Hercules Capital Business and Coronavirus Update

PALO ALTO, Calif.--(BUSINESS WIRE)-- The team at Hercules Capital, Inc. (NYSE: HTGC) (“Hercules” or the “Company”) is working collectively with our employees, shareholders, stakeholders, bondholders, rating agencies, portfolio companies, and our venture capital and private equity sponsors to navigate the significant challenges created by the unprecedented COVID-19 (Coronavirus) pandemic. We are vigilantly monitoring this evolving situation and have implemented actions to keep our employees safe while also managing the continuity of our business. Our thoughts and prayers are with everyone who has been impacted by these events.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200323005118/en/

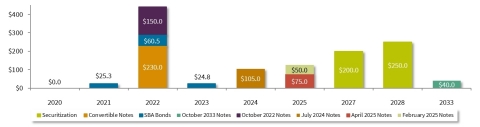

Hercules Capital Debt Maturity Schedule (as of March 2020) (Graphic: Business Wire)

Proactive Business Continuity

In an effort to keep our employees operating in a safe environment and meet our obligations to our shareholders, stakeholders and portfolio companies, effective March 12, 2020 we transitioned our work force into a work-from-home setting. Prior to that transition, the Company completed several tests of its networks, infrastructure and our ability to maintain maximum functionality, and as of today, we have not experienced any material interruptions in our ability to continue full business operations. We will continue to take all necessary steps to maintain ongoing operations and do our best to ensure the safety and well being of our employees.

Ample Liquidity and Capital

We ended 2019 with over $235.0 million of liquidity — which was further strengthened by our $120.0 million private placement of unsecured debt in early February, our 2020 quarter-to-date ATM issuances of ~$35.0 million as well as our expanded and enhanced credit facility of $400.0 million led by MUFG Union Bank that we announced in late February. Our MUFG credit facility syndicate is broad and deep with over 10 bank and institutional partners.

Based on our quarter-to-date investment activity as of March 20, 2020, including having received nearly $140.0 million of prepayments, we anticipate ending Q1 2020 with more than $350.0 million of liquidity, subject to borrowing base, leverage and other restrictions. In addition, pursuant to our February private placement, we expect to receive an additional $70.0 million in June pursuant to the agreement announced on February 6, 2020.

Currently, we believe we have ample liquidity to support our near-term capital requirements. As the impact of the Coronavirus continues, we will continue to evaluate our overall liquidity position and take proactive steps to maintain the appropriate liquidity position based upon the then current circumstances.

Strong Balance Sheet

Our diverse and well-structured balance sheet is designed to provide a long-term focused and sustainable investment platform. Our asset base is well diversified (see Portfolio Positioning below) and we maintain funding from several different debt capital sources, including our revolving credit facilities, our relationship with the U.S. Small Business Administration through our active Small Business Investment Company (SBIC) license, and our existing long-term bonds and securitizations.

Debt Maturity Schedule (as of March 2020)

We have no near-term material maturities; as illustrated in the chart accompanying this press release, with our nearest significant maturity obligation in 2022.

Diversified Portfolio Positioning

Since inception and throughout the course of our 16-year history, our belief has been that portfolio diversification and risk management is essential to achieving long term, sustainable success in the venture and growth-stage lending space.

We primarily focus on pre-IPO and M&A, innovative high-growth venture capital-backed companies at their expansion (venture growth) and established stages in a broadly diversified variety of technology, life sciences and sustainable and renewable technology industries. We are generally the only lender and 84.0% of our debt investments are “true” first-lien senior secured. We do not have any direct exposure to oil and gas, metals and mining, CLOs, CMBS or RMBS. Substantially all of our debt investments have short-term amortizing maturities of 36 to 48 months.

At the end of 2019, our debt investment portfolio was comprised of $2.17 billion of investments, at cost, and was split nearly evenly in exposure between technology and life sciences companies across 16 different industry sectors. Our top 5 and top 10 debt investments comprised 17 percent and 29 percent of our total debt portfolio at cost.

As the current situation continues to evolve, we are maintaining close communications with our portfolio companies to proactively assess and manage potential risks across our debt investment portfolio.

Our Future Action Plans

While we are all experiencing difficulties and challenges as we deal with the impact of the Coronavirus, we will continue to focus on the continuity of our operations, portfolio and business risk management, and our responsibilities to our employees, their families and our communities. We have redoubled our efforts in credit monitoring and management to increase our flow of information to gain insight into the economic impact this situation will have on our entire ecosystem. Our success has always been predicated on determined and consistent communications with each and every one of our portfolio companies and helping them navigate through both good and difficult times.

In the coming weeks and months, we will continue to focus on what has made Hercules the largest and leading venture lending platform in the industry while delivering strong, sustainable long-term shareholder returns.

About Hercules Capital, Inc.

Hercules Capital, Inc. (NYSE: HTGC) is the leading and largest specialty finance company focused on providing senior secured venture growth loans to high-growth, innovative venture capital-backed companies in a broad variety of technology, life sciences and sustainable and renewable technology industries. Since inception (December 2003), Hercules has committed more than $10.0 billion to over 490 companies and is the lender of choice for entrepreneurs and venture capital firms seeking growth capital financing. Companies interested in learning more about financing opportunities should contact info@htgc.com, or call (650) 289-3060.

Hercules’ common stock trades on the New York Stock Exchange (NYSE) under ticker symbol HTGC. In addition, Hercules has two retail bond issuances of 5.25% Notes due 2025 (NYSE: HCXZ) and 6.25% Notes due 2033 (NYSE: HCXY).

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should understand that under Section 27A(b)(2)(B) of the Securities Act of 1933, as amended, and Section 21E(b)(2)(B) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 do not apply to forward-looking statements made in periodic reports we file under the Exchange Act.

The information disclosed in this press release is made as of the date hereof and reflects Hercules’ most current assessment of its historical financial performance. Actual financial results filed with the SEC may differ from those contained herein due to timing delays between the date of this release and confirmation of final audit results. These forward-looking statements are not guarantees of future performance and are subject to uncertainties and other factors that could cause actual results to differ materially from those expressed in the forward-looking statements including, without limitation, the risks, uncertainties, including the uncertainties surrounding the current market volatility, and other factors the Company identifies from time to time in its filings with the SEC. Although Hercules believes that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statements based on those assumptions also could be incorrect. You should not place undue reliance on these forward-looking statements. The forward-looking statements contained in this release are made as of the date hereof, and Hercules assumes no obligation to update the forward-looking statements for subsequent events.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200323005118/en/

Michael Hara

Investor Relations and Corporate Communications

Hercules Capital, Inc.

(650) 433-5578

mhara@htgc.com

Source: Hercules Capital, Inc.

Released March 23, 2020