Filed Pursuant to Rule 497

Registration No. 333-187447

Exhibit s-6

PROSPECTUS SUPPLEMENT

(To prospectus dated , 2014)

Up to [—] Shares

Common Stock

We have entered into an equity distribution agreement, dated [—], 2014, with [—], relating to the shares of common stock offered by this prospectus supplement and the accompanying prospectus. Our common stock is listed on the New York Stock Exchange, or NYSE, under the trading symbol “HTGC.” The last sale price, as reported on NYSE on [—], 2014, was $[—] per share. The net asset value per share of our common stock at [—], 2014 (the last date prior to the date of this prospectus supplement on which we determined net asset value) was $[—].

We are an internally-managed, non-diversified closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Our investment objective is to maximize our portfolio total return by generating current income from our debt investments and capital appreciation from our equity-related investments.

The equity distribution agreement provides that we may offer and sell up to [—] shares of our common stock from time to time through [—], as our sales agent. Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in negotiated transactions or transactions that are deemed to be “at the market,” as defined in Rule 415 under the Securities Act of 1933, as amended, including sales made directly on the NYSE or similar securities exchange or sales made to or through a market maker other than on an exchange, at prices related to the prevailing market prices or at negotiated prices. As of the date of this prospectus supplement, we have not sold any shares of our common stock under the equity distribution agreement.

[—] will receive a commission from us to be negotiated from time to time, but in no event in excess of 2.0% of the gross sales price of any shares of our common stock sold through [—] under the equity distribution agreement. [—] is not required to sell any specific number or dollar amount of common stock, but will use its commercially reasonable efforts consistent with its sales and trading practices to sell the shares of our common stock offered by this prospectus supplement and the accompanying prospectus. See “Plan of Distribution” beginning on page S-[—] of this prospectus supplement. The sales price per share of our common stock offered by this prospectus supplement and the accompanying prospectus, less [—] commission, will not be less than the net asset value per share of our common stock at the time of such sale.

Please read this prospectus supplement, and the accompanying prospectus, before investing, and keep it for future reference. The prospectus supplement and the accompanying prospectus contain important information about us that a prospective investor should know before investing in our common stock. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission, or the SEC. This information is available free of charge by contacting us at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301, or by telephone by calling collect at (650) 289-3060 or on our website at www.htgc.com. The information on our website is not incorporated by reference into this prospectus or the accompanying prospectus. The SEC also maintains a website at www.sec.gov that contains such information.

An investment in our common stock involves risks, including the risk of a total loss of investment. In addition, the companies in which we invest are subject to special risks. See [—] “Risk Factors” beginning on page [—] of the accompanying prospectus to read about risks that you should consider before investing in our common stock, including the risk of leverage.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

[—]

The date of this prospectus supplement is [—], 2014.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not, and [·] has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and [·] is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front cover of this prospectus supplement or such prospectus, as applicable. Our business, financial condition, results of operations and prospects may have changed since that date.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. You should read this prospectus supplement and the accompanying prospectus together with the additional information described under the heading, “Available Information” before investing in our common stock.

Prospectus Supplement

Prospectus

[Insert table of contents from base Prospectus]

The following table is intended to assist you in understanding the various costs and expenses that an investor in our common stock will bear directly or indirectly. However, we caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus contains a reference to fees or expenses paid by “you” or “us” or that “we” will pay fees or expenses, stockholders will indirectly bear such fees or expenses as investors in Hercules Technology Growth Capital, Inc.

| Stockholder Transaction Expenses (as a percentage of the public offering price): |

||||

| Sales load (as a percentage of offering price)(1) |

% | |||

| Offering expenses |

% | (2) | ||

| Dividend reinvestment plan fees |

— | (3) | ||

|

|

|

|||

| Total stockholder transaction expenses (as a percentage of the public offering price) |

% | |||

|

|

|

|||

| Annual Expenses (as a percentage of net assets attributable to common stock):(8) |

||||

| Operating expenses |

% | (4)(5) | ||

| Interest and fees paid in connection with borrowed funds |

% | (6) | ||

|

|

|

|||

| Total annual expenses |

% | (7) | ||

|

|

|

| (1) | Represents the estimated commission with respect to the shares of common stock being sold in this offering. [—] will be entitled to compensation up to [—]% of the gross proceeds of the sale of any shares of our common stock under the equity distribution agreement, with the exact amount of such compensation to be mutually agreed upon by the Company and [—] from time to time. There is no guarantee that there will be any sales of our common stock pursuant to this prospectus supplement and the accompanying prospectus. |

| (2) | The percentage reflects estimated offering expenses of approximately $[—]. |

| (3) | The expenses associated with the administration of our dividend reinvestment plan are included in “Operating expenses.” We pay all brokerage commissions incurred with respect to open market purchases, if any, made by the administrator under the plan. For more details about the plan, see “Dividend Reinvestment Plan” in the accompanying prospectus. |

| (4) | “Operating expenses” represent our estimated operating expenses by annualizing our actual operating expenses incurred for the [—]-months ended [—], 2014, excluding interest and fees on indebtedness. This percentage for the year ended [—], 2013 was [—]%. See “Management’s Discussion and Analysis and Results of Operations,” “Management,” and “Executive Compensation” in the accompanying prospectus. |

| (5) | We do not have an investment adviser and are internally managed by our executive officers under the supervision of our Board of Directors. As a result, we do not pay investment advisory fees, but instead we pay the operating costs associated with employing investment management professionals. |

| (6) | “Interest and fees paid in connection with borrowed funds” represents estimated interest and fee payments on borrowed funds by annualizing our actual interest, fees and credit facility expenses incurred for the [—]-months ended [—], 2014, including our Wells Facility, Union Bank Facility, the Convertible Senior Notes, the 2019 Notes, the Asset-Backed Notes and the SBA debentures, each of which is defined within “Management’s Discussion and Analysis and Results of Operations” in this prospectus supplement. This percentage for the year ended [—], 2013 was [—]%. |

| (7) | “Total annual expenses” is the sum of “operating expenses” and “interest and fees paid in connection with borrowed funds.” |

| (8) | “Net assets attributable to common stock” equals the weighted average net assets as of [—], 2014, which is approximately $[—] million. |

S-1

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a $1,000 hypothetical investment in our common stock, assuming (1) a [—]% sales load (underwriting discounts and commissions) and offering expenses totaling [—]%, (2) total net annual expenses of [—]% of net assets attributable to common shares as set forth in the table above and (3) a 5% annual return. These amounts assume no additional leverage.

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

$[—] | $[—] | $[—] | $[—] | ||||||||||||

The example and the expenses in the tables above should not be considered a representation of our future expenses, and actual expenses may be greater or lesser than those shown. Moreover, while the example assumes, as required by the applicable rules of the SEC, a 5% annual return, our performance will vary and may result in a return greater or lesser than 5%. In addition, while the example assumes reinvestment of all dividends and distributions at net asset value, participants in our dividend reinvestment plan may receive shares valued at the market price in effect at that time. This price may be at, above or below net asset value. See “Dividend Reinvestment Plan” in the accompanying prospectus for additional information regarding our dividend reinvestment plan.

S-2

The matters discussed in this prospectus supplement and the accompanying prospectus, as well as in future oral and written statements by management of Hercules Technology Growth Capital, Inc., that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Important assumptions include our ability to originate new investments, achieve certain margins and levels of profitability, the availability of additional capital, and the ability to maintain certain debt to asset ratios. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus should not be regarded as a representation by us that our plans or objectives will be achieved. The forward-looking statements contained in this prospectus supplement and the accompanying prospectus include statements as to:

| • | our future operating results; |

| • | our business prospects and the prospects of our prospective portfolio companies; |

| • | the impact of investments that we expect to make; |

| • | our informal relationships with third parties including in the venture capital industry; |

| • | the expected market for venture capital investments and our addressable market; |

| • | the dependence of our future success on the general economy and its impact on the industries in which we invest; |

| • | our ability to access debt markets and equity markets; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | our expected financings and investments; |

| • | our regulatory structure and tax status; |

| • | our ability to operate as a business development company, a small business investment company and a regulated investment company, or RIC; |

| • | the adequacy of our cash resources and working capital; |

| • | the timing of cash flows, if any, from the operations of our portfolio companies; |

| • | the timing, form and amount of any dividend distributions; |

| • | the impact of fluctuations in interest rates on our business; |

| • | the valuation of any investments in portfolio companies, particularly those having no liquid trading market; |

| • | our ability to recover unrealized losses; and |

| • | the risks, uncertainties and other factors we identify in “Risk Factors” in the accompanying prospectus and elsewhere in the accompanying prospectus and in our filings with the SEC. |

For a discussion of factors that could cause our actual results to differ from forward-looking statements contained in this prospectus supplement and the accompanying prospectus, please see the discussion under “Risk Factors” in the accompanying prospectus. You should not place undue reliance on these forward-looking statements. The forward-looking statements made in this prospectus relate only to events as of the date on which

S-3

the statements are made and are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”).

Industry and Market Data

We have compiled certain industry estimates presented in this prospectus supplement and the accompanying prospectus from internally generated information and data. While we believe our estimates are reliable, they have not been verified by any independent sources. The estimates are based on a number of assumptions, including increasing investment in venture capital and private equity-backed companies. Actual results may differ from projections and estimates, and this market may not grow at the rates projected, or at all. If this market fails to grow at projected rates, our business and the market price of our securities, including our common stock, could be materially adversely affected.

S-4

This summary highlights some of the information in this prospectus supplement and may not contain all of the information that is important to you. For a more complete understanding of this offering, we encourage you to read this entire prospectus supplement and the accompanying prospectus and the documents that are referenced in this prospectus supplement and the accompanying prospectus, together with any accompanying supplements. In this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, the “Company,” “Hercules Technology Growth Capital,” “we,” “us” and “our” refer to Hercules Technology Growth Capital, Inc. and our wholly-owned subsidiaries and their affiliated securitization trusts.

Our Company

We are a specialty finance company focused on providing senior secured loans to venture capital-backed companies in technology-related markets, including technology, biotechnology, life science and energy and renewables technology industries at all stages of development. Our investment objective is to maximize our portfolio total return by generating current income from our debt investments and capital appreciation from our equity-related investments. We are an internally-managed, non-diversified closed-end investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended, or the 1940 Act.

As of [—], 2014, our total assets were approximately $[—] billion, of which our investments comprised $[—] million at fair value and $[—] million at cost. Since inception through [—], 2014, we have made debt and equity commitments of approximately $[—] billion to our portfolio companies.

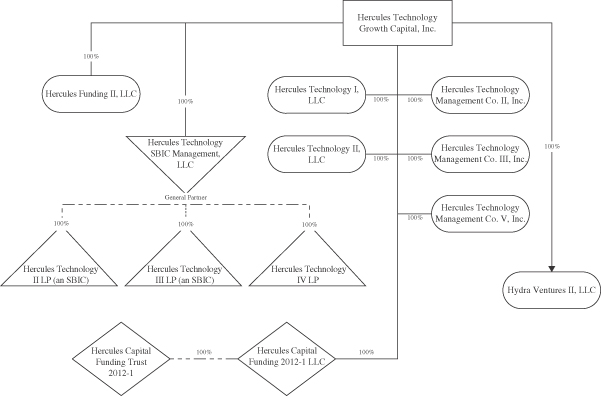

We also make investments in qualifying small businesses through two wholly-owned, small business investment company (“SBIC”) subsidiaries, Hercules Technology II, L.P. (“HT II”) and Hercules Technology III, L.P. (“HT III”). HT II and HT III hold approximately $[—] million and $[—] million in assets, respectively, and accounted for approximately [—]% and [—]%, respectively, of our total assets prior to consolidation at [—], 2014. We have issued $225.0 million in SBA-guaranteed debentures in our SBIC subsidiaries, which is the maximum amount allowed for a group of SBICs under common control. See “Regulation—Small Business Administration Regulations” in the accompanying prospectus for additional information regarding our SBIC subsidiaries.

Our portfolio is comprised of, and we anticipate that our portfolio will continue to be comprised of, investments in technology-related companies at various stages of development. Consistent with regulatory requirements, we invest primarily in United States based companies and to a lesser extent in foreign companies. See “Regulation—Qualifying Assets” in the accompanying prospectus. As of [—], 2014, our proprietary structured query language (SQL)-based database system included over [—] technology-related companies and approximately [—] venture capital, private equity sponsors/investors, as well as various other industry contacts. Our principal executive office is located in Silicon Valley, and we have additional offices in Boston, MA, New York, NY, Boulder, CO and McLean, VA.

Our goal is to be the leading structured debt financing provider of choice for venture capital and private equity backed companies in technology-related markets requiring sophisticated and customized financing solutions. Our strategy is to evaluate and invest in a broad range of companies in technology-related markets, including, technology, biotechnology, life science, and energy and renewables technology companies and to offer a full suite of growth capital products up and down the capital structure. We invest primarily in private companies and, to a lesser extent, public companies. We invest primarily in structured debt with warrants and, to a lesser extent, in senior debt and equity investments. We use the term “structured debt with warrants” to refer to any debt investment, such as a senior or subordinated secured loan, that is coupled with an equity component,

S-5

including warrants, options or rights to purchase common or preferred stock. Our structured debt with warrants investments will typically be secured by select or all of the assets of the portfolio company.

We focus our investments in companies active in technology industry sub-sectors characterized by products or services that require advanced technologies, including, but not limited to, computer software and hardware, networking systems, semiconductors, semiconductor capital equipment, information technology infrastructure or services, Internet consumer and business services, telecommunications, telecommunications equipment, renewable or alternative energy, media and life science. Within the life science sub-sector, we generally focus on medical devices, bio-pharmaceutical, drug discovery, drug delivery, health care services and information systems companies. Within the energy and renewables technology sub-sector, we focus on sustainable and renewable energy technologies and energy efficiency and monitoring technologies. We refer to all of these companies as “technology-related” companies and intend, under normal circumstances, to invest at least 80% of the value of our total assets in such businesses.

Our investment objective is to maximize our portfolio total return by generating current income from our debt investments and capital appreciation from our equity-related investments. Our primary business objectives are to increase our net income, net operating income and net asset value by investing in structured debt with warrants and equity of venture capital and private equity backed technology-related companies with attractive current yields and the potential for equity appreciation and realized gains. Our structured debt investments typically include warrants or other equity interests, giving us the potential to realize equity-like returns on a portion of our investments. Our equity ownership in our portfolio companies may represent a controlling interest. In some cases, we receive the right to make additional equity investments in our portfolio companies including the right to convert some portion of our debt into equity in connection with future equity financing rounds. Capital that we provide directly to venture capital and private equity backed technology-related companies is generally used for growth and general working capital purposes as well as in select cases for acquisitions or recapitalizations.

S-6

As of [—], 2014, our investment professionals, including Manuel A. Henriquez, our co-founder, Chairman, President and Chief Executive Officer, are currently comprised of [—] professionals who have, on average, more than 15 years of experience in venture capital, structured finance, commercial lending or acquisition finance with the types of technology-related companies that we are targeting. We believe that we can leverage the experience and relationships of our management team to successfully identify attractive investment opportunities, underwrite prospective portfolio companies and structure customized financing solutions.

Our Market Opportunity

We believe that technology-related companies compete in one of the largest and most rapidly growing sectors of the U.S. economy and that continued growth is supported by ongoing innovation and performance improvements in technology products as well as the adoption of technology across virtually all industries in response to competitive pressures. We believe that an attractive market opportunity exists for a specialty finance company focused primarily on investments in structured debt with warrants in technology-related companies for the following reasons:

| • | Technology-related companies have generally been underserved by traditional lending sources; |

| • | Unfulfilled demand exists for structured debt financing to technology-related companies as the number of lenders has declined due to the recent financial market turmoil; and |

| • | Structured debt with warrants products are less dilutive and complement equity financing from venture capital and private equity funds. |

S-7

Technology-Related Companies are Underserved by Traditional Lenders. We believe many viable technology-related companies backed by financial sponsors have been unable to obtain sufficient growth financing from traditional lenders, including financial services companies such as commercial banks and finance companies, because traditional lenders have continued to consolidate and have adopted a more risk-averse approach to lending. More importantly, we believe traditional lenders are typically unable to underwrite the risk associated with these companies effectively.

The unique cash flow characteristics of many technology-related companies include significant research and development expenditures and high projected revenue growth thus often making such companies difficult to evaluate from a credit perspective. In addition, the balance sheets of these companies often include a disproportionately large amount of intellectual property assets, which can be difficult to value. Finally, the speed of innovation in technology and rapid shifts in consumer demand and market share add to the difficulty in evaluating technology-related companies.

Due to the difficulties described above, we believe traditional lenders are generally refraining from entering the structured mezzanine marketplace, instead preferring the risk-reward profile of asset based lending. Traditional lenders generally do not have flexible product offerings that meet the needs of technology-related companies. The financing products offered by traditional lenders typically impose on borrowers many restrictive covenants and conditions, including limiting cash outflows and requiring a significant depository relationship to facilitate rapid liquidation.

Unfulfilled Demand for Structured Debt Financing to Technology-Related Companies. Private debt capital in the form of structured debt financing from specialty finance companies continues to be an important source of funding for technology-related companies. We believe that the level of demand for structured debt financing is a function of the level of annual venture equity investment activity.

We believe that demand for structured debt financing is currently underserved, in part because of the credit market collapse in 2008 and the resulting exit of debt capital providers to technology-related companies. The venture capital market for the technology-related companies in which we invest has been active and is continuing to show signs of increased investment activity. Therefore, to the extent we have capital available, we believe this is an opportune time to be active in the structured lending market for technology-related companies.

Structured Debt with Warrants Products Complement Equity Financing From Venture Capital and Private Equity Funds. We believe that technology-related companies and their financial sponsors will continue to view structured debt securities as an attractive source of capital because it augments the capital provided by venture capital and private equity funds. We believe that our structured debt with warrants product provides access to growth capital that otherwise may only be available through incremental investments by existing equity investors. As such, we provide portfolio companies and their financial sponsors with an opportunity to diversify their capital sources. Generally, we believe technology-related companies at all stages of development target a portion of their capital to be debt in an attempt to achieve a higher valuation through internal growth. In addition, because financial sponsor-backed companies have reached a more mature stage prior to reaching a liquidity event, we believe our investments provide the debt capital needed to grow or recapitalize during the extended period prior to liquidity events.

S-8

Our Business Strategy

Our strategy to achieve our investment objective includes the following key elements:

Leverage the Experience and Industry Relationships of Our Management Team and Investment Professionals. We have assembled a team of experienced investment professionals with extensive experience as venture capitalists, commercial lenders, and originators of structured debt and equity investments in technology-related companies.

Mitigate Risk of Principal Loss and Build a Portfolio of Equity-Related Securities. We expect that our investments have the potential to produce attractive risk adjusted returns through current income, in the form of interest and fee income, as well as capital appreciation from equity-related securities. We believe that we can mitigate the risk of loss on our debt investments through the combination of loan principal amortization, cash interest payments, relatively short maturities (generally, 12-60 months), security interests in the assets of our portfolio companies, and, on select investments, covenants requiring prospective portfolio companies to have certain amounts of available cash at the time of our investment and the continued support from a venture capital or private equity firm at the time we make our investment.

Provide Customized Financing Complementary to Financial Sponsors’ Capital. We offer a broad range of investment structures and possess expertise and experience to effectively structure and price investments in technology-related companies.

Invest at Various Stages of Development. We provide growth capital to technology-related companies at all stages of development, to expansion-stage companies, including select publicly listed companies and select lower middle market companies and established-stage companies.

Benefit from Our Efficient Organizational Structure. We believe that the perpetual nature of our corporate structure enables us to be a long-term partner for our portfolio companies in contrast to traditional mezzanine and investment funds, which typically have a limited life. In addition, because of our access to the equity markets, we believe that we may benefit from a lower cost of capital than that available to private investment funds.

Deal Sourcing Through Our Proprietary Database. We have developed a proprietary and comprehensive SQL-based database system to track various aspects of our investment process including sourcing, originations, transaction monitoring and post-investment performance.

General Information

Our principal executive offices are located at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301, and our telephone number is (650) 289-3060. We also have offices in Boston, Massachusetts, New York, New York, Boulder, Colorado and McLean, Virginia. We maintain a website on the Internet at www.htgc.com. Information contained in our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus, and you should not consider that information to be part of this prospectus supplement or the accompanying prospectus.

We file annual, quarterly and current periodic reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, which we refer to as the Exchange Act. This information is available at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the operation of the SEC’s public reference room by calling the SEC at (202) 551-8090. In addition, the SEC maintains an Internet website, at www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers, including us, who file documents electronically with the SEC.

S-9

| Common stock offered by us | Up to [—] shares of our common stock | |

| Common stock outstanding prior to this offering | [—] shares | |

| Manner of offering | “At the market” offering that may be made from time to time through [—], as sales agent, using commercially reasonable efforts. See “Plan of Distribution” in this prospectus supplement. | |

| Use of proceeds | We expect to use the net proceeds from this offering to fund investments in debt and equity securities in accordance with our investment objective and for other general corporate purposes.

Pending such use, we will invest a portion of the net proceeds of this offering in short-term investments, such as cash and cash equivalents, which we expect will earn yields substantially lower than the interest income that we anticipate receiving in respect of investments in accordance with our investment objective. See “Use of Proceeds” in this prospectus supplement. | |

| Distribution | To the extent that we have income available, we intend to distribute quarterly dividends to our stockholders. The amount of our dividends, if any, will be determined by our Board of Directors. Any dividends to our stockholders will be declared out of assets legally available for distribution. See “Price Range of Common Stock and Distributions” in the accompanying prospectus. | |

| Taxation | We have elected to be treated for federal income tax purposes as a RIC under Subchapter M of the Code. As a RIC, we generally do not have to pay corporate-level federal income taxes on any ordinary income or capital gains that we distribute to our stockholders as dividends. To maintain our RIC tax status, we must meet specified source-of-income and asset diversification requirements and distribute annually at least 90% of our ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. See “Price Range of Common Stock and Distributions” in the accompanying prospectus and “Certain United States Federal Income Tax Considerations” in the accompanying prospectus. | |

| New York Stock Exchange symbol | “HTGC” | |

| Risk factors | An investment in our common stock is subject to risks and involves a heightened risk of total loss of investment. In addition, the companies in which we invest are subject to special risks. See “Risk Factors” beginning on page [—] of the accompanying prospectus to read about factors you should consider, including the risk of leverage, before investing in our common stock. | |

S-10

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in negotiated transactions or transactions that are deemed to be “at the market” as defined in Rule 415 under the Securities Act, including sales made directly on the NYSE or sales made to or through a market maker other than on an exchange. There is no guarantee that there will be any sales of our common stock pursuant to this prospectus supplement and the accompanying prospectus. Actual sales, if any, of our common stock under this prospectus supplement and the accompanying prospectus may be less than as set forth in this paragraph depending on, among other things, the market price of our common stock at the time of any such sale. As a result, the actual net proceeds we receive may be more or less than the amount of net proceeds estimated in this prospectus supplement. Assuming the sale of all [—] shares of common stock offered under this prospectus supplement and the accompanying prospectus, at the last reported sale price of $[—] per share for our common stock on the NYSE as of [—], 2014, we estimate that the net proceeds of this offering will be approximately $[—] million after deducting the estimated sales commission payable to [—] and our estimated offering expenses.

We expect to use the net proceeds from this offering to fund investments in debt and equity securities in accordance with our investment objective and for other general corporate purposes.

We intend to seek to invest the net proceeds received in this offering as promptly as practicable after receipt thereof consistent with our investment objective. We anticipate that substantially all of the net proceeds from any offering of our securities will be used as described above within three to six months, depending on market conditions. We anticipate that the remainder will be used for working capital and general corporate purposes, including potential payments or distributions to shareholders. Pending such use, we will invest a portion of the net proceeds of this offering in short-term investments, such as cash and cash equivalents, which we expect will earn yields substantially lower than the interest income that we anticipate receiving in respect of investments in accordance with our investment objective.

S-11

The equity distribution agreements provide that we may offer and sell up to [—] shares of our common stock from time to time through [—], as our sales agent for the offer and sale of such common stock. The table below assumes that we will sell all of the [—] shares at a price of $[—] per share (the last reported sale price per share of our common stock on the NYSE on [—], 2014) but there is no guarantee that there will be any sales of our common stock pursuant to this prospectus supplement and the accompanying prospectus. Actual sales, if any, of our common stock under this prospectus supplement and the accompanying prospectus may be less than as set forth in the table below. In addition, the price per share of any such sale may be greater or less than $[—], depending on the market price of our common stock at the time of any such sale. The following table sets forth our capitalization as of [—], 2014:

| • | on an actual basis; and |

| • | on an as further adjusted basis giving effect to the transactions noted above and the assumed sale of [—] shares of our common stock at a price of $[—] per share (the last reported sale price per share of our common stock on the NYSE on [—], 2014) less commissions and expenses. |

This table should be read in conjunction with “Use of Proceeds” in this prospectus supplement and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and notes thereto included in the accompanying prospectus. The adjusted information is illustrative only.

| As of September 30, 2013 | ||||||||

| Actual | As Adjusted | |||||||

| (in thousands) | ||||||||

| Investments at fair value |

$ | $ | ||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Debt: |

||||||||

| Long-term SBA debentures |

$ | $ | ||||||

| Convertible Senior Notes |

||||||||

| 2019 Notes |

||||||||

| Asset-Backed Notes |

||||||||

| Total debt |

$ | $ | ||||||

| Stockholders’ equity: |

||||||||

| Common stock, par value $0.001 per share; 100,000,000 shares authorized; [—] shares issued and outstanding, actual, [—] shares issued and outstanding, as adjusted, respectively |

$ | $ | ||||||

| Capital in excess of par value |

||||||||

| Unrealized appreciation (depreciation) on investments |

||||||||

| Accumulated realized gains (losses) on investments |

||||||||

| Distributions in excess of investment income |

||||||||

| Total stockholders’ equity |

$ | $ | ||||||

| Total capitalization |

$ | $ | ||||||

S-12

[—] is acting as our sales agent in connection with the offer and sale of shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus. Upon written instructions from us, [—] will use its commercially reasonable efforts consistent with its sales and trading practices to sell, as our sales agent, our common stock under the terms and subject to the conditions set forth in our equity distribution agreement with [—] dated [—], 2014. We will instruct [—] as to the amount of common stock to be sold by it. We may instruct [—] not to sell common stock if the sales cannot be effected at or above the price designated by us in any instruction. The sales price per share of our common stock offered by this prospectus supplement and the accompanying prospectus, less [—] commission, will not be less than the net asset value per share of our common stock at the time of such sale. We or [—] may suspend the offering of shares of common stock upon proper notice and subject to other conditions.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in negotiated transactions or transactions that are deemed to be “at the market,” as defined in Rule 415 under the Securities Act, including sales made directly on the NYSE or similar securities exchange or sales made to or through a market maker other than on an exchange at prices related to the prevailing market prices or at negotiated prices.

[—] will provide written confirmation of a sale to us no later than the opening of the trading day on the NYSE following each trading day in which shares of our common stock are sold under the equity distribution agreement. Each confirmation will include the number of shares of common stock sold on the preceding day, the net proceeds to us and the compensation payable by us to [—] in connection with the sales.

[—] will receive a commission from us to be negotiated from time to time but in no event in excess of [—]% of the gross sales price of any shares of our common stock sold through [—] under the equity distribution agreement. We estimate that the total expenses for the offering, excluding compensation payable to [—] under the terms of the equity distribution agreement, will be approximately $[—] (including up to $[—] in reimbursement of the underwriters’ counsel fees in connection with the review of the terms of the offering by the Financial Industry Regulatory Authority, Inc.).

Settlement for sales of shares of common stock will occur on the third trading day following the date on which such sales are made, or on some other date that is agreed upon by us and [—] in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will report at least quarterly the number of shares of our common stock sold through [—] under the equity distribution agreement and the net proceeds to us.

In connection with the sale of the common stock on our behalf, [—] may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of [—] may be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to [—] against certain civil liabilities, including liabilities under the Securities Act.

The offering of our shares of common stock pursuant to the equity distribution agreement will terminate upon the earlier of (i) the sale of all common stock subject to the equity distribution agreement or (ii) the termination of the equity distribution agreement. The equity distribution agreement may be terminated by us in our sole discretion under the circumstances specified in the equity distribution agreement by giving notice to [—]. In addition, [—] may terminate the equity distribution agreement under the circumstances specified in the equity distribution agreement by giving notice to us.

S-13

Potential Conflicts of Interest

[—] and its affiliates have provided, or may in the future provide, various investment banking, commercial banking, financial advisory, brokerage and other services to us and our affiliates for which services they have received, and may in the future receive, customary fees and expense reimbursement. [—] and its affiliates may, from time to time, engage in transactions with and perform services for us in the ordinary course of their business for which they may receive customary fees and reimbursement of expenses. In the ordinary course of their various business activities, [—] and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and such investment and securities activities may involve securities and/or instruments of our company.

The principal business address of [—] is [—].

S-14

Certain legal matters in connection with the securities offered hereby will be passed upon for us by Sutherland Asbill & Brennan LLP, Washington, DC. Certain legal matters in connection with the securities offered hereby will be passed upon for [—] by [—].

The consolidated financial statements as of December 31, 2013 and 2012 and for each of the three years in the period ended December 31, 2013 and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) as of December 31, 2013 included in the accompanying prospectus have been so included in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

We have filed with the SEC a registration statement on Form N-2, together with all amendments and related exhibits, under the Securities Act, with respect to our securities offered by this prospectus supplement and the accompanying prospectus. The registration statement contains additional information about us and our securities being offered by this prospectus supplement and the accompanying prospectus.

We file annual, quarterly and current periodic reports, proxy statements and other information with the SEC under the Exchange Act. You may inspect and copy these reports, proxy statements and other information, as well as the registration statement of which this prospectus supplement and accompanying prospectus form a part and the related exhibits and schedules, at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549-0102. You may obtain information on the operation of the Public Reference Room by calling the SEC at 202-551-8090. The SEC maintains an Internet website that contains reports, proxy and information statements and other information filed electronically by us with the SEC which are available on the SEC’s Internet website at http://www.sec.gov. Copies of these reports, proxy and information statements and other information may be obtained, after paying a duplicating fee, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, D.C. 20549-0102.

S-15

Up to [—] Shares

Common Stock

PROSPECTUS SUPPLEMENT

The date of this prospectus supplement is [—], 2014

[—]