private equity capital to eligible small businesses. Under present SBA regulations, eligible small businesses include businesses that have a tangible net worth not exceeding $18.0 million and have average annual fully taxed net income not exceeding $6.0 million for the two most recent fiscal years. In addition, SBICs must devote 25.0% of their investment activity to “smaller” concerns as defined by the SBA. A smaller concern is one that has a tangible net worth not exceeding $6.0 million and has average annual fully taxed net income not exceeding $2.0 million for the two most recent fiscal years. SBA regulations also provide alternative size standard criteria to determine eligibility, which depend on the industry in which the business is engaged and are based on such factors as the number of employees and gross sales. According to SBA regulations, SBICs may make long-term loans to small businesses, invest in the equity securities of such businesses and provide them with consulting and advisory services. Through its wholly-owned subsidiaries HT II and HT III, we plan to provide long-term loans to qualifying small businesses, and in connection therewith, make equity investments.

HT II and HT III are periodically examined and audited by the SBA’s staff to determine their compliance with SBA regulations. If HT II or HT III fails to comply with applicable SBA regulations, the SBA could, depending on the severity of the violation, limit or prohibit HT II’s or HT III’s use of debentures, declare outstanding debentures immediately due and payable, and/or limit HT II or HT III from making new investments. In addition, HT II or HT III may also be limited in their ability to make distributions to us if they do not have sufficient capital in accordance with SBA regulations. Such actions by the SBA would, in turn, negatively affect us because HT II and III are our wholly owned subsidiaries. HT II and HT III were in compliance with the terms of the SBIC’s leverage as of December 31, 2012 as a result of having sufficient capital as defined under the SBA regulations.

The rates of borrowings under various draws from the SBA beginning in April 2007 are set semiannually in March and September and range from 2.25% to 5.73%. Interest payments on SBA debentures are payable semi-annually. There are no principal payments required on these issues prior to maturity and no prepayment penalties. Debentures under the SBA generally mature ten years after being borrowed. Based on the initial draw down date of April 2007, the initial maturity of SBA debentures will occur in April 2017. In addition, the SBA charges a fee that is set annually, depending on the Federal fiscal year the leverage commitment was delegated by the SBA, regardless of the date that the leverage was drawn by the SBIC. The annual fees related to HT II debentures that pooled on September 22, 2010 were 0.406% and 0.285%, depending upon the year in which the underlying commitment was closed. The annual fees related to HT III debentures that pooled on September 19, 2012 were 0.804%. The annual fees on other debentures have been set at 0.906%. The average amount of debentures outstanding for the year ended December 31, 2012 for HT II was approximately $95.2 million with an average interest rate of approximately 5.68%. The average amount of debentures outstanding for the year ended December 31, 2012 for HT III was approximately $112.0 million with an average interest rate of approximately 3.25%.

HT II and HT III hold approximately $154.4 million and $250.8 million in assets, respectively, and accounted for approximately 10.5% and 17.0% of our total assets prior to consolidation at December 31, 2012.