2025 PROXY STATEMENT Notice of Annual Meeting June 18, 2025 |

Empowering Innovators |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

x | No fee required |

o | Fee paid previously with preliminary materials |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11 |

TO MY FELLOW STOCKHOLDER, On behalf of the Board of Directors and the Hercules Capital team, thank you for your investment. Following another record-breaking year in 2024, it is my pleasure to once again invite you to the Hercules Capital Annual Meeting of Stockholders. Hercules Capital achieved a significant milestone in 2024 as we celebrated 20 years of investment activity while our investment platform reached and surpassed the $20 billion mark in cumulative debt commitments since inception. This achievement underscores our commitment to serving the capital needs of the venture and growth- stage ecosystems. Since our inception, our success has been made possible by the tremendous work and dedication of our talented employees and the trust that our investors have placed with us. We are grateful to continue to serve our stockholders by successfully supporting innovative technology and life sciences companies. Serving our stockholders means protecting their investment. For the last two years, stockholders have granted us the ability to sell shares of common stock if the price per share is less than the net asset value per share, subject to certain conditions. While we have no current intention to conduct such sales, the Board of Directors and I continue to believe strongly that having this approval is protective to stockholders during times of market volatility. The current approval expires August 15, 2025. We are asking you to once again renew this approval for an additional twelve month period by voting your shares in favor of Proposal 3 using one of the methods described on page 1 of this proxy statement before June 18, 2025. |  | |

Hercules Capital achieved a significant milestone in 2024 as we celebrated 20 years of investment activity while our investment platform reached and surpassed the $20 billion mark in cumulative debt commitments since inception. | ||

Your investment and support is vital to our mission and success. | The Board of Directors and the entire Hercules team remain steadfast in our efforts to maximize total stockholder returns and expand our platform capabilities for the benefit of our clients. We will continue to be guided by our unwavering commitment to venture and growth- stage companies and doing what we believe is in the best interests of our stockholders - just as we have done for more than 20 years. Thank you for your continued commitment to Hercules Capital and the entrepreneurs and businesses we serve. |

Sincerely, | |

| |

Scott Bluestein Chief Executive Officer Chief Investment Officer |

NOTICE OF 2025 ANNUAL MEETING |

Date and Time | Location | Record Date |

Wednesday, June 18, 2025 9:00 a.m. Eastern Time | www.virtualshareholdermeeting.com/HTGC2025 | Thursday, April 17, 2025 |

Proposal | Description | Board Recommendation | For more information, see page: | |||

FOR | ||||||

FOR | ||||||

3 | Authorization of the Company to sell or issue Shares at a price below its then-current NAV per share, subject to the conditions set forth in Proposal 3 | FOR | ||||

4 | FOR |

YOUR VOTE IS IMPORTANT – How to vote: |

| Internet: Visit www.proxyvote.com You will need the 16-digit control number included in the proxy card, voter instruction card or notice. |  | Phone Call 1-800-690-6903 or the number on your voter instruction form. You will need the control number included in your proxy card. | |||||

| QR Code You can scan the QR Code on your proxy card to vote with your mobile phone. |  | Mail Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. |

By Order of the Board, | |

| |

Kiersten Zaza Botelho Corporate Secretary |

Definition of Certain Terms or Abbreviations | Where You Can Find More Information | |

1940 Act means the Investment Company Act of 1940, as amended Annual Meeting means the 2025 annual meeting of stockholders Annual Report means the Company’s Annual Report on Form 10-K BDC means business development company Board means the Company’s Board of Directors CEO means chief executive officer Committees means the Company’s Audit, Compensation and Nominating and Governance (“Governance”) Committees Company, we or us means Hercules Capital, Inc., its wholly-owned subsidiaries and affiliated securitization trusts Director means a member of the Company’s Board Dodd-Frank Act means the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 Exchange Act means the Securities Exchange Act of 1934, as amended Independent Director means a Director who is not an “interested person” of the Company, as defined by the 1940 Act and applicable NYSE rules Independent Public Accountant means PricewaterhouseCoopers LLP, or PwC NAV means net asset value NEO means named executive officer NYSE means the New York Stock Exchange Proxies refers to Scott Bluestein and Kiersten Zaza Botelho, the designated proxies for the Annual meeting Proxy Statement means this proxy statement, which provides important information about the Annual Meeting RIC means regulated investment company under the Internal Revenue Code of 1986, as amended SEC means the Securities and Exchange Commission Securities Act means the Securities Act of 1933, as amended Shares means shares of the Company’s common stock | Annual Meeting | |

Proxy Statement & Annual Report https://investor.htgc.com/company-information/annual-reports-proxy Voting Your Proxy Online before the 2025 Annual Meeting www.proxyvote.com | ||

Board of Directors | ||

https://investor.htgc.com/corporate-governance board-of-directors | ||

Communications with the Board | ||

Please see page 10 of this Proxy Statement for details. | ||

Committee Charters | ||

https://investor.htgc.com/corporate-governance/governance- documents • Audit Committee Charter • Compensation Committee Charter • Nominating and Corporate Governance Committee Charter | ||

Other Governance Documents | ||

https://investor.htgc.com/corporate-governance/governance- documents • Code of Business Conduct and Ethics • Code of Ethics for Directors, Officers and All Employees • Corporate Governance Guidelines • ESG Policy • Sarbanes-Oxley Whistleblower Procedures | ||

Investor Relations | ||

https://investor.htgc.com |

Quorum Required to Hold the Annual Meeting |

Vote Required for Each Proposal to Pass | |||

Proposal | Vote Required | ||

1 | Election of three Directors | Affirmative vote of a majority of the votes cast for and against a Director Nominee at the Annual Meeting in person or by proxy | |

2 | Advisory vote to approve the Company’s named executive officer compensation | Affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy | |

3 | Authorization of the Company to sell or issue Shares at a price below its then-current NAV per share, subject to the conditions set forth in Proposal 3 | The affirmative vote of holders of at least a “majority of outstanding shares” (as defined in the 1940 Act) of (i) the Shares and (ii) the Shares held by persons that are not affiliated persons of the Company, is required to approve this proposal. Under the 1940 Act, the vote of holders of a “majority of outstanding shares” means the vote of the holders of the lesser of (a) 67% or more of the outstanding Shares present or represented by proxy at the Annual Meeting if the holders of more than 50% of the Shares are present or represented by proxy or (b) more than 50% of the outstanding Shares | |

4 | Ratification of the selection of the Independent Public Accountant for the fiscal year ending December 31, 2025 | Affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy | |

Abstentions and Broker Non-Votes |

An abstention represents action by a stockholder to refrain from voting “for” or “against” a proposal. Abstentions will have no effect on the outcomes of Proposals 1, 2, and 4 but will have the effect of a vote against Proposal 3. “Broker non-votes” represent votes that are not cast on a non-routine matter by a broker that is present (in person or by proxy) at the meeting because (i) the Shares entitled to cast the votes are held in “street name,” (ii) the broker lacks discretionary authority to vote the Shares and (iii) the broker has not received voting instructions from the beneficial owner. For the Annual Meeting, each of Proposals 1 – 3 is a non-routine matter. This means that if you hold your Shares in “street name,” your broker, bank or nominee will not be able to vote your Shares with respect to Proposals 1 – 3 unless you give your broker (or bank or other nominee) specific instructions on how to vote your Shares. Proposal 4 is a routine matter. As a result, if you beneficially own your Shares and you do not provide your broker, bank or nominee with voting instructions, then your broker, bank or nominee will be able to vote your Shares with respect to Proposal 4 on your behalf. |

YOUR VOTE IS IMPORTANT – PLEASE VOTE TODAY |

2025 Annual Meeting and How to Vote |

Proposal | Description | Board Recommendation | For more information, see page: | |||

FOR | ||||||

FOR | ||||||

3 | FOR | |||||

4 | FOR |

How to Vote |

| Internet: Visit www.proxyvote.com You will need the 16-digit control number included in the proxy card, voter instruction card or notice. |  | Phone Call 1-800-690-6903 or the number on your voter instruction form. You will need the control number included in your proxy card. | |||||

| QR Code You can scan the QR Code on your proxy card to vote with your mobile phone. |  | Mail Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. |

Frequently Asked Questions and Contact Information |

• Why did I receive this Proxy Statement? • How do I vote? • What happens if I do nothing (aka choose not to vote)? • May I change my vote or revoke my proxy? • What is householding? | • What is the vote required for each proposal? • What are abstentions and “broker non-votes”? • Who is paying for the costs of soliciting these proxies? • Do stockholders have dissenters’ or appraisal rights? • How do I find out the results of the voting at the Annual Meeting? |

About Hercules, Our Governance and Our Performance |

Corporate Governance Highlights |

Board Practices | Stockholder Matters | |||||

•7 out of 8 Directors are Independent Directors •Demonstrated commitment to Board refreshment (since 2021, assuming election of current Director Nominees, 4 new Directors have joined and 4 have rolled off the Board) •Demonstrated commitment to periodic committee refreshment and committee chair succession (since 2019, new chairs have been appointed on all three Committees) •Robust Director nominee selection process •Regular Board, Committee and Director evaluations •Lead Independent Director elected by the Independent Directors, with robust duties and oversight responsibilities •Independent Audit, Compensation and Governance Committees •Regular executive sessions of Independent Directors •Strategy and risk oversight by full Board and Committees •Regular review and assessment of Committee responsibilities | •Long-standing, active stockholder engagement •Annual “say-on-pay” advisory vote (90.3% stockholder approval (based on number of votes cast) in 2024) •Majority voting with resignation policy for Directors in uncontested elections | |||||

Other Best Practices | ||||||

•Stock ownership guidelines for executive officers and Directors •Annual Board review of CEO and senior management succession planning • Anti-hedging and anti-pledging policies • Clawback policy for incentive awards • No tax gross-up payments | ||||||

2024 Performance |

Name Address of Beneficial Owner | Type of Ownership | Number of Shares Owned Beneficially(1) | Percentage of Class | ||||

Interested Director | |||||||

Scott Bluestein(2) | Record/Beneficial | 2,292,204 | 1.3% | ||||

Independent Directors | |||||||

Robert P. Badavas(3) | Record/Beneficial | 111,686 | * | ||||

DeAnne Aguirre(4) | Record/Beneficial | 13,875 | * | ||||

Gayle Crowell(5) | Record/Beneficial | 62,069 | * | ||||

Thomas J. Fallon(6) | Record/Beneficial | 99,697 | * | ||||

Wade Loo(7) | Record/Beneficial | 26,560 | * | ||||

Pam Randhawa(8) | Record/Beneficial | 16,225 | * | ||||

Nikos Theodosopoulos(9) | Record/Beneficial | 5,962 | * | ||||

Other Executive Officers | |||||||

Seth H. Meyer(10) | Record/Beneficial | 384,630 | * | ||||

Christian Follmann(11) | Record/Beneficial | 121,301 | * | ||||

Kiersten Zaza Botelho(12) | Record/Beneficial | 67,563 | * | ||||

Executive Officers and Directors as a group (11 persons)(13) | 1.8% | ||||||

Beneficial Owners of More than 5% | |||||||

Kingdom Holding Company(14) | 9,411,490 | 5.4% |

Name and Address of Beneficial Owner | Dollar Range of Equity Securities Beneficially Owned | ||

Interested Director | |||

Scott Bluestein | Over $100,000 | ||

Independent Directors | |||

Robert P. Badavas | Over $100,000 | ||

DeAnne Aguirre | Over $100,000 | ||

Gayle Crowell | Over $100,000 | ||

Thomas J. Fallon | Over $100,000 | ||

Wade Loo | Over $100,000 | ||

Pam Randhawa | Over $100,000 | ||

Nikos Theodosopoulos | Over $100,000 | ||

Other Executive Officers | |||

Seth H. Meyer | Over $100,000 | ||

Christian Follmann | Over $100,000 | ||

Kiersten Zaza Botelho | Over $100,000 |

PROPOSAL 1 |

Key Sections | Page |

Page | |

Summary of the Board and 2025 Director Nomination Process |

Key Stockholder Considerations |

Board Structure and Composition |

Board Committees |

Director Qualifications |

Corporate Governance Practices |

Board Practices | Stockholder Matters | |||

•7 out of 8 Directors are Independent Directors •Demonstrated commitment to Board refreshment (since 2021, assuming election of current Director Nominees, 4 new Directors have joined and 4 have rolled off the Board) •Demonstrated commitment to periodic committee refreshment and committee chair succession (since 2019, new chairs have been appointed on all three committees) •Robust Director nominee selection process •Regular Board, Committee and Director evaluations •Lead Independent Director elected by the Independent Directors, with robust duties and oversight responsibilities •Independent Audit, Compensation and Governance Committees •Regular executive sessions of Independent Directors •Strategy and risk oversight by full Board and Committees •Regular review and assessment of Committee responsibilities | • Long-standing, active stockholder engagement •Annual “say-on-pay” advisory vote 90.3% stockholder approval (based on number of votes cast) in 2024) •Majority voting with resignation policy for Directors in uncontested elections | |||

Other Best Practices | ||||

•Stock ownership guidelines for executive officers and Directors •Annual Board review of CEO and senior management succession planning • Anti-hedging and anti-pledging policies • Clawback policy for incentive awards • No tax gross-up payments | ||||

Director Independence; Conflicts |

Board Oversight of Risk |

Corporate Responsibility |

Additional Information |

Communication with the Board |

Availability of Corporate Governance Documents |

Committee Composition, Responsibilities and Meetings |

AUDIT COMMITTEE | COMPENSATION COMMITTEE | NOMINATING & CORPORATE GOVERNANCE COMMITTEE | |||||

Members | Wade Loo (Chair) Robert P. Badavas Pam Randhawa Nikos Theodosopoulos | Gayle Crowell (Chair) DeAnne Aguirre Wade Loo Nikos Theodosopoulos | Thomas J. Fallon (Chair) DeAnne Aguirre Gayle Crowell Pam Randhawa | ||||

Meetings held in 2024 | 5 | 5 | 4 | ||||

Key Oversight Responsibilities | •Oversees the accounting and financial reporting processes and the integrity of the financial statements. • Establishes procedures for complaints relating to accounting, internal accounting controls or auditing matters. • Examines the independence qualifications of our auditors. • Assists our Board’s oversight of our compliance with legal and regulatory requirements and enterprise risk management. • Assists our Board in fulfilling its oversight responsibilities related to the systems of internal controls and disclosure controls which management has established regarding finance, accounting, and regulatory compliance. • Reviews and recommends to the Board the valuation of the Company’s portfolio. | • Oversees our overall compensation strategies, plans, policies and programs. •Approves Director and executive compensation. •Assesses compensation-related risks. •Reviews compliance with applicable exemptive orders and stockholder-approved equity compensation plans. •Approves and oversees the implementation of the executive compensation clawback policy. | •Discharges our Board’s responsibilities related to general corporate governance practices, including developing, reviewing and recommending to our Board a set of principles to be adopted as the Company’s Corporate Governance Guidelines. •Conducts an annual performance evaluation of our Board, its Committees, and its members. •Reviews Board composition, size, and refreshment and identifying and recommending to our Board qualified director candidates. •Oversees succession planning for the CEO, Section 16 officers and senior management who report to the CEO. •Oversees the Director resignation policy set forth in the Corporate Governance Guidelines. •Criteria considered by the Governance Committee in evaluating qualifications of individuals for election as members of the Board consist of the independence and other applicable NYSE corporate governance requirements; the 1940 Act and all other applicable laws, rules, regulations and listing standards; and the criteria, polices and principles set forth in the Governance Committee charter. •Considers nominees properly recommended by a stockholder. •Regularly considers the composition of our Board to ensure there is a proper combination of skills, professional experience, tenure and diverse viewpoints, perspectives and backgrounds. |

Biographical Summary Table (Directors) |

Name, address and age(1) | Position(s) held with Company | Term of office and length of time served | Principal occupation(s) during the past 5 years | Other directorships held by Director or Director Nominee during the past 5 years | ||||

Robert P. Badavas (72) | Lead Independent Director | Class I Director since 2006 | President of Petros Ventures, Inc. from November 2009 to December 2011 and since September 2016. | Polyvinyl Films, Inc. since 2019. | ||||

Pam Randhawa (56) | Independent Director | Class I Director since 2021 | Founder and Chief Executive Officer of Empiriko Corporation since 2010. | Massachusetts Life Science Center since 2016 and Massachusetts Biotechnology Council since 2017. | ||||

Gayle Crowell (74) | Independent Director | Class II Director since 2019 | Independent Business Consultant since 2019. | Envestnet (formerly NYSE: ENV) from 2016 to 2024, Pliant Therapeutics since 2019, Instinct Science since 2022, Centerbase since 2022, Fexa since 2023, GTreasury from 2021 to 2023, and Resman from 2020 to 2021. | ||||

Thomas J. Fallon (63) | Independent Director | Class II Director since 2014 | Executive Vice President - Business Development of Sanmina Corporation since 2022, Chief Executive Officer of Infinera Corporation from 2010 to 2020. | Infinera Corporation from 2010 to 2020. | ||||

Nikos Theodosopoulos (62) | Independent Director | Class II Director since 2023 | Independent director, advisor, consultant and angel investor in the technology industry. | Arista Networks from 2014 to 2023, Driving Management Systems from 2018 to 2022, Harmonic from 2015 to 2022, ADVA Optical Networking from 2014 to 2022. Adtran Holdings Board Member since 2022. | ||||

DeAnne Aguirre (64) | Director Nominee and Independent Director | Class III Director since 2022 | North America Managing Partner and Health Industries Leader at Strategy&, a PwC Network Company from 2015 to 2020. | Cisive, a GTCR portfolio company, since 2022; EPAM Systems, Inc. since 2023. | ||||

Wade Loo (64) | Director Nominee and Independent Director | Class III Director since 2021 | Investor Committee Member at Mapletree Europe Income Trust since 2021 and Investment Committee Member at Mapletree US Commercial Income Trust since 2021. | Silicon Valley Community Foundation 2015 to 2023, University of Denver – Daniels College of Business since 2015, University of Denver Board of Trustees since 2023, Computer History Museum since 2023, JobTrain from 2006 to 2019. | ||||

Scott Bluestein (46) | Director Nominee and Interested Director, Chief Executive Officer and Chief Investment Officer | Class III Director since 2019 | Chief Investment Officer of Hercules since 2014; Director and Chief Executive Officer since 2019. |

Biographical Information of Director Nominees |

SCOTT BLUESTEIN Interested Director, Chief Executive Officer and Chief Investment Officer Age: 46 Board Member since 2019 Term expires in 2025 | Mr. Bluestein is the only Interested Director on the Board, as he also serves as the Company’s Chief Executive Officer and Chief Investment Officer. He joined the Company as Chief Credit Officer in 2010 and was promoted to Chief Investment Officer in 2014. While continuing to serve in that role, he was elected as Chief Executive Officer and President in 2019. Additional Business Experience • Founder and Partner, Century Tree Capital Management (2009-2010) • Managing Director, Laurus-Valens Capital Management, an investment firm specializing in financing small and microcap growth-oriented businesses through debt and equity securities (2003-2009) • Member of Financial Institutions Coverage Group focused on Financial Technology, UBS Investment Bank (2000-2003) Private Directorships • Director, Tectura Corporation since 2017. • Director, Gibraltar Business Capital since 2019. • Director, Gibraltar Equipment Finance since 2023 Past Directorships • Director, Sungevity from 2017 – 2020 Education • Bachelor’s degree in Business Administration from Emory University |

WADE LOO ✓ Independent Director Age: 64 Board Member since 2021 Term expires in 2025 Committee Memberships: • Audit (Chair) •Compensation | Business Experience • Audit partner for multinationals and venture-backed entities, with experience working with companies in the areas of technology, financial and life sciences •Partner in Charge of KPMG LLP’s Northern California Audit Business Unit, whose territory includes the Silicon Valley and San Francisco offices •Certified Public Accountant (California) Prior Public Company Directorships •Guidance Software - Board Member and Audit Committee Chair (2016-2017) •Kofax Ltd. - Board Member and Audit Committee Chair (2011-2015) Private and Non-Profit Directorships •Member of the Board of Trustees at University of Denver (2023-present) •Board Member at Computer History Museum, a not-for-profit museum (2023-Present) •Investor Committee Member at Mapletree Europe Income Trust and Mapletree US Income Commercial Trust, both Private Real Estate Investment Trusts (2021-present) •Board Member (2015-2023), Audit Committee Chair (2015-2019) and Board Chair (2021-2023) at the Silicon Valley Community Foundation •Executive Advisory Board Member at the University of Denver—Daniels College of Business (2015- present) and Board Chair (2018-2021) •JobTrain—Board Member (2006-2018), Audit Committee Chair (2006-2010) and Board Chair (2011-2017) Other Experience •Led KPMG’s Audit Committee Institute activities in Silicon Valley, which provides audit committee and governance best practices to audit committee chairs Education •Bachelor’s degree in Accounting from the University of Denver | |||

KEY QUALIFICATIONS AND EXPERIENCE | ||||

✓ Client Industries. Experience in venture capital-backed companies in general, and our specific portfolio company industries: technology, life sciences and middle market. ✓ Banking/Financial Services. Experience with banking, mutual fund or other financial services industries, including regulatory experience and specific knowledge of the Securities Act. ✓ Leadership/Strategy. Both as partner at KPMG and board chair at various organizations, responsible for leading large teams and establishing and executing successful business strategies. ✓ Finance, IT and other Business Processes. Extensive experience as an audit partner and audit committee chair related to finance, accounting and internal controls, IT and other key business processes | ✓ Enterprise Risk Management. Experience with enterprise risk management processes and functions, including compliance and operations. ✓ Governance. Experience with corporate governance issues, particularly in publicly-traded companies. ✓ Strategic Planning. Experience with senior executive level strategic planning for publicly-traded companies, private companies and non-profit companies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A, both in identifying targets and evaluating potential targets, as well as post-acquisition integration. | |||

DEANNE AGUIRRE ✓ Independent Director Age: 64 Board Member since 2022 Term expires in 2025 Committee Memberships: •Governance •Compensation | Business Experience • North America Managing Partner and Health Industries Leader at Strategy&, a PwC Network Company, and Healthcare Strategy Leader for the strategy consulting business •Various positions, including Technology Leader of Southern Cone based in Brazil, and Co-leader Organization and Strategic Leadership Business at Booz & Co./Booz Allen Hamilton Public Directorships •EPAM Systems, Inc. (NYSE: EPAM) (member of nominating and corporate governance committee), a leading digital transformation services and product engineering company, since 2023 Private Directorships •Director, Cisive, a global technology-enabled compliance solutions company, since 2022 Prior Directorships •Director, Global board of directors at Booz & Co./Booz Allen Hamilton from 1998 to 2007 •Director, Stanford University Sloan Advisory Board from 1994 to 2005 Director, Catalyst Global Advisory Board from 2011 to 2013 •Director, Catalyst Western Region Advisory Board from 2005 to 2011 Education • Master’s degree in Science, Business Administration from Stanford University • Bachelor’s degree in Science, Mathematics with an emphasis in Computer Science from Fort Hays State University Other Experience • Member, National Association of Corporate Directors (NACD) • Member, Women Corporate Directors (WCD) | ||||

KEY QUALIFICATIONS AND EXPERIENCE | |||||

✓ Leadership/Strategy. Extensive experience as a director and executive with broad operational experience in investments and finance. ✓ Finance, IT and other Business Processes. Extensive experience in commercial lending, sales marketing as well as other key business processes ✓ Governance. Experienced in both corporate governance and executive compensation for both public and private companies. | ✓ Strategic Planning. Experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration. ✓ Enterprise Risk Management. Co-leader of Booz Allen Hamilton's Business Continuity Program solving critical cyber security problems and ensuring business continuity. | ||||

Biographical Information of Directors |

ROBERT P. BADAVAS ✓ Independent Director (Board Chair) Age: 72 Board Member since 2006 Term expires in 2026 Committee Memberships: • Audit | Business Experience • President, Petros Ventures, Inc., a management and advisory services firm (2009-2011 and since 2016) • President and Chief Executive Officer at TAC Worldwide, a multi-national technical workforce management and business services company (2005-2009) • Chairman and CEO of PlumChoice, Inc., a technology services and software company (2011-2016) • Executive Vice President and Chief Financial Officer, TAC Worldwide (2003-2005) • Senior Partner and Chief Operating Officer, Atlas Venture, an international venture capital firm (2001-2003) • Chief Executive Officer at Cerulean Technology, Inc., as venture capital backed wireless application software company (1995-2001) •Certified Public Accountant, PwC (1974-1983) Public Directorships •Constant Contact, Inc., including chairman of the audit committee, a provider of email and other engagement marketing products and services for small and medium sized organizations, acquired by Endurance International Group Holdings, Inc. (2007-2016) Private Directorships • Polyvinyl Films, Inc., director, a leading manufacturer and distributer of food-grade film products for consumer, retail, and food-service markets worldwide (since 2019) Prior Directorships • PlumChoice, a venture-backed technology, software and services company • RSA Security, a computer and network security company – publicly traded until acquired by EMC • Arivana, Inc., a telecommunications infrastructure company—publicly traded until its acquisition by SAC Capital • On Technology, an IT software infrastructure company—publicly traded until its acquisition by Symantec • Renaissance Worldwide; an IT services and solutions company—publicly traded until its acquisition by Aquent Other Experience •Trustee Emeritus, Bentley University (2005-2019); Board Chair (2018-2019); Vice Chair (2013-2018) • Board of Trustees Executive Committee and Corporate Treasurer, Hellenic College/Holy Cross School of Theology (2002-2018) • Trustee Emeritus, The Learning Center for the Deaf; Board Chair (1995-2005) • Master Professional Director Certification, American College of Corporate Directors • National Association of Corporate Directors Certification • Annunciation Greek Orthodox Cathedral of New England, Parish Council President (2016-2022) Education •Bachelor’s degree in Accounting and Finance from Bentley University | ||||

KEY QUALIFICATIONS AND EXPERIENCE | |||||

✓ Client Industries. Extensive experience in software, business and technology enabled services and venture capital. ✓ Leadership/Strategy. Significant experience as a senior corporate executive in private and public companies, including tenure as CEO, CFO and COO ✓ Finance, IT and Other Business Strategy and Enterprise Risk Management. Prior experience as a CEO directing business strategy and as a CFO directing IT, financing and accounting, strategic alliances and human resources and evaluation of enterprise risk in such areas. | ✓ Enterprise Risk Management. Experience in managing enterprise risk as CEO. ✓ Governance. Extensive experience as an executive and director of private and public companies with governance matters. ✓ Strategic Planning. Experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration. | ||||

PAM RANDHAWA ✓ Independent Director Age: 56 Board Member since 2021 Term expires in 2026 Committee Memberships: • Audit • Governance | Business Experience •CEO and Founder of Empiriko Corporation, a biotechnology startup (2010-present) • Co-Founder, AgroGreen Biofuels, renewable energy startup (2010-2012) • Vice President, Strategic Development, Sermo, a healthcare technology company (2008-2009) • Vice President, Marketing, Phase Forward, a life sciences technology company (2005-2007) Other Business Experience • Director of Massachusetts Life Sciences Center, a Massachusetts Investment Fund to promote the life sciences sector (2016-present) • Director and past chair of Massachusetts Biotechnology Council, an industry association for biotechnology (2017-present) Non-Profit/Government Leadership • Member, The World Economic Forum’s Global Future Council on Biotechnology (2018-2020) • Chair, National Science Foundation and National Institution of Justice, Industrial Advisory Board of Center for Advanced Research in Forensic Science (2019-2020) • Member, the Economic Development Planning Council for the State of Massachusetts (2019) • Member, Boston Women’s Workforce Council, a public-private partnership between the Mayor’s Office and Greater Boston employers dedicated to eliminating the gender/racial wage gap (2016-2020) Education • BA in Economics from University of Rajasthan • MPM from Carnegie Mellon University | ||||

KEY QUALIFICATIONS AND EXPERIENCE | |||||

✓ Client Industries. Experience leading and advising venture capital-backed companies generally and in our portfolio company industries. ✓ Finance, IT and Other Business Processes. Experience related to finance, IT, sales, business development, marketing, or other key business processes. ✓ Governance. Experience with corporate governance issues ✓ Strategic Planning. Experience with senior executive-level strategic planning for publicly-traded companies, private companies, non-profit and government. | ✓ Enterprise Risk Management. Experience with enterprise risk management processes and functions, including compliance and operational. ✓ Leadership/Strategy. Experience leading teams and establishing and executing successful business strategies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration. | ||||

GAYLE CROWELL ✓ Independent Director Age: 74 Board Member since 2019 Term expires in 2027 Committee Memberships: •Compensation (Chair) • Governance | Business Experience •Independent Business Consultant since 2019 •Senior Operating Consultant, Warburg Pincus, a leading global private equity firm (2001-2019) •President and CEO, RightPoint Software (acquired by E.piphany), customer relationship development and management software (1998-2000) •Senior Vice President and General Manager, ViewStar (acquired by Mosaix), network-based process automation software encompassing workflow automation, document image processing and information management company (1994-1998) •Group Director, Oracle Corporation, computer technology corporation (1990-1992) •Vice President of Sales, DSC, networking company (1989-1990) •Vice President of Sales, Cubix Corporation, designer, engineer and manufacturer of computer hardware systems (1985-1989) Public Directorships •Pliant Therapeutics (chair of the nominating and governance committee and member of the audit committee), a clinical stage biopharmaceutical company that discovers, develops and commercializes novel therapies for the treatment of fibrosis (since 2019) Private Directorships •Executive Chair, Instinct Science, a provider of cloud-based, electronic medical records and practice management systems for the modern veterinary office and hospital (since 2022) •Executive Chair, Centerbase, a law practice software platform that allows law firms to support the management and growth of their firms with configurable legal operations and client lifecycle management software solutions (since 2022). •Lead Director, Fexa, a provider of innovative facility management software tools that cater to the needs of retailers, restauranteurs, and service providers (since 2023) Prior Directorships •Envestnet (chair of information security and compliance committee and nominating and governance committee, member of compensation committee and audit committee), a formerly public (NYSE: ENV) leading provider of integrated portfolio, practice management, and reporting solutions to financial advisors and institutions (2016-2024) •Lead Director, GTreasury, an integrated digital treasury management platform that allows companies to manage liquidity risk, market risk, counter party and credit risk (2021-2023) •Dude Solutions, the leading provider of cloud-based operations management software to optimize facilities, assets and workflow (2014-2019) •Lead Director, Resman, a property management platform of owners, operators and investors across the multifamily, affordable and commercial real estate marketplaces (2020-2021) •MercuryGate, a developer of a transportation management system and offers a software that enables shippers, carriers, brokers, freight forwarders and third-party logistics providers to plan, monitor and track shipments (2014-2018) •Lead Director, Yodlee, the leading data aggregation and data analytics platform, helps consumers live better financial lives through innovative products and services delivered through financial institutions and FinTech companies (2002-2015) •Coyote Logistics, a third-party logistics provider that combines a centralized marketplace with freight and transportation solutions to empower your business (2011-2015) •SRS, an automotive dealer software designed to increase fixed operations profitability, provide customer multipoint vehicle reports and increase customer loyalty and retention (2004-2013) •TradeCard, a SaaS collaboration product that was designed to allow companies to manage their extended supply chains including tracking movement of goods and payments (2009-2013) Other Experience •Member, National Association of Corporate Directors (NACD) •Member, Women Corporate Directors (WCD) Education •BS from University of Nevada Reno | |||

KEY QUALIFICATIONS AND EXPERIENCE | ||||

✓ Client Industries. Significant experience in venture capital and technology. ✓ Banking/Financial Services. Held a variety of key executive and management positions at large global financial institutions. Significant experience as a board member and board committee chair overseeing financial services regulatory compliance. ✓ Leadership/Strategy. Extensive experience as a director and executive with broad operational experience in investments and finance. ✓ Finance, IT and other Business Processes. Extensive experience in commercial lending, sales marketing as well as other key business processes ✓ Enterprise Risk Management. Experience in managing enterprise risk as CEO. Significant experience in cybersecurity and regulatory oversight as a director and committee chair and as a career technologist with cybersecurity software experience. | ✓ Governance. Experienced in both corporate governance and executive compensation for both public and private companies. ✓ Strategic Planning. Experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration. ✓ Cybersecurity. Experience in cybersecurity, a certification or degree in cybersecurity, or the knowledge, skills or other background in cybersecurity, including, for example, in the areas of security policy and governance, risk management, security assessment, control evaluation, security architecture and engineering, security operations, incident handling, or business continuity planning. | |||

THOMAS J. FALLON ✓ Independent Director Age: 63 Board Member since 2014 Term expires in 2027 Committee Memberships: •Governance (Chair) | Business Experience • Executive Vice President - Business Development, Sanmina Corporation, an American electronics manufacturing services provider (2022-present) • Chief Executive Officer, Infinera Corporation, a global supplier of innovative networking solutions (2010-2020) • Chief Operating Officer, Infinera Corporation (2006-2009) • Vice President of Engineering and Operations, Infinera Corporation (2004-2006) Other Business Experience • Vice President, Corporate Quality and Development Operations of Cisco Systems, Inc. (2003-2004) • General Manager of Cisco Systems’ Optical Transport Business Unit, Vice President Operations, Vice President Supply, various executive positions (1991-2003) Prior Directorships • Infinera Corporation, a global supplier of innovative networking solutions (2009-2022) • Piccaro, a leading provider of solutions to measure greenhouse gas concentrations, trace gases and stable isotopes (2010-2016) Other Experience • Member, Engineering Advisory Board of the University of Texas at Austin • Member, President’s Development Board University of Texas • Member, Technical Advisory Board Quantumscape Education • Bachelor’s degree in Mechanical Engineering from the University of Texas at Austin • Master’s degree in Business Administration from the University of Texas at Austin | |||

KEY QUALIFICATIONS AND EXPERIENCE | ||||

✓ Client Industries. Significant experience in venture capital and technology. ✓ Leadership/Strategy. Extensive experience as a director and executive with broad operational experience in investments and finance. ✓ Finance, IT and other Business Processes. Extensive experience in commercial lending, sales marketing as well as other key business processes ✓ Enterprise Risk Management. Experience in managing enterprise risk as CEO. | ✓ Governance. Experienced in both corporate governance and executive compensation for both public and private companies. ✓ Strategic Planning. Experience with senior executive level strategic planning for publicly-traded companies, private companies and/or non-profit companies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A both in identifying targets and evaluating potential targets, as well as post-acquisition integration. | |||

NIKOS THEODOSO- POULOS ✓ Independent Director Age: 62 Board Member since 2023 Term expires in 2027 Committee Memberships: •Audit •Compensation | Business Experience •Independent director, advisor, consultant and angel investor in the technology industry •Various capacities with UBS, a provider of financial services, most recently as managing director of technology equity research (1995-2012) •Senior equity research analyst for Bear, Stearns & Co. Inc., an investment banking firm that was acquired in 2008 by JPMorgan Chase (1994-1995) •Various capacities at AT&T Bell Laboratories and AT&T Network Systems a provider of communications equipment (1985-1994) Public Company Directorships •Adtran Holdings, a provider of networking and communications equipment (2022-present) Prior Public Company Directorships •Arista Networks (member of audit and nominating and corporate governance committees), a provider of data-driven, client to cloud networking for large data center/AI, campus and routing environments (2014-2023) •Harmonic (chair of audit committee), a provider of virtualized broadband and video streaming solutions (2015-2022) •ADVA Optical Networking (chair of supervisory board and nomination and compensation committee; member of audit committee), a telecommunications vendor providing network equipment for data, storage, voice and video services (2014-2022) Prior Private Company Directorships •Driving Management Systems (d/b/a Motion Intelligence), a producer of distracted-driving prevention solutions (2018-2022) Other Experience •Member at NT Advisors LLC (2012-Present) •Member, Columbia Engineering Entrepreneurship Advisory Board (2013-2021) Education •MBA from NYU Stem School of Business •Master of Science, Electrical Engineering from Stanford University •Bachelor of Science Electrical Engineering from Columbia University | |||

KEY QUALIFICATIONS AND EXPERIENCE | ||||

✓ Client Industries. Experience in venture capital-backed companies in general, and our specific portfolio company industries: technology, life sciences and middle market. ✓ Banking/Financial Services. Experience with banking, mutual fund or other financial services industries, including regulatory experience and specific knowledge of the Securities Act. ✓ Finance, IT and other Business Processes. Extensive experience as an audit committee chair overseeing finance, accounting and internal controls, IT and other key business processes. | ✓ Enterprise Risk Management. Experience with enterprise risk management processes and functions, including compliance and operations. ✓ Governance. Experience with corporate governance issues, particularly in publicly-traded companies. ✓ Strategic Planning. Experience with senior executive level strategic planning for publicly-traded companies, private companies and non-profit companies. ✓ Mergers and Acquisitions. Experience with public and/or private company M&A, both in identifying targets and evaluating. | |||

Officers Who Are Not Directors(1) |

SETH H. MEYER Chief Financial Officer Age: 56 | Mr. Meyer joined the Company in 2019 as Chief Financial Officer. He oversees the financial and accounting functions of the Company and serves as an officer of select subsidiaries. Additional Business Experience • Chief Financial Officer, Swiss Re Corporate Solutions Ltd. (2011-2017) • Managing Director, Swiss Re, serving as Group Tax Director, Finance Division Operating Officer and Head of Finance Large Transactions (2000-2011) • Senior Tax Manager, PricewaterhouseCoopers LLP (1997-2000) •Tax Manager, Jackson National Life Insurance Company (1994-1997) •Senior Tax Accountant, KPMG Peat Marwick (1992-1994) •Tax/Audit Assistant, Burke & Stegman CPAs (1990-1992) Education • Bachelor’s degree in Accounting from Michigan State University •Master’s degree in Business Administration in Professional Accounting from Michigan State University |

CHRISTIAN FOLLMANN Chief Operating Officer Age: 42 | Mr. Follmann first joined the Company in 2006 and was promoted to Chief Operating Officer in 2022. He oversees the operations function for the Company and serves as an officer of select subsidiaries. Additional Business Experience •Analyst, Hercules Capital, Inc. (2006 – 2009) •Associate, Hercules Capital, Inc. (2009 – 2011) •Director of Investment Analysis and Strategy, Hercules Capital, Inc. (2011 – 2016) •Senior Director of Operations and Strategic Projects, Hercules Capital, Inc. (2016 – 2022) Education •Bachelor’s degree in International Business from Northeastern University •Bachelor’s degree in International Management from Reutingen University |

KIERSTEN ZAZA BOTELHO Chief Legal Officer Chief Compliance Officer and Corporate Secretary Age: 39 | Ms. Botelho joined the Company in 2022 and serves as Chief Legal Officer, Chief Compliance Officer and Corporate Secretary. She oversees the legal and compliance function for the Company and serves as secretary for the Company and an officer of select subsidiaries. Additional Business Experience • Associate General Counsel, Bain Capital Credit, LP (2019-2021) • Vice President, Legal, BlackRock, Inc. (2017-2019) • Associate, Skadden, Arps, Slate, Meagher & Flom LLP (2013-2017) Education/Other • Bachelor’s degree in International Relations from Boston University • Juris Doctor from Boston University School of Law • Member, State Bar of Massachusetts |

COMPENSATION DISCUSSION AND ANALYSIS |

Scott Bluestein | Seth H. Meyer | Christian Follmann | Kiersten Zaza Botelho | |||

Chief Executive Officer Chief Investment Officer | Chief Financial Officer | Chief Operating Officer | Chief Legal Officer Chief Compliance Officer Corporate Secretary |

Key Sections | Page | |

Page | |

Introduction |

Compensation Determination Process |

Role of the Independent Compensation Consultant |

The Compensation Committee has engaged FW Cook as its Independent Compensation Consultant to assist the Compensation Committee and provide advice on a variety of compensation matters relating to CEO and NEOs compensation, peer group selection, compensation program best practices, market and industry compensation trends, improved program designs, market competitive director compensation levels and regulatory developments. FW Cook reports directly to the Compensation Committee and does not provide any other services to the Company. The Compensation Committee has assessed the independence of FW Cook pursuant to applicable NYSE rules and has concluded that FW Cook’s work for the Compensation Committee does not raise any conflict of interest. | INDEPENDENT COMPENSATION CONSULTANT DUTIES: •Providing information, research, market analysis and recommendations with respect to our NEO and Independent Director compensation programs, including evaluating the components of those programs and the alignment of those programs with Company performance. •Advising on the design of the NEO and Independent Director compensation programs and the reasonableness of individual compensation levels and awards, including in the context of business and stockholder performance and the importance of individual officers to the Company’s success. •Providing advice and recommendations that incorporate both market data and Company-specific factors. •Assisting the Compensation Committee in making compensation determinations for NEOs after the evaluation of, among other things, Company and individual performance, market compensation levels and recommendations by the CEO. •Advising the Compensation Committee on certain other compensation matters, including peer group selection and regulatory developments. |

Peer Group Composition, Data and Review |

Peer Group | ||||||

BDCs | Financial Services | Real Estate Investment Trusts | ||||

Capital Southwest Main Street Capital Trinity Capital | AllianceBernstein Artisan Partners Cohen & Steers HA Sustainable Moelis & Company Victory Capital WisdomTree | Arbor Realty Chimera Investment EPR Properties Essential Properties Ladder Capital LXP Industrial | MFA Financial New York Mortgage Redwood Trust Sabra Health Care Two Harbors | |||

Return on Average Assets (ROAA) | Return on Equity (ROE) | Average Annual Shareholder Return (AASR) | |||||||||||

Performance Period | HTGC | % Rank of Peer Group | HTGC | % Rank of Peer Group | HTGC | % Rank of Peer Group | |||||||

1-Year | 9.0% | 100% | 17.2% | 100% | 33.3% | 82% | |||||||

3-Year | 8.4% | 100% | 16.7% | 100% | 19.9% | 92% | |||||||

5-Year | 7.4% | 100% | 14.9% | 100% | 20.1% | 90% | |||||||

Assessment of Company and Individual Performance, Pay-for-Performance Alignment and Other Considerations |

Risk Assessment of the Compensation Program |

The NEO Compensation Program |

Compensation Philosophy |

Regulatory Limitations on Compensation |

Compensation Elements |

Base Salary Provides a level of fixed income that is market competitive to allow the Company to retain and attract executive talent |

Annual Cash Bonus Awards Rewards NEOs for individual achievements and contributions to our financial performance and strategic success during the year |

Name | 2024 Cash Bonus Award ($) | |

Scott Bluestein | 3,500,000 | |

Seth H. Meyer | 915,000 | |

Christian Follmann | 470,000 | |

Kiersten Zaza Botelho | 440,000 |

Long-Term Equity Incentive Awards Provides meaningful retention incentives while rewarding NEOs for individual achievements and contributions to our success through the alignment with and creation of stockholder value |

Name | Grant Date | Restricted Stock Award | Fair Value of Restricted Stock Award($)(1) | |||

Scott Bluestein | 1/09/2025 | 241,742 | 4,830,005 | |||

Seth H. Meyer | 1/09/2025 | 82,583 | 1,650,008 | |||

Christian Follmann | 1/09/2025 | 33,784 | 675,004 | |||

Kiersten Zaza Botelho | 1/09/2025 | 27,528 | 550,009 |

Name | Grant Date | Restricted Stock Milestone Award | Fair Value of Restricted Stock Milestone Award($)(1) | |||

Seth H. Meyer | 12/05/2024 | 132 | 2,496 |

Name | Grant Date | Restricted Stock Units | Fair Value of Restricted Stock Units($)(1) | |||

Scott Bluestein | 12/05/2024 | 33,051 | 303,739 | |||

Seth H. Meyer | 12/05/2024 | 10,576 | 97,193 | |||

Christian Follmann | 12/05/2024 | 10,576 | 97,193 | |||

Kiersten Zaza Botelho | 12/05/2024 | 10,576 | 97,193 |

Other – Benefits and Perquisites |

Clawback Policy for Section 16 Officers |

Timing of Equity Compensation |

Compensation Committee Report We have reviewed and discussed the foregoing Compensation Discussion and Analysis with management. Based on our review and discussions with management, we recommend to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement for the 2025 Annual Meeting of Hercules Capital, Inc. COMPENSATION COMMITTEE MEMBERS Gayle Crowell, Chair DeAnne Aguirre Wade Loo Nikos Theodosopoulos The information contained in the report above shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act or the Exchange Act except to the extent specifically incorporated by reference therein. |

Executive Compensation Tables |

Summary Compensation Table |

Name and Principal Occupation | Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($) (3) | Option Awards ($) | All Other Compensation ($) (4) | Total ($) | ||||||||

Scott Bluestein | 2024 | 650,000 | 3,500,000 | 4,903,742 | — | 23,000 | 9,076,742 | ||||||||

Chief Executive Officer and | 2023 | 650,000 | 3,200,000 | 5,019,494 | — | 22,500 | 8,891,994 | ||||||||

Chief Investment Officer | 2022 | 650,000 | 3,000,000 | 3,700,008 | — | 20,500 | 7,370,508 | ||||||||

Seth H. Meyer | 2024 | 550,000 | 915,000 | 1,749,697 | — | 30,500 | 3,245,197 | ||||||||

Chief Financial Officer | 2023 | 550,000 | 835,000 | 1,625,903 | — | 30,000 | 3,040,903 | ||||||||

2022 | 550,000 | 875,000 | 1,274,998 | — | 27,000 | 2,726,998 | |||||||||

Christian Follmann | 2024 | 300,000 | 470,000 | 657,195 | 23,000 | 1,450,195 | |||||||||

Chief Operating Officer | 2023 | 300,000 | 425,000 | 462,343 | — | 22,500 | 1,209,843 | ||||||||

2022 | 260,000 | 350,000 | 250,005 | — | 20,500 | 880,505 | |||||||||

Kiersten Zaza Botelho | 2024 | 300,000 | 440,000 | 547,192 | 23,000 | 1,310,192 | |||||||||

Chief Legal Officer, Chief Compliance Officer and Corporate Secretary(5) | 2023 | 300,000 | 395,000 | 366,067 | — | 22,500 | 1,083,567 | ||||||||

2022 | 300,000 | 300,000 | 99,993 | — | 18,000 | 717,993 |

Grants of Plan Based Awards in 2024 |

Name | Grant Date | All Other Stock Awards: Number of Shares of Stock or Units Threshold | Grant Date Fair Value of Stock and Option Awards ($)(3) | |||||

Scott Bluestein | 01/09/2024 | 264,368 | (1) | 4,600,003 | ||||

12/05/2024 | 33,051 | (2) | 303,739 | |||||

Seth H. Meyer | 01/09/2024 | 94,828 | (1) | 1,650,007 | ||||

12/05/2024 | 10,576 | (2) | 97,193 | |||||

12/05/2024 | 132 | (1) | 2,496 | |||||

Christian Follmann | 01/09/2024 | 32,184 | (1) | 560,002 | ||||

12/05/2024 | 10,576 | (2) | 97,193 | |||||

Kiersten Zaza Botelho | 01/09/2024 | 25,862 | (1) | 449,999 | ||||

12/05/2024 | 10,576 | (2) | 97,193 |

Outstanding Equity Awards at Fiscal Year End, December 31, 2024 |

Name | Number of shares or units of stock that have not vested | Market value of shares or units of stock that have not vested ($) | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) | |||||||

Scott Bluestein | 17,620 | (1) | 353,986 | (9) | — | — | |||||

138,889 | (2) | 2,790,280 | (9) | — | — | ||||||

74,983 | (3) | 1,506,408 | (10) | — | — | ||||||

39,164 | (5) | 786,805 | (10) | — | — | ||||||

264,368 | (6) | 5,311,153 | (9) | — | — | ||||||

33,051 | (7) | 663,995 | (10) | — | — | ||||||

Seth H. Meyer | 6,072 | (1) | 121,986 | (9) | — | — | |||||

46,297 | (2) | 930,107 | (9) | — | — | ||||||

13,633 | (3) | 273,887 | (10) | — | — | ||||||

13,055 | (5) | 262,275 | (10) | — | — | ||||||

94,828 | (6) | 1,905,095 | (9) | — | — | ||||||

10,576 | (7) | 212,472 | (10) | — | — | ||||||

132 | (8) | 2,652 | (9) | — | — | ||||||

Christian Follmann | 1,191 | (1) | 23,927 | (9) | — | — | |||||

11,575 | (2) | 232,542 | (9) | — | — | ||||||

8,521 | (3) | 171,187 | (10) | — | — | ||||||

9,791 | (5) | 196,701 | (10) | — | — | ||||||

32,184 | (6) | 646,577 | (9) | — | — | ||||||

10,576 | (7) | 212,472 | (10) | — | — | ||||||

Kiersten Zaza Botelho | 490 | (4) | 9,844 | (9) | — | — | |||||

9,260 | (2) | 186,033 | (9) | — | — | ||||||

3,408 | (3) | 68,467 | (10) | — | — | ||||||

9,791 | (5) | 196,701 | (10) | — | — | ||||||

25,862 | (6) | 519,568 | (9) | — | — | ||||||

10,576 | (7) | 212,472 | (10) | — | — |

Options Exercised and Stock Vested in 2024 |

Stock Awards | |||||

Name | Number of shares Acquired on Vesting(1) | Value Realized on Vesting ($) (2) | |||

Scott Bluestein | 284,626 | 5,281,846 | |||

Seth H. Meyer | 95,318 | 1,769,648 | |||

Christian Follmann | 22,165 | 411,084 | |||

Kiersten Zaza Botelho | 14,920 | 276,486 | |||

Potential Payments Upon Termination or Change in Control |

Name | Benefit | Termination upon death or disability ($)(1) | Upon a change in control ($)(1) | Termination without cause or resignation for good reason prior to a change in control ($)(2) | Termination without cause or resignation for good reason after a change in control ($) (2) | ||||||

Scott Bluestein | Salary | — | — | 1,137,500 | 1,137,500 | ||||||

Bonus | — | — | 7,654,167 | 7,654,167 | |||||||

Other (3) | — | — | 82,544 | 82,544 | |||||||

Accelerated equity award vesting | 11,412,627 | 11,412,627 | 7,570,203 | 11,412,627 | |||||||

Total | 11,412,627 | 11,412,627 | 16,444,414 | 20,286,838 | |||||||

Seth H. Meyer | Accelerated equity award vesting | 3,708,473 | 3,708,473 | — | 3,708,473 | ||||||

Total | 3,708,473 | 3,708,473 | — | 3,708,473 | |||||||

Christian Follmann | Accelerated equity award vesting | 1,483,405 | 1,483,405 | — | 1,483,405 | ||||||

Total | 1,483,405 | 1,483,405 | — | 1,483,405 | |||||||

Kiersten Zaza Botelho | Accelerated equity award vesting | 1,193,085 | 1,193,085 | — | 1,193,085 | ||||||

Total | 1,193,085 | 1,193,085 | — | 1,193,085 |

CEO Pay Ratio |

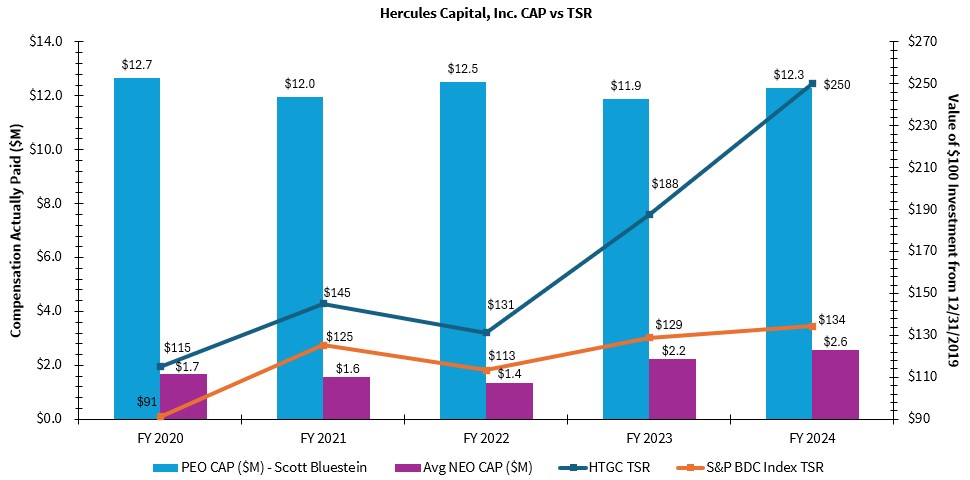

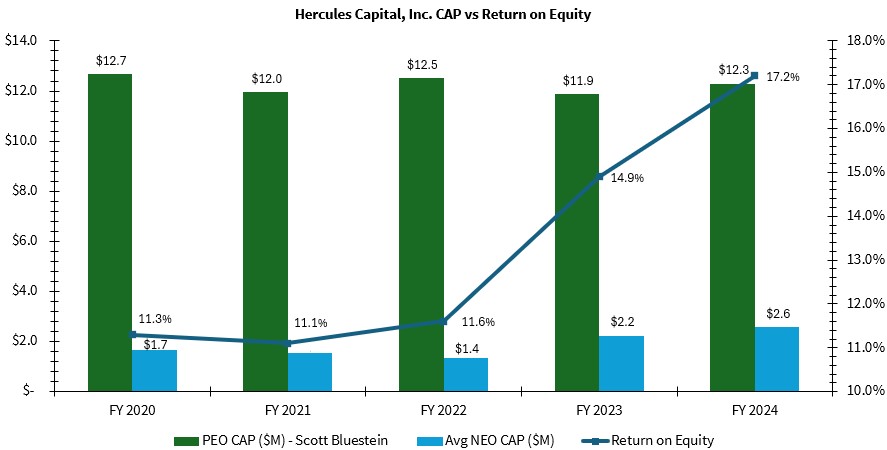

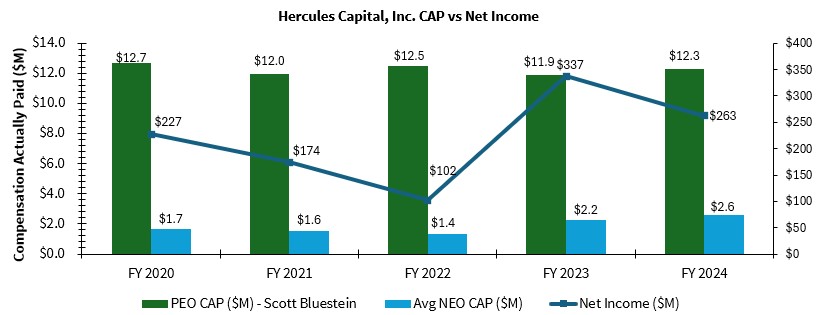

Pay vs. Performance |

Value of Initial $100 Investment: | |||||||||||||||||

Year | Summary Compensation Table CEO Total Compensation ($) | Compensation Actually Paid to CEO ($)(1) | Average SCT Non-CEO NEOs Total Compensation ($) | Average Compensation Actually Paid to Non-CEO NEOs ($)(1) | Company TSR ($) | Peer Group TSR ($)(2) | Net Income ($ in thousands) | R | |||||||||

2024 | |||||||||||||||||

2023 | |||||||||||||||||

2022 | |||||||||||||||||

2021 | |||||||||||||||||

2020 | |||||||||||||||||

Name | Year | SCT Total ($) | SCT Stock Awards ($) | Fair Value of Stock Awards Granted in the Covered Year ($) | Change in Fair Value of Unvested Stock Awards from Prior Years ($) | Fair Value of Stock Awards Granted and Vested in the Covered Year ($) | Change in Fair Value of Stock Awards from Prior Years that Vested in the Covered Year ($) | Fair Value of Stock Awards Forfeite d ($) | Value of Dividends on Unvested Stock Awards Not Otherwise Reflected in Fair Value ($) | Compensation Actually Paid | ||||||||||

PEO | 2024 | ( | ||||||||||||||||||

2023 | ( | |||||||||||||||||||

2022 | ( | ( | ||||||||||||||||||

2021 | ( | |||||||||||||||||||

2020 | ( | ( | ||||||||||||||||||

NEO Average | 2024 | ( | ||||||||||||||||||

2023 | ( | |||||||||||||||||||

2022 | ( | ( | ||||||||||||||||||

2021 | ( | ( | ||||||||||||||||||

2020 | ( | ( |

Independent Director Compensation |

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($) | All Other Compensation ($) | Total ($) | |||||

Robert P. Badavas | 265,000 | — | — | 265,000 | ||||||

DeAnne Aguirre | 205,000 | — | — | — | 205,000 | |||||

Gayle Crowell | 230,000 | 59,994 | — | — | 289,994 | |||||

Thomas J. Fallon | 220,000 | 59,994 | — | — | 279,994 | |||||

Wade Loo | 230,000 | — | — | — | 230,000 | |||||

Pam Randhawa | 205,000 | — | — | 205,000 | ||||||

Nikos Theodosopoulos | 129,167 | 59,994 | — | — | 189,161 |

Equity Compensation Plan Information |

Plan Category | (a) Number of securities to be issued upon exercise of outstanding options and warrants | (b) Weighted-average exercise price of outstanding options and warrants ($) | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

Equity compensation plans approved by stockholders: | |||||||

2018 Equity Incentive Plan | 956,544 | (1) | 16.64 | 4,639,677 | |||

2018 Non-Employee Director Plan | — | — | 245,670 | ||||

Equity compensation plans not approved by stockholders: | — | — | — | ||||

Total | 956,544 | 4,885,347 |

PROPOSAL 2 |

2025 “Say-on-Pay” Advisory Vote |

NEO Compensation and 2024 “Say-on-Pay” Advisory Vote |

Key Stockholder Considerations |

PROPOSAL 3 |

Key Definitions |

Overview and Conditions of Below-NAV Sales |

Reasons to Conduct Below-NAV Sales |

Key Stockholder Considerations |

Dilutive Effect of a Below-NAV Sale on Stockholders |

Impact of a Below-NAV Sale on Non-Participating Existing Stockholders |

Impact of a Below-NAV Sale Participating Existing Stockholders |

Trading History of the Shares |

Tables |

Prior to Sale Below NAV | Example 1 | Example 2 | Example 3 | Example 4 | |||||||||||||

5% Offering at 5% Discount | 10% Offering at 10% Discount | 20% Offering at 20% Discount | 25% Offering at 25% Discount | ||||||||||||||

Following Sale | % Change | Following Sale | % Change | Following Sale | % Change | Following Sale | % Change | ||||||||||

Offering Price | |||||||||||||||||

Price per Share to Public(1) | $10.00 | — | $9.47 | — | $8.42 | — | $7.89 | — | |||||||||

Net Proceeds per Share to Issuer | $9.50 | — | $9.00 | — | $8.00 | — | $7.50 | — | |||||||||

Decrease to Net Asset Value | |||||||||||||||||

Total Shares Outstanding | 3,000,000 | 3,150,000 | 5.00% | 3,300,000 | 10.00% | 3,600,000 | 20.00% | 3,750,000 | 25.00% | ||||||||

Net Asset Value per Share $ | $10.00 | $9.98 | -0.20% | $9.91 | -0.90% | $9.67 | -3.30% | $9.50 | -5.00% | ||||||||

Dilution to Nonparticipating Stockholder | |||||||||||||||||

Shares Held by Stockholder A | 30,000 | 30,000 | 0.00% | 30,000 | 0.00% | 30,000 | 0.00% | 30,000 | 0.00% | ||||||||

Percentage Held by Stockholder A | 1.00% | 0.95% | -4.76% | 0.91% | -9.09% | 0.83% | -16.67% | 0.80% | -20.00% | ||||||||

Total Net Asset Value Held by Stockholder A | $300,000 | $299,400 | -0.20% | $297,300 | -0.90% | $290,100 | -3.30% | $285,000 | -5.00% | ||||||||

Total Investment by Stockholder A (Assumed to Be $10.00 per Share) | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | ||||||||||||

Total Dilution to Stockholder A (Total Net Asset Value Less Total Investment) | $(600) | $(2,700) | $(9,900) | $(15,000) | |||||||||||||

Investment per Share Held by Stockholder A (Assumed to be $10.00 per Share on Shares Held Prior to Sale) | $10.00 | $10.00 | 0.00% | $10.00 | 0.00% | $10.00 | 0.00% | $10.00 | 0.00% | ||||||||

Net Asset Value per Share Held by Stockholder A | $9.98 | $9.91 | $9.67 | $9.50 | |||||||||||||

Dilution per Share Held by Stockholder A (Net Asset Value per Share Less Investment per Share) | $(0.02) | $(0.09) | $(0.33) | $(0.50) | |||||||||||||

Percentage Dilution to Stockholder A (Dilution per Share Divided by Investment per Share) | -0.20% | -0.90% | -3.30% | -5.00% | |||||||||||||

50% Participation | 150% Participation | |||||||||

Prior to Sale Below NAV | Following Sale | % Change | Following Sale | % Change | ||||||

Offering Price | ||||||||||

Price per Share to Public (1) | $8.42 | $8.42 | ||||||||

Net Proceeds per Share to Issuer | $8.00 | $8.00 | ||||||||

Decrease/Increase to Net Asset Value | ||||||||||

Total Shares Outstanding | 3,000,000 | 3,600,000 | 20.00% | 3,600,000 | 20.00% | |||||

Net Asset Value per Share | $10.00 | $9.67 | -3.33% | $9.67 | -3.33% | |||||

Dilution/Accretion to Participating Stockholder Shales Held by Stockholder A | ||||||||||

Shares Held by Stockholder A | 30,000 | 33,000 | 10.00% | 39,000 | 30.00% | |||||

Percentage Held by Stockholder A | 1.00% | 0.92% | -8.33% | 1.08% | 8.33% | |||||

Total Net Asset Value Held by Stockholder A | $300,000 | $319,000 | 6.33% | $377,000 | 25.67% | |||||

Total Investment by Stockholder A (Assumed to Be $10.00 per Share on Shares Held Prior to Sale) | $325,260 | $375,780 | ||||||||

Total Dilution/Accretion to Stockholder A (Total Net Asset Value Less Total Investment) | $(6,260) | $1,220 | ||||||||

Investment per Share Held by Stockholder A (Assumed to be $10.00 per Share on Shares Held Prior to Sale) | $10.00 | $9.86 | -1.44% | $9.64 | -3.65% | |||||

Net Asset Value per Share Held by Stockholder A | $9.67 | $9.67 | ||||||||

Dilution/Accretion per Share Held by Stockholder A (Net Asset Value per Share Less Investment per Share) | $(0.19) | $0.03 | ||||||||

Percentage Dilution/Accretion to Stockholder A (Dilution/ Accretion per Share Divided by Investment per Share) | -1.92% | 0.32% | ||||||||

Price Range | |||||||||

NAV(1) | High | Low | High Sales Price Premium (Discount) to NAV(2) | Low Sales Price Premium (Discount) to NAV(2) | |||||

2022 | |||||||||

First quarter | $ | $ | $ | ||||||

Second quarter | $ | $ | $ | ||||||

Third quarter | $ | $ | $ | ||||||

Fourth quarter | $ | $ | $ | ||||||

2023 | |||||||||

First quarter | $ | $ | $ | ||||||

Second quarter | $ | $ | $ | ||||||

Third quarter | $ | $ | $ | ||||||

Fourth quarter | $ | $ | $ | ||||||

2024 | |||||||||

First quarter | $ | $ | $ | ||||||

Second quarter | $ | $ | $ | ||||||

Third quarter | $ | $ | $ | ||||||

Fourth quarter | $ | $ | $ | ||||||

2025 | |||||||||

First quarter | $ | $ | $ | * | * | ||||

Second quarter (through April 17, 2025) | $ | $ | $ | * | * | ||||

PROPOSAL 4 |

Background |

Key Stockholder Considerations |

Principal Accountant Fees and Services |

Fiscal Year Ended (in millions) | |||

2024 | 2023 | ||

Audit Fees | $1.7 | $1.4 | |

Audit-Related Fees | — | 0.2 | |

Tax Fees | 0.1 | 0.1 | |

All Other Fees | — | — | |

Total Fees: | $1.8 | $1.7 | |

Pre-Approval Policy |

1. Why did I receive this Proxy Statement? |

2. How do I vote? |

3. What happens if I do nothing (aka choose not to vote)? |

4. May I change my vote or revoke my proxy? |

5. What is householding? |

6. What is the vote required for each proposal? |

7. What are abstentions and “broker non-votes”? |

8. Who is paying for the costs of soliciting these proxies? |

9. Do stockholders have dissenters’ or appraisal rights? |

Stockholders have no dissenters’ or appraisal rights in connection with any of the proposals described herein. |

10. How do I find out the results of the voting at the annual meeting? |