FORM OF PROSPECTUS SUPPLEMENT FOR WARRANT OFFERINGS

Exhibit s.5

The information in this preliminary prospectus supplement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus supplement is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted

[FORM OF PROSPECTUS SUPPLEMENT TO BE USED IN

CONJUNCTION WITH FUTURE WARRANT OFFERINGS]

PROSPECTUS SUPPLEMENT

(to Prospectus dated , 2015)

Warrants to Purchase Up to [Type of Security]

We are an internally-managed, non-diversified closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Our investment objective is to maximize our portfolio total return by generating current income from our debt investments and capital appreciation from our equity-related investments.

All of the warrants offered by this prospectus supplement are being sold by us. We are offering warrants to purchase up to [number][type of security]. Each warrant entitles the holder to purchase [one] [type of security]. [We are not generally able to issue and sell our common stock at a price below our net asset value per share unless we have stockholder approval.]

Our common stock is traded on the New York Stock Exchange, or NYSE, under the symbol “HTGC”. The last reported closing price for our common stock on , was $ per share. [The rights are transferable and will be listed for trading on the NYSE under the symbol “ .”]

Please read this prospectus supplement, and the accompanying prospectus, before investing, and keep it for future reference. The prospectus supplement and the accompanying prospectus contain important information about us that a prospective investor should know before investing in our preferred stock. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission. This information is available free of charge by contacting us at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301, or by telephone by calling collect at (650) 289-3060 or on our website at www.herculestech.com. The information on our website is not incorporated by reference into this prospectus or the accompanying prospectus. The SEC also maintains a website at www.sec.gov that contains such information.

An investment in our common stock involves risks, including the risk of a total loss of investment. In addition, the companies in which we invest are subject to special risks. See “Risk Factors” beginning on page 11 of the accompanying prospectus and page S-12 in this prospectus supplement to read about risks you should consider before investing in our securities, including the risk of leverage.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Warrant | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Sales load (underwriting discounts and commissions) |

$ | $ | ||||||

| Proceeds to us (before expenses) |

$ | $ | ||||||

[In addition, the underwriters may purchase up to an additional warrants at the public offering price, less the sales load payable by us, to cover over-allotments, if any, within days from the date of this prospectus supplement. If the underwriters exercise this option in full, the total sales load paid by us will be $ , and total proceeds, before expenses, will be $ .]

The underwriters are offering the warrants as set forth in “Underwriting.” Delivery of the warrants will be made on or about , 2015.

The date of this prospectus supplement is , 2015

S-1

ABOUT THIS PROSPECTUS SUPPLEMENT

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. Neither we nor the underwriters have authorized any other person to provide you with different information from that contained in this prospectus supplement or the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to buy, our securities by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. The information contained in this prospectus supplement and the accompanying prospectus is complete and accurate only as of their respective dates, regardless of the time of their delivery or sale of our securities. This prospectus supplement supersedes the accompanying prospectus to the extent it contains information different from or additional to the information in that prospectus.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. You should read this prospectus supplement and the accompanying prospectus together with the additional information described under the heading, “Available Information” before investing in our warrants.

S-2

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

| Page | ||||

| S-4 | ||||

| S-9 | ||||

| S-10 | ||||

| S-12 | ||||

| S-13 | ||||

| S-15 | ||||

| S-18 | ||||

| S-19 | ||||

| S-22 | ||||

| S-25 | ||||

| S-25 | ||||

| S-25 | ||||

PROSPECTUS

| Page | ||||

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 58 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

59 | |||

| 113 | ||||

| 126 | ||||

| 149 | ||||

| 152 | ||||

| 158 | ||||

| 168 | ||||

| 190 | ||||

| 192 | ||||

| 193 | ||||

| 202 | ||||

| 208 | ||||

| 212 | ||||

| 217 | ||||

| 218 | ||||

| 225 | ||||

| 227 | ||||

| 229 | ||||

| 231 | ||||

| 244 | ||||

| 246 | ||||

| 246 | ||||

| 246 | ||||

| 246 | ||||

| 247 | ||||

| F-1 | ||||

S-3

This summary highlights some of the information in this prospectus supplement and may not contain all of the information that is important to you. For a more complete understanding of this offering, we encourage you to read this entire prospectus supplement and the accompanying prospectus and the documents that are referenced in this prospectus supplement and the accompanying prospectus, together with any accompanying supplements. In this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, the “Company,” “Hercules Technology Growth Capital,” “Hercules,” “we,” “us” and “our” refer to Hercules Technology Growth Capital, Inc. and our wholly-owned subsidiaries.

Our Company

We are a specialty finance company focused on providing senior secured loans to venture capital-backed companies in technology-related industries, including technology, biotechnology, life science and energy and renewables technology, at all stages of development. Our investment objective is to maximize our portfolio total return by generating current income from our debt investments and capital appreciation from our equity-related investments. We are an internally-managed, non-diversified closed-end investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended, or the 1940 Act. We have qualified as and have elected to be treated for tax purposes as a regulated investment company, or RIC, under the Internal Revenue Code of 1986, as amended, or the Code.

As of [ ], 20[ ], our total assets were approximately $[ ], of which our investments comprised $[ ] at fair value and $[ ] at cost. Since inception through [ ], 20[ ], we have made debt and equity commitments of approximately $[ ] to our portfolio companies.

We also make investments in qualifying small businesses through two wholly-owned, small business investment company, or SBIC, subsidiaries, Hercules Technology II, L.P., or HT II, and Hercules Technology III, L.P., or HT III. At [ ], 20[ ], we have issued $[ ] in Small Business Administration, or SBA, guaranteed debentures in our SBIC subsidiaries. See “Regulation-Small Business Administration Regulations” in the accompanying prospectus for additional information regarding our SBIC subsidiaries.

S-4

As of [ ], 20___, our investment professionals, including Manuel A. Henriquez, our co-founder, Chairman, President and Chief Executive Officer, are currently comprised of [ ] professionals who have, on average, more than [ ] years of experience in venture capital, structured finance, commercial lending or acquisition finance with the types of technology-related companies that we are targeting. We believe that we can leverage the experience and relationships of our management team to successfully identify attractive investment opportunities, underwrite prospective portfolio companies and structure customized financing solutions.

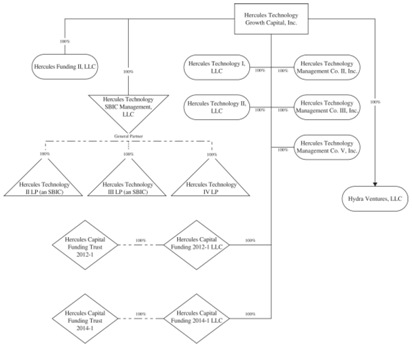

The following chart shows the ownership structure and relationship of certain entities with us.

Our Market Opportunity

We believe that technology-related companies compete in one of the largest and most rapidly growing sectors of the U.S. economy and that continued growth is supported by ongoing innovation and performance improvements in technology products as well as the adoption of technology across virtually all industries in response to competitive pressures. We believe that an attractive market opportunity exists for a specialty finance company focused primarily on investments in structured debt with warrants in technology-related companies for the following reasons:

S-5

| • | Technology-related companies have generally been underserved by traditional lending sources; |

| • | Unfulfilled demand exists for structured debt financing to technology-related companies as the number of lenders has declined due to the recent financial market turmoil; and |

| • | Structured debt with warrants products are less dilutive and complement equity financing from venture capital and private equity funds. |

Technology-Related Companies are Underserved by Traditional Lenders. We believe many viable technology-related companies backed by financial sponsors have been unable to obtain sufficient growth financing from traditional lenders, including financial services companies such as commercial banks and finance companies, because traditional lenders have continued to consolidate and have adopted a more risk-averse approach to lending. More importantly, we believe traditional lenders are typically unable to underwrite the risk associated with these companies effectively.

The unique cash flow characteristics of many technology-related companies, which typically include significant research and development expenditures and high projected revenue growth thus often making such companies difficult to evaluate from a credit perspective. In addition, the balance sheets of these companies often include a disproportionately large amount of intellectual property assets, which can be difficult to value. Finally, the speed of innovation in technology and rapid shifts in consumer demand and market share add to the difficulty in evaluating technology-related companies.

Due to the difficulties described above, we believe traditional lenders are generally refraining from entering the structured debt financing marketplace, instead preferring the risk-reward profile of asset based lending. Traditional lenders generally do not have flexible product offerings that meet the needs of technology-related companies. The financing products offered by traditional lenders typically impose on borrowers many restrictive covenants and conditions, including limiting cash outflows and requiring a significant depository relationship to facilitate rapid liquidation.

Unfulfilled Demand for Structured Debt Financing to Technology-Related Companies. Private debt capital in the form of structured debt financing from specialty finance companies continues to be an important source of funding for technology-related companies. We believe that the level of demand for structured debt financing is a function of the level of annual venture equity investment activity.

We believe that demand for structural debt financing is currently underserved. The venture capital market for the technology-related companies in which we invest has been active and is continuing to show signs of increased investment activity. In addition, lending requirements of traditional lenders have recently become more stringent due to the significant write-offs in the financial services sector, the re-pricing of credit risk in the broadly syndicated market and the financial turmoil affecting the banking system and financial market, which have negatively impacted the debt and equity capital market in the United States and most other markets. At the same time, the venture capital market for the technology-related companies in which we invest has continued to be active. Therefore, to the extent we have capital available, we believe this is an opportune time to be active in the structured lending market for technology-related companies.

Structured Debt with Warrants Products Complement Equity Financing From Venture Capital and Private Equity Funds. We believe that technology-related companies and their financial sponsors will continue to view structured debt securities as an attractive source of capital because it augments the capital provided by venture capital and private equity funds. We believe that our structured debt with warrants product provides access to

S-6

growth capital that otherwise may only be available through incremental investments by existing equity investors. As such, we provide portfolio companies and their financial sponsors with an opportunity to diversify their capital sources. Generally, we believe technology-related companies at all stages of development target a portion of their capital to be debt in an attempt to achieve a higher valuation through internal growth. In addition, because financial sponsor-backed companies have reached a more mature stage prior to reaching a liquidity event, we believe our investments could provide the debt capital needed to grow or recapitalize during the extended period prior to liquidity events.

Our Business Strategy

Our strategy to achieve our investment objective includes the following key elements:

Leverage the Experience and Industry Relationships of Our Management Team and Investment Professionals. We have assembled a team of experienced investment professionals with extensive experience as venture capitalists, commercial lenders and originators of structured debt and equity investments in technology-related companies.

Mitigate Risk of Principal Loss and Build a Portfolio of Equity-Related Securities. We expect that our investments have the potential to produce attractive risk adjusted returns through current income, in the form of interest and fee income, as well as capital appreciation from equity-related securities. We seek to mitigate the risk of loss on our debt investments through the combination of loan principal amortization, cash interest payments, relatively short maturities (generally 12-60 months), security interests in the assets of our portfolio companies, and, on select investments, covenants requiring prospective portfolio companies to have certain amounts of available cash at the time of our investment and the continued support from a venture capital or private equity firm at the time we make our investment.

Provide Customized Financing Complementary to Financial Sponsors’ Capital. We offer a broad range of investment structures and possess expertise and experience to effectively structure and price investments in technology-related companies.

S-7

Invest at Various Stages of Development. We provide growth capital to technology-related companies at all stages of development, including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalization and refinancing, and established-stage companies.

Benefit from Our Efficient Organizational Structure. We believe that our corporate structure enables us to be a long-term partner for our portfolio companies in contrast to traditional investment funds, which typically have a limited life. In addition, because of our access to the equity markets, we believe that we may benefit from a lower cost of capital than that available to private investment funds.

Deal Sourcing Through Our Proprietary Database. We have developed a proprietary and comprehensive structured query language-based (SQL) database system to track various aspects of our investment process including sourcing, originations, transaction monitoring and post-investment performance.

Recent Developments

[Insert description of recent developments at time of offering.]

General Information

Our principal executive offices are located at 400 Hamilton Avenue, Suite 310, Palo Alto, California 94301, and our telephone number is (650) 289-3060. We also have offices in Boston, MA, New York, NY, McLean, VA and Radnor, PA. We maintain a website on the Internet at www.htgc.com. Information contained in our website is not incorporated by reference into this prospectus, and you should not consider that information to be part of this prospectus.

We file annual, quarterly and current periodic reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, which we refer to as the Exchange Act. This information is available at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the operation of the SEC’s public reference room by calling the SEC at (202) 551-8090. In addition, the SEC maintains an Internet website, at www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers, including us, who file documents electronically with the SEC.

S-8

| Warrants Offered by Us | , excluding warrants issuable pursuant to the over-allotment option granted to the underwriters. | |

| Warrants Outstanding After this Offering |

, excluding warrants issuable pursuant to the over-allotment option granted to the underwriters. | |

| Exercisability | Each warrant is exercisable for [number] [type of security]. | |

| Exercise Price | $[ ] | |

| Exercise Period | The warrants will be exercisable beginning on , and will expire on , or earlier upon redemption. However, the warrants will only be exercisable if a registration statement relating to the [type of security] issuable upon exercise of the warrants is effective and current. We have agreed to use our best efforts to have an effective registration statement cover the [type of security] issuable upon exercise of the warrants from the date the warrants become exercisable and to maintain a current prospectus relating to such [type of security] until the warrants expire or are redeemed. | |

| Redemption | At any time while the warrants are exercisable, we may redeem the outstanding warrants: | |

| • in whole and not in part; | ||

| • at a price of $ per warrant; | ||

| • upon a minimum of days’ prior written notice of redemption; and | ||

| • if, and only if, the last sales price of our common stock equals or exceeds $ per share for any trading days within a trading day period ending business days before we send the notice of redemption, | ||

| provided that we have an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, covering the [type of security] issuable upon exercise of the warrants and a current prospectus relating to them is available on the date we give notice of redemption and during the entire period thereafter until the time we redeem the warrants. | ||

| Use of Proceeds | We intend to use the net proceeds from selling our securities for general corporate purposes, which includes investing in debt and equity securities, repayment of any outstanding indebtedness and other general corporate purposes. See “Use of Proceeds” in this prospectus supplement for more information. | |

S-9

The following table is intended to assist you in understanding the various costs and expenses that an investor in our securities will bear directly or indirectly. However, we caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus contains a reference to fees or expenses paid by “you” or “us” or that “we” will pay fees or expenses, stockholders will indirectly bear such fees or expenses as investors in the Company.

| Stockholder Transaction Expenses |

||||

| Sales Load (as a percentage of offering price) |

— | %(1) | ||

| Offering Expenses (as a percentage of offering price) |

— | %(2) | ||

| Dividend Reinvestment Plan Fees |

— | %(3) | ||

| Debt Securities and/or Preferred Stock Offering Expenses Borne by Holders of Common Stock |

— | %(4) | ||

|

|

|

|||

| Total Stockholder Transaction Expenses (as a percentage of offering price) |

— | %(4) | ||

|

|

|

|||

| Annual Expenses (as a Percentage of Net Assets Attributable to Common Shares)(11) |

||||

| Operating Expenses |

%(5)(6) | |||

| Interest Payments on Borrowed Funds |

%(7) | |||

| Fees paid in connection with borrowed funds |

%(8) | |||

| Acquired fund fees and expenses |

%(9) | |||

| Cost of Servicing Debt Securities and/or Preferred Stock |

— | % | ||

|

|

|

|||

| Total Annual Expenses |

%(10) | |||

|

|

|

|||

| (1) | The underwriting discounts and commissions with respect to the shares sold in this offering, which is a one-time fee, is the only sales load paid in connection with this offering. |

| (2) | Amount reflects estimated offering expenses of $ and is based on the offering of shares at the public offering price of $ per share. |

| (3) | The expenses of the dividend reinvestment plan are included in “Other Expenses.” See “Dividend Reinvestment Plan” in the accompanying prospectus. |

| (4) | The prospectus supplement corresponding to each offering will disclose the applicable offering expenses and total stockholder transaction expenses. |

| (5) | “Operating expenses” represent our estimated operating expenses for the year ending December 31, [ ] including income tax expense (benefit) including excise tax, excluding interests and fees on indebtedness. This percentage for the year ended December 31, [ ] was [ ] %. See “Management’s Discussion and Analysis and Results of Operations,” “Management,” and “Compensation of Executive Officers and Directors.” |

| (6) | We do not have an investment adviser and are internally managed by our executive officers under the supervision of our Board of Directors. As a result, we do not pay investment advisory fees, but instead we pay the operating costs associated with employing investment management professionals.. |

| (7) | “Interest payments on borrowed funds” represents estimated interest payments on borrowed funds for 20[ ] including [ ]. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus supplement. For purposes of this section, we have computed interest expense assuming that: (i) we maintain no cash or cash equivalents, (ii) borrow for investment purposes an amount equal to % of our total assets ($___ million out of total assets of $ ___ million) and (iii) the annual interest rate, representing interest and credit facility fees and amortization of debt issuance costs, is ___%. Total assets of $___ million assumes full utilization of the $500 million under our shelf registration statement. |

S-10

| (8) | “Fees paid in connection with borrowed funds” represents estimated fees paid in connection with borrowed funds for [ ] including [ ]. This percentage for the year ended December 31, [ ] was approximately [ ]%. |

| (9) | For the year ended December 31, [ ], we [did not] have any investments in shares of Acquired Funds that are not consolidated and, as a result, we did not directly or indirectly incur any fees from Acquired Funds. |

| (10) | “Total annual expenses” is the sum of “operating expenses,” “interest payments on borrowed funds” and “fees paid in connection with borrowed funds.” |

| (11) | “Average net assets attributable to common stock” equals the weighted estimated average net assets for [ ] which is $[ ]. |

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a $1,000 hypothetical investment in our common stock, assuming a 5% annual return. These amounts are based upon our payment of annual operating expenses at the levels set forth in the table above and assume no additional leverage.

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

$ | $ | $ | $ | ||||||||||||

The example and the expenses in the tables above should not be considered a representation of our future expenses, and actual expenses may be greater or lesser than those shown. Moreover, while the example assumes, as required by the applicable rules of the SEC, a 5% annual return, our performance will vary and may result in a return greater or lesser than 5%. In addition, while the example assumes reinvestment of all dividends and distributions at net asset value, participants in our dividend reinvestment plan may receive shares valued at the market price in effect at that time. This price may be at, above or below net asset value. See “Dividend Reinvestment Plan” in the accompanying prospectus for additional information regarding our dividend reinvestment plan.

This example and the expenses in the table above should not be considered a representation of our future expenses as actual expenses (including the cost of debt, and other expenses) may be greater or less than those shown.

S-11

Investing in our securities involves a number of significant risks. Before you invest in our securities, you should be aware of various risks, including those described below and those set forth in the accompanying prospectus. You should carefully consider these risk factors, together with all of the other information included in this prospectus supplement and the accompanying prospectus, before you decide whether to make an investment in our securities. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us may also impair our operations and performance. If any of the following events occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. In such case, our net asset value and the trading price of our common stock could decline, and you may lose all or part of your investment. The risk factors described below, together with those set forth in the accompanying prospectus, are the principal risk factors associated with an investment in us as well as those factors generally associated with an investment company with investment objectives, investment policies, capital structure or trading markets similar to ours.

If you exercise your warrants, you may be unable to sell any [securities] you purchase at a profit.

The public trading market price of our [type of security] may decline after you elect to exercise your warrants. If that occurs, you will have committed to buy [type of securities] at a price above the prevailing market price and you will have an immediate unrealized loss. Moreover, we cannot assure you that following the exercise of warrants you will be able to sell your [type of securities] at a price equal to or greater than the exercise price.

The exercise price is not necessarily an indication of our value.

The exercise price of the warrants does not necessarily bear any relationship to any established criteria for valuation of business development companies. You should not consider the exercise price an indication of our value or any assurance of future value. After the date of this prospectus supplement, our [type of security] may trade at prices above or below the exercise price.

[Insert any additional relevant risk factors not included in base prospectus.]

S-12

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The matters discussed in this prospectus supplement and the accompanying prospectus, as well as in future oral and written statements by management of Hercules Technology Growth Capital, Inc., that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Important assumptions include our ability to originate new investments, achieve certain margins and levels of profitability, the availability of additional capital, and the ability to maintain certain debt to asset ratios and our outlook on the economy and its effect on venture capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus supplement and the accompanying prospectus should not be regarded as a representation by us that our plans or objectives will be achieved. The forward-looking statements contained in this prospectus supplement and the accompanying prospectus include statements as to:

| • | our future operating results; |

| • | our business prospects and the prospects of our prospective portfolio companies; |

| • | the impact of investments that we expect to make; |

| • | the impact of a protracted decline in the liquidity of credit markets on our business; |

| • | our informal relationships with third parties including in the venture capital industry; |

| • | the expected market for venture capital investments and our addressable market; |

| • | the dependence of our future success on the general economy and its impact on the industries in which we invest; |

| • | our ability to access debt markets and equity markets; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | our expected financings and investments; |

| • | our regulatory structure and tax status; |

| • | our ability to operate as a business development company, SBIC and a RIC; |

| • | the adequacy of our cash resources and working capital; |

| • | the timing of cash flows, if any, from the operations of our portfolio companies; |

| • | the timing, form and amount of any dividend distributions; |

| • | the impact of fluctuations in interest rates on our business; |

| • | the valuation of any investments in portfolio companies, particularly those having no liquid trading market; and |

| • | our ability to recover unrealized losses. |

S-13

For a discussion of factors that could cause our actual results to differ from forward-looking statements contained in this prospectus supplement and the accompanying prospectus, please see the discussion under “Risk Factors” in both this prospectus supplement and the accompanying prospectus. You should not place undue reliance on these forward-looking statements. The forward-looking statements made in this prospectus supplement and the accompanying prospectus relate only to events as of the date on which the statements are made. The forward-looking statements contained herein are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933.

Industry and Market Data

This prospectus supplement and the accompanying prospectus contain third-party estimates and data regarding valuations of venture capital-backed companies. This data was reported by Dow Jones VentureSource, an independent venture capital industry research company which we refer to as VentureSource. VentureSource is commonly relied upon as an information source in the venture capital industry. Although we have not independently verified any such data, we believe that the industry information contained in such releases and data tables and included in this prospectus supplement and the accompanying prospectus is reliable.

We have compiled certain industry estimates presented in this prospectus supplement and the accompanying prospectus from internally generated information and data. While we believe our estimates are reliable, they have not been verified by any independent sources. The estimates are based on a number of assumptions, including increasing investment in venture capital and private equity-backed companies. Actual results may differ from projections and estimates, and this market may not grow at the rates projected, or at all. If this market fails to grow at projected rates, our business and the market price of our common stock could be materially adversely affected.

S-14

We estimate that the net proceeds from the sale of our warrants in this offering will be $ after deducting estimated offering expenses of approximately $ payable by us.

We expect to use the net proceeds from this offering to fund investments in debt and equity securities in accordance with our investment objective and for other general corporate purposes.

We intend to seek to invest the net proceeds received in this offering as promptly as practicable after receipt thereof consistent with our investment objective. We anticipate that substantially all of the net proceeds from any offering of our securities will be used as described above within three to six months, depending on market conditions. We anticipate that the remainder will be used for working capital and general corporate purposes, including potential payments or distributions to shareholders. Pending such use, we will invest a portion of the net proceeds of this offering in short-term investments, such as cash and cash equivalents, which we expect will earn yields substantially lower than the interest income that we anticipate receiving in respect of investments in accordance with our investment objective.

S-15

DESCRIPTION OF THE WARRANTS

[No] warrants are currently outstanding. Once issued, each warrant will entitle the registered holder to purchase [one] share of [type of security] at a price of $ per [security], subject to adjustment as discussed below, at any time commencing [ ].

The warrants will be exercisable beginning on , and will expire on , or earlier upon redemption. However, the warrants will be exercisable only if a registration statement relating to the [type of security] issuable upon exercise of the warrants is effective and current. We have agreed to use our best efforts to have an effective registration statement covering [type of security] issuable upon exercise of the warrants from the date the warrants become exercisable and to maintain a current prospectus relating to such [type of security] until the warrants expire or are redeemed.

At any time while the warrants are exercisable, we may redeem the outstanding warrants:

| • | in whole and not in part; |

| • | at a price of $ per warrant; |

| • | upon not less than days’ prior written notice of redemption to each warrant holder; and |

| • | if, and only if, the reported last sale price of the [type of security] equals or exceeds $ per [type of security], for any trading days within a trading day period ending on the business day prior to the notice of redemption to warrant holders, |

provided that we have an effective registration statement under the Securities Act covering the [type of security] issuable upon exercise of the warrants and a current prospectus relating to them is available on the date we give notice of redemption and during the entire period thereafter until the time we redeem the warrants.

We have established the above conditions to our exercise of redemption rights with the intent of:

| • | providing warrant holders with adequate notice of redemption, and allowing them to exercise their warrants prior to redemption at a time when there is a reasonable premium to the warrant exercise price; and |

| • | providing a sufficient differential between the then prevailing [type of security] price and the warrant exercise price so there is a buffer to absorb any negative market reaction to our redemption of the warrants. |

The right to exercise will be forfeited unless they are exercised prior to the date specified in the notice of redemption. On and after the redemption date, a record holder of a warrant will have no further rights except to receive the redemption price for such holder’s warrant upon surrender of such warrant.

The warrants will be issued in registered form under a warrant agreement between , as warrant agent, and us. You should review a copy of the warrant agreement, which has been filed as an exhibit to the registration statement, for a complete description of the terms and conditions applicable to the warrants.

The exercise price and number of [type of security] issuable upon exercise of the warrants may be adjusted in certain circumstances, including in the event of a stock dividend, or our recapitalization, reorganization, merger or consolidation. [However, the exercise price and number of [type of security] issuable upon exercise of the warrants will not be adjusted for issuances of [type of security] at a price below the warrant exercise price.

The warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price, by certified or official bank check payable to us, for the number of warrants being exercised. The warrant holders do not have the rights or privileges of holders of [type of security] or any voting rights until they exercise their warrants and receive [type of security]. After the issuance of [type of security] upon exercise of the warrants, each holder will be entitled to one vote for each [type of security] held of record on all matters to be voted on by [security holder].

S-16

No warrants will be exercisable and we will not be obligated to issue [type of security] unless at the time a holder seeks to exercise such warrant, a registration statement relating to the [type of security] issuable upon exercise of the warrants is effective and current and the [type of security] has been registered or qualified or deemed to be exempt under the securities laws of the state of residence of the holder of the warrants. Under the terms of the warrant agreement, we have agreed to use our best efforts to meet these conditions and to maintain a current prospectus relating to the [type of security] issuable upon exercise of the warrants until the expiration of the warrants. However, we cannot assure you that we will be able to do so and, if we do not maintain a current prospectus relating to the common stock issuable upon exercise of the warrants, holders will be unable to exercise their warrants and we will not be required to settle any such warrant exercise. If the prospectus relating to the [type of security] issuable upon the exercise of the warrants is not current or if the [type of security] is not qualified or exempt from qualification in the jurisdictions in which the holders of the warrants reside, we will not be required to net cash settle or cash settle the warrant exercise, the warrants may have no value, the market for the warrants may be limited and the warrants may expire worthless.

No fractional [type of security] will be issued upon exercise of the warrants. If, upon exercise of the warrants, a holder would be entitled to receive a fractional interest in a [type of security], we will, upon exercise, round up or down to the nearest whole number the number of [type of security] to be issued to the warrant holder.

We are not generally able to issue and sell our common stock, or warrants to purchase common stock, at a price below our net asset value per share unless we have stockholder approval.

S-17

The following table sets forth (i) our actual capitalization as of , 20 , and (ii) our capitalization as adjusted to give effect to he sale of our warrants in this offering and our receipt of the estimated net proceeds from that sale.

| As of , 20 | ||||||||

| Actual (in thousands) |

Pro Forma (in thousands) |

|||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Investments at fair value |

$ | $ | ||||||

| Other assets |

$ | $ | ||||||

| Total assets |

$ | $ | ||||||

| Liabilities: |

||||||||

| Credit facilities payable |

$ | $ | ||||||

| Other Liabilities |

$ | $ | ||||||

| Total Liabilities |

$ | $ | ||||||

| Stockholders’ equity: |

||||||||

| Common stock, par value $0.001 per share; 200,000,000 shares authorized, shares issued and outstanding, shares issued and outstanding, as adjusted, respectively |

$ | |||||||

| Capital in excess of par value |

$ | |||||||

| Total stockholders’ equity |

||||||||

S-18

PRICE RANGE OF COMMON STOCK AND DISTRIBUTIONS

Our common stock is traded on the NYSE under the symbol “HTGC.”

The following table sets forth the range of high and low sales prices of our common stock as reported on the NYSE, the sales price as a percentage of net asset value and the dividends declared by us for each fiscal quarter. The stock quotations are interdealer quotations and do not include markups, markdowns or commissions.

| Price Range | Premium/ Discount of High Sales Price to NAV |

Premium/ Discount of Low Sales Price to NAV |

Cash Dividend per Share |

|||||||||||||||||||||

| NAV(1) | High | Low | ||||||||||||||||||||||

| 2013 |

||||||||||||||||||||||||

| First quarter |

$ | 10.00 | $ | 11.88 | $ | 11.58 | 18.8 | % | 15.8 | % | $ | 0.250 | ||||||||||||

| Second quarter |

$ | 10.09 | $ | 13.61 | $ | 11.05 | 34.9 | % | 9.5 | % | $ | 0.270 | ||||||||||||

| Third quarter |

$ | 10.42 | $ | 15.18 | $ | 13.20 | 45.7 | % | 26.7 | % | $ | 0.280 | ||||||||||||

| Fourth quarter |

$ | 10.51 | $ | 17.09 | $ | 14.62 | 62.6 | % | 39.1 | % | $ | 0.310 | ||||||||||||

| 2014 |

||||||||||||||||||||||||

| First quarter |

$ | 10.58 | $ | 15.27 | $ | 13.24 | 44.3 | % | 25.1 | % | $ | 0.310 | ||||||||||||

| Second quarter |

$ | 10.42 | $ | 15.54 | $ | 12.75 | 49.1 | % | 22.4 | % | $ | 0.310 | ||||||||||||

| Third quarter |

$ | 10.22 | $ | 16.24 | $ | 14.16 | 58.9 | % | 38.6 | % | $ | 0.310 | ||||||||||||

| Fourth quarter |

$ | 10.18 | $ | 15.82 | $ | 13.16 | 55.4 | % | 29.3 | % | $ | 0.310 | ||||||||||||

| 2015 |

||||||||||||||||||||||||

| First quarter |

* | $ | 15.27 | $ | 13.47 | * | * | $ | 0.310 | |||||||||||||||

| Second quarter (through [ ], 2015) |

* | $ | $ | * | * | ** | ||||||||||||||||||

| (1) | Net asset value per share is generally determined as of the last day in the relevant quarter and therefore may not reflect the net asset value per share on the date of the high and low sales prices. The net asset values shown are based on outstanding shares at the end of each period. |

| * | Net asset value has not yet been calculated for this period. |

| ** | Cash dividend per share has not yet been determined for this period. |

The last reported price for our common stock on [ ], 20__ was $[ ] per share.

Shares of business development companies may trade at a market price that is less than the value of the net assets attributable to those shares. The possibility that our shares of common stock will trade at a discount from net asset value or at premiums that are unsustainable over the long term are separate and distinct from the risk that our net asset value will decrease. At times, our shares of common stock have traded at a premium to net asset value and at times our shares of common stock have traded at a discount to the net assets attributable to those shares. It is not possible to predict whether the shares offered hereby will trade at, above, or below net asset value.

S-19

Dividends

The following table summarizes our dividends declared and paid or to be paid on all shares, including restricted stock, to date:

| Date Declared |

Record Date | Payment Date | Amount Per Share | |||||

| October 27, 2005 |

November 1, 2005 | November 17, 2005 | $ | 0.03 | ||||

| December 9, 2005 |

January 6, 2006 | January 27, 2006 | 0.30 | |||||

| April 3, 2006 |

April 10, 2006 | May 5, 2006 | 0.30 | |||||

| July 19, 2006 |

July 31, 2006 | August 28, 2006 | 0.30 | |||||

| October 16, 2006 |

November 6, 2006 | December 1, 2006 | 0.30 | |||||

| February 7, 2007 |

February 19, 2007 | March 19, 2007 | 0.30 | |||||

| May 3, 2007 |

May 16, 2007 | June 18, 2007 | 0.30 | |||||

| August 2, 2007 |

August 16, 2007 | September 17, 2007 | 0.30 | |||||

| November 1, 2007 |

November 16, 2007 | December 17, 2007 | 0.30 | |||||

| February 7, 2008 |

February 15, 2008 | March 17, 2008 | 0.30 | |||||

| May 8, 2008 |

May 16, 2008 | June 16, 2008 | 0.34 | |||||

| August 7, 2008 |

August 15, 2008 | September 19, 2008 | 0.34 | |||||

| November 6, 2008 |

November 14, 2008 | December 15, 2008 | 0.34 | |||||

| February 12, 2009 |

February 23, 2009 | March 30, 2009 | 0.32 | * | ||||

| May 7, 2009 |

May 15, 2009 | June 15, 2009 | 0.30 | |||||

| August 6, 2009 |

August 14, 2009 | September 14, 2009 | 0.30 | |||||

| October 15, 2009 |

October 20, 2009 | November 23, 2009 | 0.30 | |||||

| December 16, 2009 |

December 24, 2009 | December 30, 2009 | 0.04 | |||||

| February 11, 2010 |

February 19, 2010 | March 19, 2010 | 0.20 | |||||

| May 3, 2010 |

May 12, 2010 | June 18, 2010 | 0.20 | |||||

| August 2, 2010 |

August 12, 2010 | September 17,2010 | 0.20 | |||||

| November 4, 2010 |

November 10, 2010 | December 17, 2010 | 0.20 | |||||

| March 1, 2011 |

March 10, 2011 | March 24, 2011 | 0.22 | |||||

| May 5, 2011 |

May 11, 2011 | June 23, 2011 | 0.22 | |||||

| August 4, 2011 |

August 15, 2011 | September 15, 2011 | 0.22 | |||||

| November 3, 2011 |

November 14, 2011 | November 29, 2011 | 0.22 | |||||

| February 27, 2012 |

March 12, 2012 | March 15, 2012 | 0.23 | |||||

| April 30, 2012 |

May 18, 2012 | May 25, 2012 | 0.24 | |||||

| July 30, 2012 |

August 17, 2012 | August 24, 2012 | 0.24 | |||||

| October 26, 2012 |

November 14, 2012 | November 21, 2012 | 0.24 | |||||

| February 26, 2013 |

March 11, 2013 | March 19, 2013 | 0.25 | |||||

| April 29, 2013 |

May 14, 2013 | May 21, 2013 | 0.27 | |||||

| July 29, 2013 |

August 13, 2013 | August 20, 2013 | 0.28 | |||||

| November 4, 2013 |

November 18, 2013 | November 25, 2013 | 0.31 | |||||

| February 24, 2014 |

March 10, 2014 | March 17, 2014 | 0.31 | |||||

| April 28, 2014 |

May 12, 2014 | May 19, 2014 | 0.31 | |||||

| July 28, 2014 |

August 18, 2014 | August 25, 2014 | 0.31 | |||||

| October 29, 2014 |

November 17, 2014 | November 24, 2014 | 0.31 | |||||

| February 24, 2015 |

March 12, 2015 | March 19, 2015 | 0.31 | |||||

| May 4, 2015 |

May 18, 2015 | May 25, 2015 | 0.31 | |||||

|

|

|

|||||||

| $ | 10.61 | |||||||

|

|

|

|||||||

| * | Dividend paid in cash and stock. |

On May 4, 2015 the Board of Directors declared a cash dividend of $0.31 per share to be paid on May 25, 2015 to shareholders of record as of May 18, 2015. This dividend represents our thirty-ninth consecutive dividend declaration since our initial public offering, bringing the total cumulative dividend declared to date $10.61 per share.

Our Board of Directors maintains a variable dividend policy with the objective of distributing four quarterly distributions in an amount that approximates 90—100% of our taxable quarterly income or potential annual income for a particular year. In addition, at the end of the year, we may also pay an additional special dividend or fifth dividend, such that we may distribute approximately all of our annual taxable income in the year it was earned, while maintaining the option to spill over our excess taxable income.

Distributions in excess of our current and accumulated earnings and profits would generally be treated first as a return of capital to the extent of the stockholder’s tax basis, and any remaining distributions would be treated as a capital gain. The determination of the tax attributes of our distributions is made annually as of the end of our fiscal year based upon our taxable income for the full year and distributions paid for the full year, therefore a determination made on a quarterly basis may not be representative of the tax attributes of our distributions to stockholders. If we had determined the tax attributes of our distributions year-to-date as of , , approximately % would be from ordinary income and spillover earnings from 20 , and % would be a return of capital.

S-20

We intend to distribute quarterly dividends to our stockholders. In order to avoid certain excise taxes imposed on RICs, we currently intend to distribute during each calendar year an amount at least equal to the sum of (1) 98% of our ordinary income for the calendar year, (2) 98.2% of our capital gains in excess of capital losses for the one year period ending on October 31 of the calendar year, and (3) any ordinary income and net capital gains for the preceding year that were not distributed during such year. We will not be subject to excise taxes on amounts on which we are required to pay corporate income tax (such as retained net capital gains). In order to obtain the tax benefits applicable to RICs, we will be required to distribute to our stockholders with respect to each taxable year at least 90% of our ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses.

We can offer no assurance that we will achieve results that will permit the payment of any cash distributions and, if we issue senior securities, we will be prohibited from making distributions if doing so causes us to fail to maintain the asset coverage ratios stipulated by the 1940 Act or if distributions are limited by the terms of any of our borrowings. See “Regulation” in the accompanying prospectus.

We maintain an “opt-out” dividend reinvestment plan for our common stockholders. As a result, if we declare a dividend, cash dividends will be automatically reinvested in additional shares of our common stock unless the stockholder specifically “opts out” of the dividend reinvestment plan and chooses to receive cash dividends. See “Dividend Reinvestment Plan” in the accompanying prospectus.

Our ability to make distributions will be limited by the asset coverage requirements under the 1940 Act.

S-21

We are offering the warrants described in this prospectus supplement and the accompanying prospectus through a number of underwriters. and are acting as representatives of the underwriters. We have entered into an underwriting agreement with the underwriters. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriters, and each underwriter has severally agreed to purchase, at the public offering price less the underwriting discounts and commissions set forth on the cover page of this prospectus supplement, the number of warrants listed next to its name in the following table:

| Underwriter |

Number of Warrants | |

| Total |

The underwriters are committed to purchase all of the warrants offered by us if they purchase any warrants. The underwriting agreement also provides that if an underwriter defaults, the purchase commitments of non-defaulting underwriters may also be increased or this offering may be terminated.

[Overallotment Option

The underwriters have an option to buy up to additional warrants from us to cover sales of shares by the underwriters which exceed the number of warrants specified in the table above. The underwriters have days from the date of this prospectus supplement to exercise this overallotment option. If any warrants are purchased with this overallotment option, the underwriters will purchase warrants in approximately the same proportion as shown in the table above. If any additional warrants are purchased, the underwriters will offer the additional shares on the same terms as those on which the shares are being offered.]

The underwriters propose to offer the warrants directly to the public at the public offering price set forth on the cover page of this prospectus supplement and to certain dealers at that price less a concession not in excess of $ per warrant. Any such dealers may resell warrants to certain other brokers or dealers at a discount of up to $ per warrant from the public offering price. After the public offering of the warrants the offering price and other selling terms may be changed by the underwriters. Sales of warrants made outside of the United States may be made by affiliates of the underwriters. The representatives have advised us that the underwriters do not intend to confirm discretionary sales in excess of % of the warrants offered in this offering.

Commissions and Discounts

The underwriting fee is equal to the public offering price per warrant less the amount paid by the underwriters to us per share of common stock. The underwriting fee is $ per share. The following table shows the per warrant and total underwriting discounts and commissions to be paid to the underwriters assuming both no exercise and full exercise of the underwriters’ option to purchase additional warrants.

| Per warrant | Total | |||||||||||

| Without Over- Allotment |

Without Over- Allotment |

With Over- Allotment |

||||||||||

| Public offering price |

$ | $ | $ | |||||||||

| Sales load (underwriting discounts and commissions) |

$ | $ | $ | |||||||||

| Proceeds before expenses |

$ | $ | $ | |||||||||

S-22

We estimate that the total expenses of this offering, including registration, filing and listing fees, printing fees and legal and accounting expenses, but excluding the underwriting discounts and commissions, will be approximately $ , or approximately $ per warrant excluding the overallotment and approximately $ per warrant including the overallotment.

[Lock-Up Agreements

During the period from the date of this prospectus supplement continuing through the date days after the date of this prospectus, we, our officers and directors have agreed with the representatives of the underwriters, subject to certain exceptions, not to:

| (1) | offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any shares of our common stock or any securities convertible into or exercisable or exchangeable for common stock, whether now owned or hereafter acquired, or |

| (2) | enter into any swap or other agreement, arrangement or transaction that transfers to another, in whole or in part, directly or indirectly, any of the economic consequences of ownership of any common stock or any securities convertible into or exercisable or exchangeable for any common stock. |

Moreover, if (1) during the last 17 days of such -day restricted period, we issue an earnings release or material news or a material event relating to us occurs or (2) prior to the expiration of such -day restricted period, we announce that we will release earnings results or become aware that material news or a material event will occur during the 16-day period beginning on the last day of such -day restricted period, the restrictions described above shall continue to apply until the expiration of the 18-day period beginning on the date of issuance of the earnings release or the occurrence of the material news or material event, as the case may be, unless the representatives of the underwriters waive, in writing, such extension.]

Price Stabilizations and Short Positions

In connection with this offering, and , on behalf of the underwriters, may purchase and sell securities in the open market. These transactions may include short sales, syndicate covering transactions and stabilizing transactions. Short sales involve sales by the underwriters of common stock in excess of the number of securities required to be purchased by the underwriters in the offering, which creates a syndicate short position. “Covered” short sales are sales of securities made in an amount up to the number of securities represented by the underwriters’ over-allotment option. Transactions to close out the covered syndicate short involve either purchases of such securities in the open market after the distribution has been completed or the exercise of the over-allotment option. In determining the source of securities to close out the covered syndicate short position, the underwriters may consider the price of securities available for purchase in the open market as compared to the price at which they may purchase securities through the over-allotment option. The underwriters may also make “naked” short sales, or sales in excess of the over-allotment option. The underwriters must close out any naked short position by purchasing securities in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the securities in the open market after pricing that could adversely affect investors who purchase in this offering. Stabilizing transactions consist of bids for or purchases of securities in the open market while this offering is in progress for the purpose of fixing or maintaining the price of the securities.

The underwriters also may impose a penalty bid. Penalty bids permit the underwriters to reclaim a selling concession from an underwriter or syndicate member when the underwriters repurchase securities originally sold by that underwriter or syndicate member in order to cover syndicate short positions or make stabilizing purchases.

Any of these activities may have the effect of raising or maintaining the market price of the securities or preventing or retarding a decline in the market price of the securities. As a result, the price of the securities may be higher than the price that might otherwise exist in the open market. The underwriters may conduct these transactions on or otherwise. Neither we nor any of the underwriters makes any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of our securities. In addition, neither we nor any of the underwriters makes any representation that the underwriters will engage in these transactions. If the underwriters commence any of these transactions, they may discontinue them at any time.

S-23

In connection with this offering, the underwriters may engage in passive market making transactions in our securities on in accordance with Rule 103 of Regulation M under the Exchange Act during a period before the commencement of offers or sales of securities and extending through the completion of distribution. A passive market maker must display its bid at a price not in excess of the highest independent bid of that security. However, if all independent bids are lowered below the passive market maker’s bid, that bid must then be lowered when specified purchase limits are exceeded.

Additional Underwriter Compensation

Certain of the underwriters and their respective affiliates have from time to time performed and may in the future perform various commercial banking, financial advisory and investment banking services for us and our affiliates for which they have received or will receive customary compensation. [Describe any specific transactions and compensation related thereto to the extent required to be disclosed by applicable law or regulation.]

Sales Outside the United States

No action has been taken in any jurisdiction (except in the United States) that would permit a public offering of our warrants, or the possession, circulation or distribution of this prospectus supplement or accompanying prospectus or any other material relating to us or the warrants in any jurisdiction where action for that purpose is required. Accordingly, our warrants may not be offered or sold, directly or indirectly, and none of this prospectus supplement, the accompanying prospectus or any other offering material or advertisements in connection with our warrants may be distributed or published, in or from any country or jurisdiction except in compliance with any applicable rules and regulations of any such country or jurisdiction.

Each of the underwriters may arrange to sell our warrants offered hereby in certain jurisdictions outside the United States, either directly or through affiliates, where it is permitted to do so.

[Insert applicable legends for jurisdictions in which offers and sales may be made.]

Electronic Delivery

The underwriters may make this prospectus supplement and accompanying prospectus available in an electronic format. The prospectus supplement and accompanying prospectus in electronic format may be made available on a website maintained by any of the underwriters, and the underwriters may distribute such documents electronically. The underwriters may agree with us to allocate a limited number of securities for sale to their online brokerage customers. Any such allocation for online distributions will be made by the underwriters on the same basis as other allocations.

We estimate that our share of the total expenses of this offering, excluding underwriting discounts, will be approximately $ .

We have agreed to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act.

The addresses of the underwriters are: .

S-24

Certain legal matters in connection with the securities offered hereby will be passed upon for us by Sutherland Asbill & Brennan LLP, Washington, DC. Certain legal matters in connection with the securities offered hereby will be passed upon for the underwriters by .

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The consolidated financial statements as of December 31, 20[ ] and 20[ ] and for each of the three years in the period ended December 31, 20[ ] and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) as of December 31, 20[ ] included in this prospectus supplement have been so included in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

We have filed with the SEC a registration statement on Form N-2, together with all amendments and related exhibits, under the Securities Act, with respect to our shares of common stock offered by this prospectus supplement and the accompanying prospectus. The registration statement contains additional information about us and our shares of common stock being offered by this prospectus supplement and the accompanying prospectus.

We are required to file with or submit to the SEC annual, quarterly and current periodic reports, proxy statements and other information meeting the informational requirements of the Exchange Act. You may inspect and copy these reports, proxy statements and other information, as well as the registration statement and related exhibits and schedules, at the Public Reference Room of the SEC in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. The SEC maintains an Internet site that contains reports, proxy and information statements and other information filed electronically by us with the SEC which are available on the SEC’s website at http://www.sec.gov. Copies of these reports, proxy and information

S-25

statements and other information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing to the SEC’s Public Reference Section, Washington, D.C. 20549. The information is available free of charge by contacting us at Hercules Technology Growth Capital, Inc., 400 Hamilton Avenue, Suite 310, Palo Alto, CA 94301, or by calling us collect at (650) 289-3060 or on our website at www.herculestech.com.

S-26